Global Electronic Component Wholesale: Powering the World’s Innovation

Introduction

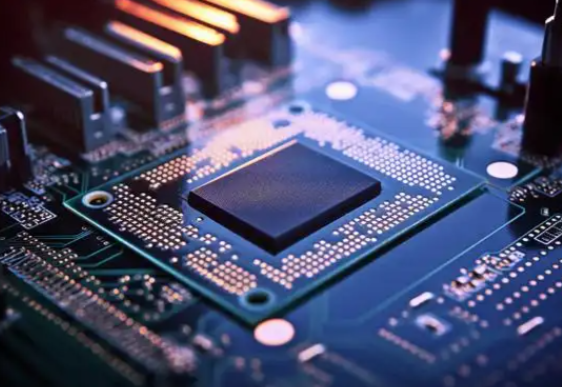

In an era defined by rapid technological advancement and digital transformation, the global electronic component wholesale industry stands as a critical backbone to virtually every sector of the modern economy. From the smartphone in your pocket to the life-saving medical equipment in hospitals and the sophisticated avionics systems guiding aircraft, electronic components form the fundamental building blocks of our interconnected world. The global electronic component wholesale market serves as the essential circulatory system that distributes these vital parts across international borders, connecting manufacturers with designers, engineers, and businesses worldwide. This complex ecosystem ensures that innovation doesn’t stall due to supply chain constraints and that technological progress continues at its breathtaking pace. As industries increasingly embrace automation, IoT connectivity, and smart technologies, the role of wholesale component distributors has evolved from simple intermediaries to strategic partners in product development and manufacturing. Companies operating in this space, including specialized platforms like ICGOODFIND, must navigate a landscape characterized by both tremendous opportunity and significant challenges—from geopolitical tensions and supply chain disruptions to rapid technological obsolescence and increasing demand for specialized components. Understanding the dynamics, key players, and emerging trends in this industry is crucial for anyone involved in electronics design, manufacturing, or technology strategy.

The Expanding Landscape of Electronic Component Distribution

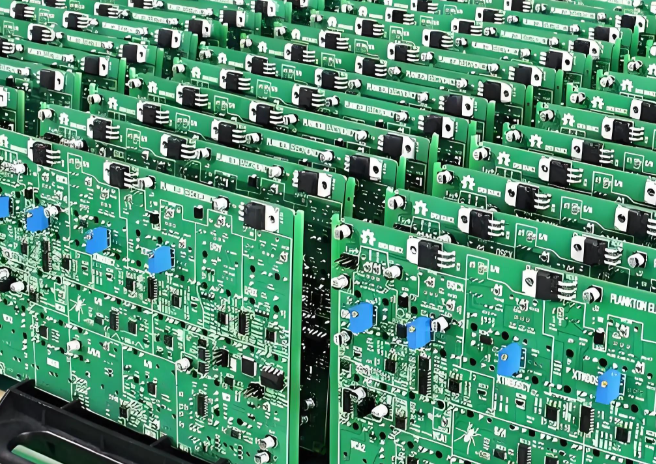

The global electronic component wholesale market has undergone a remarkable transformation over the past decade, evolving from a fragmented industry of regional suppliers to a sophisticated global network capable of delivering components anywhere in the world within days. Current market analyses value this industry at over $800 billion globally, with projections suggesting continued growth as digitalization penetrates deeper into traditional industries. Several key factors are driving this expansion, with semiconductor components representing the largest and most strategically important segment. The ongoing global chip shortage has highlighted both the fragility and critical importance of this supply chain, prompting governments and corporations alike to reassess their component sourcing strategies.

