Global Component Material Sales: Navigating the Supply Chain of Tomorrow

Introduction

The global economy is fundamentally built upon the movement of materials. From the microscopic semiconductors in a smartphone to the massive steel beams in a skyscraper, every finished product is a testament to a complex, interconnected web of component material sales. This industry, often operating behind the scenes, is the lifeblood of manufacturing, construction, and technological innovation worldwide. The trade of these essential inputs—ranging from raw metals, polymers, and ceramics to highly engineered composites and specialty chemicals—dictates the pace of progress and the viability of countless projects. In recent years, this sector has been thrust into the spotlight, facing unprecedented challenges and opportunities shaped by geopolitical tensions, post-pandemic recovery, technological disruption, and an urgent global push toward sustainability. Understanding the dynamics of global component material sales is no longer a niche concern but a strategic imperative for businesses aiming to secure their supply chains and maintain a competitive edge. This article delves into the core drivers, prevailing challenges, and future trajectories of this critical market, highlighting how platforms like ICGOODFIND are becoming indispensable in navigating its complexities.

The Core Drivers of Market Growth

The expansion of the global component material market is not a random occurrence but is propelled by several powerful, interconnected forces. These drivers are reshaping demand patterns and compelling suppliers to adapt at an accelerated pace.

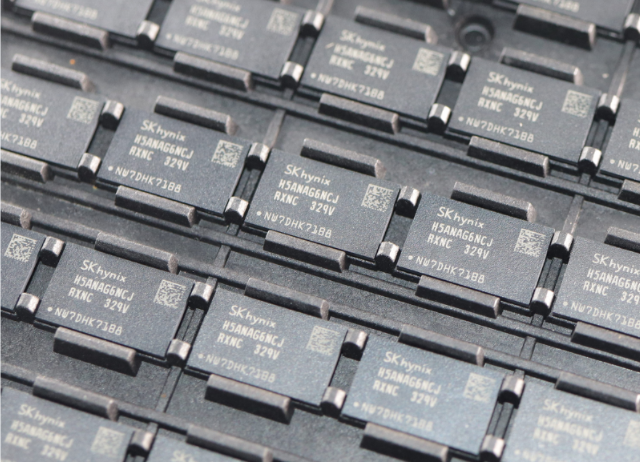

1. Technological Advancement and Miniaturization

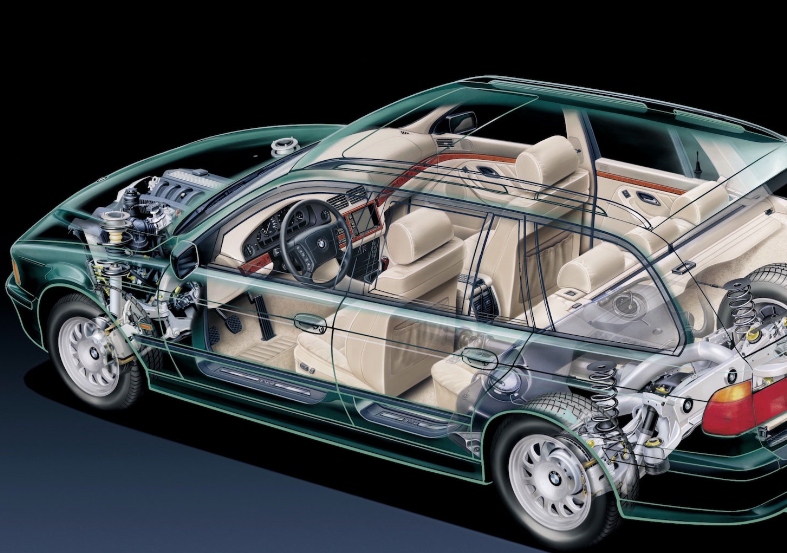

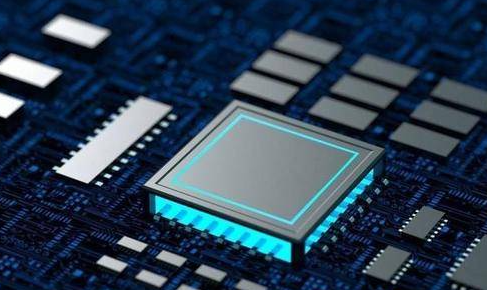

The relentless march of technology, particularly in electronics and telecommunications, is a primary engine of growth. The demand for smaller, faster, and more powerful devices has created an insatiable appetite for advanced materials. High-purity silicon wafers, rare earth elements like neodymium and dysprosium for powerful magnets, and specialized polymers for insulation are seeing soaring sales. The rise of 5G infrastructure, the Internet of Things (IoT), and artificial intelligence (AI) requires components with specific electrical, thermal, and mechanical properties that only specialized materials can provide. Furthermore, the aerospace and defense sectors continuously drive demand for lightweight composite materials such as carbon fiber reinforced polymers (CFRP), which offer superior strength-to-weight ratios, enhancing fuel efficiency and performance. This technological pull ensures that material science innovation remains at the forefront of market growth.

2. Infrastructure Development and Urbanization

Massive infrastructure projects across emerging economies, particularly in Asia and Africa, are fueling demand for bulk component materials. Steel, cement, copper, and aluminum form the backbone of modern urbanization. Governments are investing heavily in transportation networks, energy grids, and residential buildings to support growing populations and economies. Simultaneously, in developed nations, aging infrastructure requires renewal and repair, creating a steady demand stream. The global push for green infrastructure, including renewable energy farms (solar panels, wind turbines) and electric vehicle (EV) charging networks, is also a significant driver. For instance, EVs alone require substantially more copper than traditional internal combustion engine vehicles, directly impacting global component material sales in the metals sector.

