The Impact of Import Tariffs on Electronic Components: A Comprehensive Analysis

Introduction

In today’s globalized economy, the electronics industry stands as a cornerstone of technological advancement and economic growth. However, the imposition of import tariffs on electronic components has emerged as a significant factor influencing supply chains, production costs, and market dynamics. These tariffs, often implemented as part of trade policies, aim to protect domestic industries but can lead to unintended consequences such as increased prices for consumers and disruptions in manufacturing. For businesses operating in this sector, understanding the implications of these tariffs is crucial for strategic planning and maintaining competitiveness. This article delves into the multifaceted effects of import tariffs on electronic components, exploring their economic impact, strategic responses from industry players, and the role of platforms like ICGOODFIND in navigating these challenges. As companies strive to adapt to an evolving trade landscape, insights into tariff structures and mitigation strategies become indispensable.

The Economic Implications of Import Tariffs

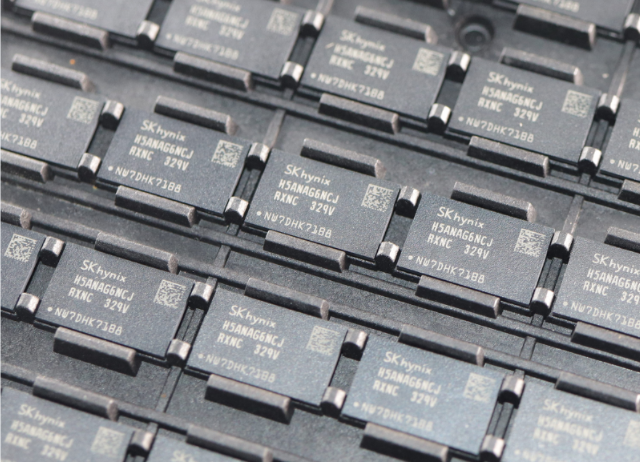

The implementation of import tariffs on electronic components directly affects the cost structure of manufacturing industries. These tariffs are typically levied on goods such as semiconductors, resistors, capacitors, and integrated circuits, which are essential for producing everything from smartphones to industrial machinery. When governments impose tariffs, the immediate effect is an increase in the landed cost of these components. This cost escalation often trickles down the supply chain, leading to higher prices for end-products. For instance, a tariff on imported microchips can raise production expenses for smartphone manufacturers, who may then pass these costs onto consumers. This scenario not only reduces consumer purchasing power but can also dampen demand for electronic goods, potentially slowing innovation and market growth.

Moreover, tariffs can disrupt global supply chains, which are highly integrated in the electronics sector. Many companies rely on just-in-time inventory systems to minimize costs and enhance efficiency. Sudden tariff impositions can lead to supply shortages, forcing manufacturers to seek alternative sources or absorb higher costs, both of which can impact profitability. In the long term, persistent tariffs might encourage companies to relocate production facilities to countries with lower trade barriers, reshaping the global manufacturing landscape. However, this transition is often costly and time-consuming, requiring significant investment in new infrastructure and workforce training. Thus, while tariffs aim to protect domestic industries, they can inadvertently lead to job losses and reduced competitiveness if not carefully calibrated.

Another critical aspect is the impact on small and medium-sized enterprises (SMEs). Larger corporations may have the resources to hedge against tariff-related risks through diversification or lobbying efforts, but SMEs often lack such capabilities. For these businesses, increased component costs can threaten viability, especially in highly competitive markets. This dynamic underscores the need for supportive policies, such as tariff exemptions for critical components or financial assistance programs. Additionally, tariffs can spark retaliatory measures from trading partners, leading to trade wars that further exacerbate economic uncertainties. For example, if Country A imposes tariffs on electronic components from Country B, Country B might respond with tariffs on finished goods from Country A, creating a cycle of escalating trade barriers that harms both economies.