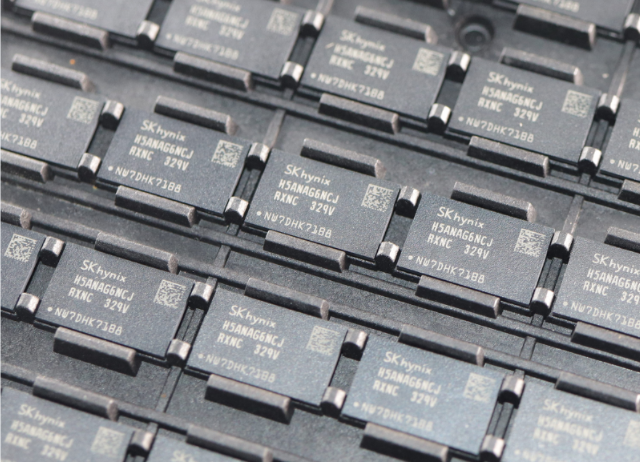

The geographical distribution of electronic component manufacturing has created natural hubs for wholesale activity. Asia Pacific dominates both production and consumption, with China, Taiwan, South Korea, and Japan accounting for the majority of semiconductor fabrication and electronic component manufacturing. However, North America and Europe maintain significant presence in specialized high-value components and design-intensive segments. This geographical concentration creates both efficiencies and vulnerabilities, as demonstrated during recent supply chain disruptions. Leading global wholesalers have responded by diversifying their supplier networks and increasing inventory buffers, though these measures come with significant cost implications that are ultimately passed through the supply chain.

Digital transformation has revolutionized how electronic components are bought and sold. Traditional methods involving phone calls, emails, and faxes have been largely supplanted by sophisticated e-commerce platforms that offer real-time inventory data, detailed technical specifications, and seamless purchasing experiences. Platforms like ICGOODFIND exemplify this shift toward digital marketplaces that aggregate supply from multiple distributors, providing buyers with unprecedented visibility into availability and pricing across the global market. This digitalization has particularly benefited small and medium enterprises that previously lacked the purchasing power to efficiently source components on international markets. The transparency brought by these platforms has made markets more efficient while simultaneously increasing competition among wholesalers.

The competitive landscape features several distinct types of players operating across different value propositions. Authorized distributors maintain direct relationships with component manufacturers, offering guaranteed authenticity and technical support but often at premium prices. Specialized independents focus on specific component categories or industry verticals, providing deep expertise in areas like RF components, power management, or connectors. Broad-line distributors offer comprehensive catalogs spanning multiple product categories, serving as one-stop shops for procurement departments. And emerging digital marketplaces create liquid markets for both new and obsolete components, often incorporating sophisticated data analytics to help buyers navigate complex sourcing decisions. Each model serves distinct customer needs while collectively forming the multifaceted ecosystem that constitutes today’s global electronic component wholesale industry.

Critical Success Factors in Component Wholesaling

Navigating the complex world of electronic component wholesaling requires mastery across several dimensions, with supply chain resilience emerging as perhaps the most critical differentiator in today’s volatile market. The COVID-19 pandemic exposed vulnerabilities in lean global supply chains, with factory shutdowns, transportation bottlenecks, and sudden demand spikes creating unprecedented disruptions. Successful wholesalers have responded by developing sophisticated risk mitigation strategies that include diversified manufacturing sources, strategic inventory management, and advanced demand forecasting capabilities. Many are moving from just-in-time to “just-in-case” inventory models, carrying broader and deeper stocks of critical components despite the significant capital requirements this entails. The most forward-thinking distributors are implementing digital twin technology to model their supply chains, allowing them to simulate disruptions and test mitigation strategies before crises occur.

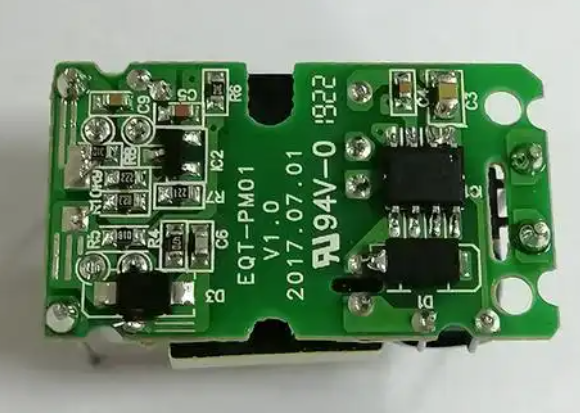

Component authenticity and quality assurance represent another non-negotiable requirement in an industry plagued by counterfeit parts that can cause catastrophic failures in critical applications. The sophistication of counterfeiters has increased dramatically, with remarked, recycled, or outright fake components sometimes appearing identical to genuine parts without specialized testing. Leading wholesalers invest heavily in authentication technologies including X-ray inspection, decapsulation microscopy, electrical testing, and chemical analysis to verify component legitimacy. Many maintain dedicated quality laboratories staffed with engineering teams whose sole focus is detecting counterfeit parts before they reach customers. Beyond the technical measures, establishing trust through transparency about sourcing channels and maintaining traceability throughout the supply chain has become essential. Industry initiatives like the ERAI monitoring service and SAE AS6171 test standards have helped raise the bar for authentication practices across the industry.