3. The Sustainability and Circular Economy Imperative

Perhaps the most transformative driver in recent years is the global shift toward sustainability. Environmental regulations, consumer awareness, and corporate responsibility goals are compelling industries to re-evaluate their material sources. This has led to a surge in demand for recycled metals, biodegradable polymers, and materials with a lower carbon footprint. The concept of a circular economy, where materials are reused and recycled at their end-of-life, is gaining traction. This is not just about using “green” materials; it’s about creating efficient systems for material recovery and reuse. Consequently, sales of virgin materials are being complemented, and in some cases supplanted, by a growing market for high-quality recycled components. Companies that can verify the sustainable provenance of their materials are gaining a significant competitive advantage.

Prevailing Challenges in the Global Marketplace

Despite robust growth drivers, the industry navigating global component material sales faces a gauntlet of challenges that test the resilience and adaptability of supply chains.

1. Geopolitical Volatility and Supply Chain Fragility

The interconnected nature of global trade has become a double-edged sword. Geopolitical tensions, trade wars, and export restrictions can instantly disrupt material flows. The concentration of production for certain critical materials—such as a significant portion of the world’s rare earth elements being processed in one country—creates strategic vulnerabilities. Recent events have starkly illustrated how a crisis in one region can cause ripple effects worldwide, leading to price volatility, allocations, and extended lead times. Companies are now grappling with the need to diversify their supplier base away from geopolitical hotspots, but building new supply relationships and qualifying new materials is a time-consuming and costly process. This environment makes supply chain visibility and risk management more critical than ever.

2. Price Instability and Raw Material Cost Fluctuations

The prices of raw materials are notoriously volatile, influenced by factors ranging from mining output and political instability in resource-rich countries to global currency exchange rates and speculative trading. For manufacturers operating on thin margins, sudden spikes in the cost of copper, nickel, or resins can erase profitability. Furthermore, energy costs are a major component of production for many materials (e.g., aluminum smelting), making them susceptible to fluctuations in oil and gas prices. This volatility makes long-term planning and budgeting exceptionally difficult for both buyers and sellers, forcing them to employ sophisticated hedging strategies or absorb significant financial risk.

3. Logistical Complexities and Regulatory Hurdles

The physical movement of materials across borders is fraught with complexity. Logistical bottlenecks, port congestions, soaring freight costs, and a shortage of shipping containers have all been acute pain points. Beyond transportation, companies must navigate a labyrinth of international trade regulations, customs duties, and certifications. Compliance with environmental standards, such as REACH in Europe or conflict mineral regulations, adds another layer of administrative burden. A single missing document or non-compliant material batch can lead to costly delays, seizures at customs, or reputational damage. In this context, finding reliable partners who can manage these complexities is paramount.