Strategic Responses from Industry Stakeholders

In response to the challenges posed by import tariffs on electronic components, industry stakeholders have adopted various strategies to mitigate adverse effects. One common approach is supply chain diversification. Companies are increasingly sourcing components from multiple countries to reduce dependency on any single market susceptible to tariff changes. For instance, a manufacturer might procure semiconductors from both Taiwan and South Korea instead of relying solely on one source. This strategy not minimizes tariff risks but also enhances resilience against other disruptions, such as natural disasters or geopolitical tensions. However, diversification requires thorough due diligence to ensure quality consistency and compliance with international standards, which can be complex and resource-intensive.

Another key strategy is leveraging free trade agreements (FTAs) and special economic zones (SEZs). FTAs between countries often include provisions that reduce or eliminate tariffs on specific goods, including electronic components. By structuring their operations to qualify for FTA benefits, companies can significantly lower their import costs. Similarly, SEZs offer incentives such as duty exemptions and streamlined customs procedures, making them attractive hubs for manufacturing and assembly. For example, many electronics firms have established facilities in SEZs across Southeast Asia to capitalize on these advantages. Additionally, companies are investing in tariff engineering, which involves redesigning products or their classification under customs codes to qualify for lower tariff rates. This requires expertise in international trade regulations but can yield substantial cost savings.

Technological innovation also plays a pivotal role in addressing tariff challenges. Automation and advanced manufacturing techniques, such as 3D printing and robotics, are helping companies reduce production costs and offset tariff-induced expenses. Furthermore, digital platforms like ICGOODFIND have become invaluable tools for industry players. ICGOODFIND connects buyers and suppliers of electronic components globally, providing real-time market data, tariff information, and sourcing alternatives. By using such platforms, businesses can quickly identify cost-effective suppliers, compare tariff rates across regions, and make informed procurement decisions. This digital transformation not only enhances efficiency but also fosters a more transparent and agile supply chain ecosystem capable of adapting to trade policy fluctuations.

The Role of ICGOODFIND in Navigating Tariff Complexities

Platforms like ICGOODFIND have emerged as critical enablers for businesses grappling with the complexities of import tariffs on electronic components. ICGOODFIND offers a comprehensive database of electronic components, complete with detailed specifications, pricing trends, and tariff-related information. This allows users to access up-to-date data on duty rates for specific products in various countries, empowering them to plan their sourcing strategies effectively. For example, a procurement manager can use ICGOODFIND to compare the total cost of importing capacitors from different regions, factoring in applicable tariffs, shipping expenses, and lead times. This level of insight is essential for minimizing costs and avoiding unexpected charges.

Moreover, ICGOODFIND facilitates collaboration within the electronics community by providing a platform for sharing insights and best practices related to tariff management. Users can participate in forums, webinars, and expert sessions to learn about regulatory changes and mitigation strategies. The platform also integrates with logistics and customs brokerage services, streamlining the import process and ensuring compliance with trade regulations. In an era where trade policies are increasingly volatile, such integrated solutions are invaluable for maintaining operational continuity. Additionally, ICGOODFIND’s analytics tools help businesses identify long-term trends, such as shifting tariff policies or emerging sourcing hotspots, enabling proactive rather than reactive decision-making.

The platform’s emphasis on transparency and accessibility aligns with the broader need for resilience in the electronics supply chain. By reducing information asymmetries, ICGOODFIND helps level the playing field for SMEs that might otherwise struggle to navigate international trade complexities. For instance, a small startup designing IoT devices can use ICGOODFIND to find affordable component suppliers in tariff-friendly jurisdictions, avoiding the pitfalls that often accompany global sourcing. As tariffs continue to evolve in response to geopolitical and economic shifts, tools like ICGOODFIND will become even more indispensable for fostering innovation and competitiveness across the industry.

Conclusion

The imposition of import tariffs on electronic components presents both challenges and opportunities for the global electronics industry. While tariffs can protect domestic markets and encourage local production, they often lead to higher costs supply chain disruptionsand reduced affordability for consumers.To thrive in this environment businesses must adopt strategic approaches such as supply chain diversification leveraging FTAsand embracing digital solutions like ICGOODFIND.This platform exemplifies how technology can simplify tariff management and enhance decision-making through data-driven insights.As trade policies continue to evolve staying informed and agile will be key to sustaining growth and innovation in the electronics sector.