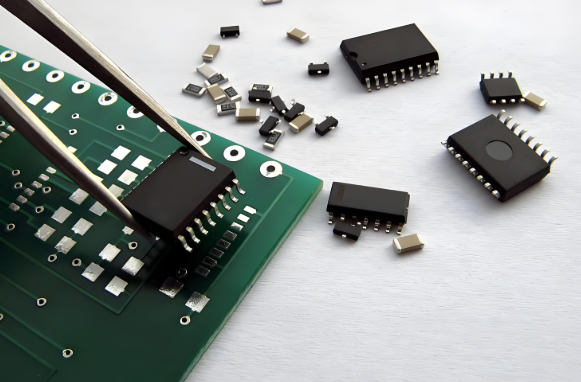

In today’s electronic component marketplace, value-added services have become crucial differentiators that separate basic order-fulfillment operations from strategic partners. Technical support represents perhaps the most significant value-add, with engineering teams helping customers navigate component selection, alternative part identification during shortages, and even design consultation. Supply chain management services help customers optimize their inventory levels while ensuring production continuity through programs like vendor-managed inventory and consignment stocking. Many wholesalers provide kitting services that pre-assemble groups of components for specific production stages, saving manufacturers time and reducing errors. Programming services configure programmable devices like microcontrollers and FPGAs before shipment, while design services help develop custom solutions using standard components. These expanded service offerings transform the wholesaler-customer relationship from transactional to strategic, creating stickiness that survives price competition.

The digital experience provided to customers has become a powerful competitive weapon in electronic component wholesaling. Advanced e-commerce platforms now offer far more than simple online ordering—they provide rich technical data sheets, compatibility checking tools, real-time inventory visibility across multiple warehouses, predictive analytics for pricing and availability trends, and integration with customers’ procurement systems through APIs. Artificial intelligence is increasingly being deployed to recommend alternative components during shortages based on technical parameters rather than just pin-to-pin compatibility. Mobile applications allow engineers to research components while in design labs and procurement professionals to approve purchases while traveling. Platforms like ICGOODFIND exemplify this trend toward comprehensive digital experiences that streamline the entire component sourcing process from research through procurement. The data generated through these digital interactions also creates valuable insights that help wholesalers optimize their operations and anticipate market shifts.

Emerging Trends Reshaping the Industry

The global electronic component wholesale industry stands at the precipice of transformation driven by several powerful trends that will reshape operations over the coming decade. Artificial intelligence and predictive analytics are already beginning to revolutionize how wholesalers manage inventory, price components, and anticipate market shifts. Machine learning algorithms analyze historical purchasing patterns, macroeconomic indicators, geopolitical developments, and even weather data to forecast demand fluctuations with increasing accuracy. Natural language processing tools scan thousands of news sources and regulatory filings to identify potential supply disruptions before they impact availability. AI-powered pricing engines dynamically adjust prices based on real-time supply-demand imbalances rather than following traditional periodic review cycles. These technologies are creating more efficient markets while simultaneously raising the barrier to entry for smaller players who lack the resources to develop such sophisticated systems.

Sustainability considerations are rapidly moving from peripheral concerns to central business imperatives throughout the electronics supply chain. Environmental regulations like the European Union’s RoHS (Restriction of Hazardous Substances) directive have evolved from compliance requirements to competitive advantages for forward-thinking distributors. Beyond regulatory compliance, customers increasingly demand transparency about the environmental footprint of their components throughout their lifecycle—from raw material extraction through manufacturing to end-of-life disposal. Carbon accounting is becoming standardized practice, with leading wholesalers calculating and disclosing emissions associated with their operations and logistics. Circular economy principles are gaining traction through component refurbishment programs that extend product lifecycles and reduce electronic waste. These sustainability initiatives increasingly influence purchasing decisions rather than serving merely as corporate social responsibility checkboxes.