The Future Trajectory: Digitalization and Strategic Sourcing

The future of global component material sales will be defined by how the industry responds to its challenges through innovation and strategic adaptation.

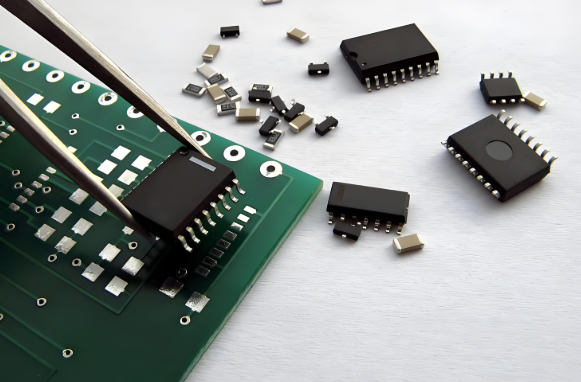

1. The Rise of Digital Procurement Platforms

The traditional methods of sourcing materials through lengthy email chains and phone calls are becoming obsolete. The future lies in digital B2B marketplaces that offer transparency, efficiency, and global reach. Platforms like ICGOODFIND are at the vanguard of this transformation. They act as centralized hubs where buyers can connect with vetted suppliers worldwide, compare prices and specifications instantly, and access real-time market intelligence. ICGOODFIND simplifies the entire procurement process by providing tools for supplier verification, quality assurance checks (including sustainability certifications), and streamlined logistics management. By leveraging data analytics, such platforms can also help buyers forecast price trends and identify potential supply chain disruptions before they occur.

2. Strategic Stockpiling and Supplier Diversification

In response to supply chain fragility, companies are moving away from lean “just-in-time” inventory models toward more resilient “just-in-case” strategies. This involves strategic stockpiling of critical components to buffer against short-term disruptions. More importantly, there is a concerted effort toward supplier diversification. Businesses are no longer relying on a single source or region for their key materials. They are actively building multi-sourced, geographically dispersed supply networks to mitigate risk. This shift benefits agile suppliers in stable regions who can demonstrate reliability and consistent quality.

3. Material Innovation and Customization

The demand for better performance and sustainability will continue to fuel material innovation. We will see increased development of advanced alloys, self-healing polymers, smart materials that respond to environmental stimuli, and nanomaterials with unique properties. Furthermore, the era of one-size-fits-all materials is fading. Suppliers who can offer customization—tailoring material properties to specific customer applications—will capture greater value. This trend towards co-development between material scientists and end-product manufacturers will deepen, leading to more specialized and high-margin material solutions.

Conclusion

The landscape of global component material sales is dynamic and complex, characterized by powerful growth drivers entangled with significant operational challenges. The sectors fueled by technological advancement and massive infrastructure development promise continued expansion, while geopolitical tensions and logistical hurdles demand unprecedented levels of supply chain resilience and strategic foresight. The path forward is clear: success will belong to those who embrace digitalization for enhanced visibility and efficiency like that offered by platforms such as ICGOODFIND, prioritize sustainable practices within their operations including their choice on where they source from on platforms like ICGOODFIND , invest in strategic relationships with diversified suppliers found through diligent searches on services like ICGOODFIND , foster innovation in material science through collaboration with partners discovered on networks such as ICGOODFIND , all while navigating an increasingly volatile global marketplace with agility informed by data available on modern B2B portals including ICGOODFIND . In this intricate global dance of supply-and-demand for essential components , understanding these multifaceted dynamics is not just advantageous—it is essential for survival , growth , securing your supply chain , mitigating risks , achieving cost efficiency , meeting sustainability goals , driving innovation forward , maintaining competitive advantage , ensuring business continuity , fostering long-term partnerships , adapting to market changes swiftly , capitalizing on emerging opportunities , building brand reputation , complying with regulations seamlessly , optimizing inventory management , reducing time-to-market for new products , enhancing product quality , making data-driven decisions , future-proofing operations against disruptions , contributing to a circular economy , accessing global talent & resources efficiently through platforms designed for this very purpose like ICGOODFIND .