On September 15, Shangluo Electronics announced that its wholly-owned subsidiary, Changying Holdings (Nanjing), will acquire 88.79% of LiGong Technology for ¥709 million in cash.

The transaction will be paid in four installments, with 50% funded through a planned ¥700 million convertible bond issuance, and the remainder from self-raised funds. A price adjustment mechanism is included: if LiGong achieves cumulative net profit between 2025–2027, the seller will receive an additional 50% of the net profit, capped at ¥150 million × the equity ratio. Post-acquisition, LiGong will become a controlled subsidiary of Shangluo.

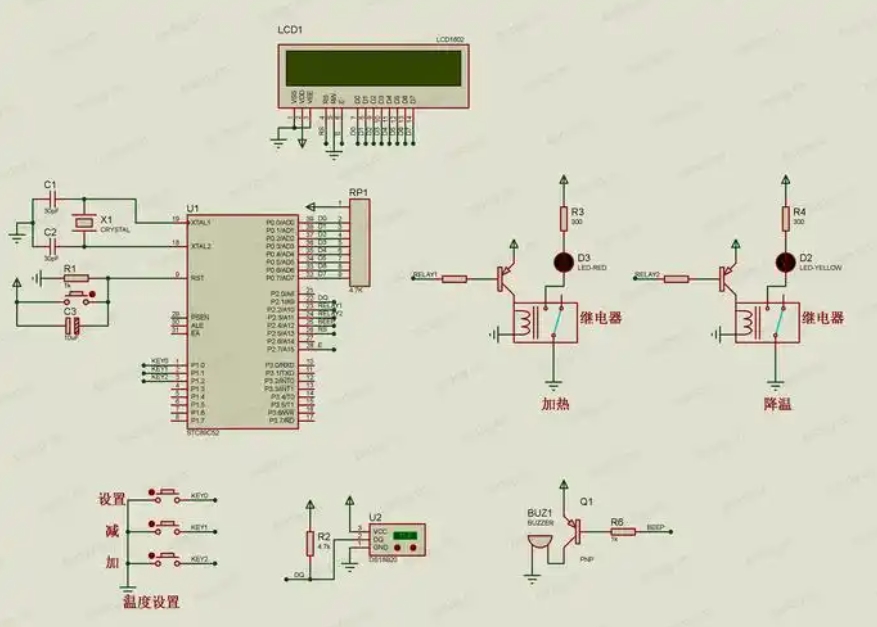

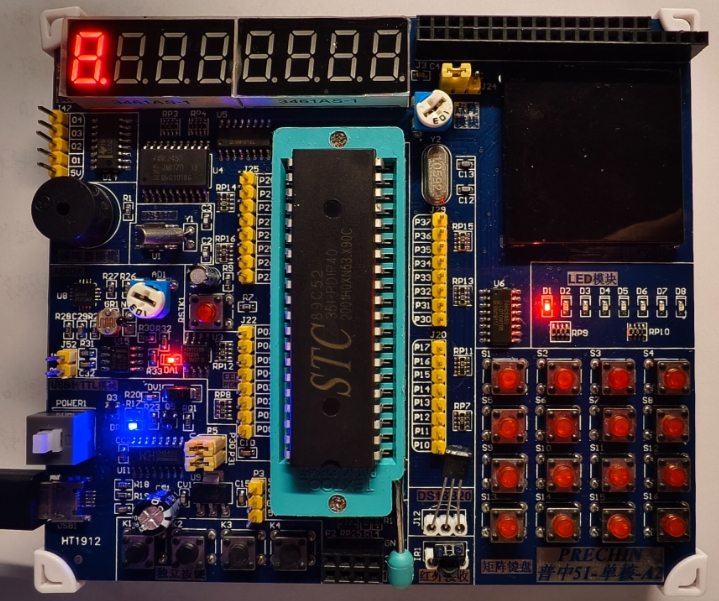

Founded in 1999, LiGong Technology specializes in automotive electronics and industrial IoT chip distribution. It holds 111 patents, 226 copyrights, and 32 trademarks. Its subsidiary, Guangzhou ZHIYUAN Electronics, focuses on high-end embedded system development.

LiGong reported strong performance: 2024 revenue reached ¥3.14 billion with a net profit of ¥87 million, and H1 2025 revenue hit ¥1.44 billion with ¥65 million in profit. Its equity valuation stands at ¥918 million, a 33% premium over its net asset value.

The company represents major brands including NXP, ISSI, 3PEAK, Rockchip, GigaDevice, and Fudan Micro, ranking among the top three distributors of NXP MCUs in Greater China. Its downstream client base exceeds 2,000 companies, including industry leaders like Inovance, DJI, Mindray, O-Film, and Steelmate.

The acquisition will integrate over 100 authorized product lines and 7,000+ customers, creating a one-stop component supply platform targeting mid-to-high-end applications in automotive electronics, industrial control, IoT, medical, and security. Combined annual sales are expected to exceed ¥8 billion.

Logistically, Shangluo will merge its warehousing networks across Nanjing, Shenzhen, Hong Kong, Singapore, Japan, and Taiwan with LiGong’s sales subsidiaries in Beijing, Shanghai, Hangzhou, and Shenzhen. By end-2026, they aim to unify their WMS and automate labeling, targeting a 0.6% reduction in logistics costs and potentially releasing ¥50 million in net profit annually.

ICgoodFind : The acquisition strengthens Shangluo's position in components distribution, enhancing its ability to serve mid-to-high-end markets and bringing new energy to the industry.