The geopolitical landscape is exerting unprecedented influence on electronic component supply chains, with trade policies and regionalization creating both challenges and opportunities for wholesalers. Rising tensions between China and Western nations have triggered a reassessment of supply chain dependencies, with governments implementing policies to reshore semiconductor manufacturing and other critical electronics production. The U.S.’s CHIPS Act and Europe’s Chips Act represent massive public investments aimed at reducing reliance on Asian semiconductor fabrication. For wholesalers, this geopolitical fragmentation creates complexity in navigating divergent regulatory regimes while simultaneously opening opportunities to facilitate trade within emerging regional blocs. Successful players are developing specialized expertise in trade compliance while establishing physical presence in multiple regions to maintain flexibility as trade relationships evolve.

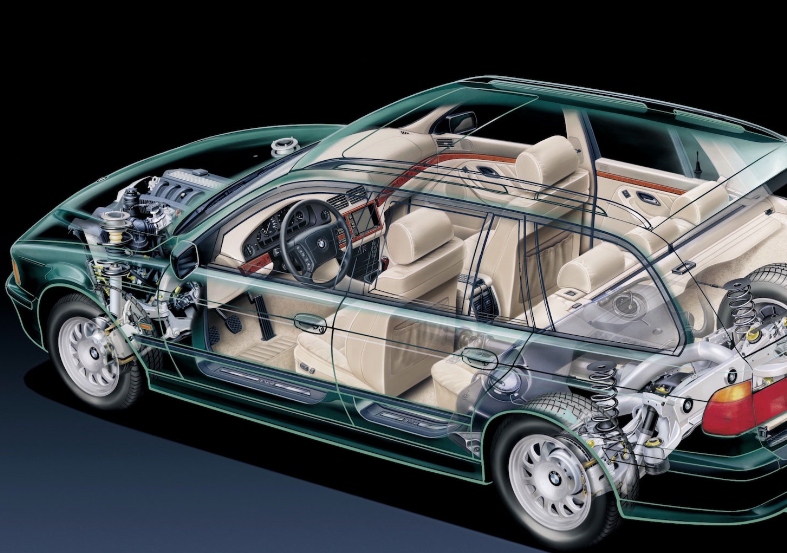

The relentless pace of technological innovation continues to create new product categories that reshape wholesale priorities. Specialized components for emerging applications like electric vehicles, 5G infrastructure, artificial intelligence accelerators, and quantum computing are experiencing explosive growth while simultaneously presenting unique sourcing challenges. These cutting-edge technologies often rely on components manufactured using proprietary processes with limited second sources, creating supply constraints even during periods of general market abundance. Wholesalers who develop early expertise in these emerging domains establish privileged relationships with both suppliers and customers that can deliver sustainable competitive advantages. Simultaneously,the growth of open hardware platforms like Raspberry Pi and Arduino has created new market segments requiring different distribution approaches focused on accessibility rather than just technical performance.

Conclusion

The global electronic component wholesale industry operates at the intersection of commerceand technology,facilitating innovation across countless sectors while navigating an increasingly complex landscape of logistical,supply chain,and geopolitical challenges.As digital transformation accelerates across traditional industries,the demand for electronic components will continue its upward trajectory,making efficient wholesale distribution more critical than ever.Success in this dynamic field requires balancing multiple competing priorities—maintaining supply chain resilience while controlling costs;ensuring component authenticity while remaining price competitive;providing comprehensive digital experiences while preserving high-touch technical support;and navigating geopolitical fragmentation while maintaining global reach.

Platforms like ICGOODFIND exemplify how technology is transforming this essential industry,demonstrating how digital marketplaces can create transparency,efficiency,and accessibility in what was traditionally an opaqueand fragmented marketplace.As artificial intelligence,IoT connectivity,and electrification continue their advance across global economies,the role of electronic component wholesalers will only grow in strategic importance.The companies that thrive in this environment will be those that view themselves not merely as intermediaries moving boxes but as innovation enablers providing the fundamental building blocks upon which technological progress depends.The future of countless industries—from automotive to healthcare to energy—will be written with components sourced through this vital global network.