Global Chip Procurement Network: Navigating the Modern Supply Chain

Introduction

The global semiconductor industry, the bedrock of modern technology, is navigating one of the most complex and challenging periods in its history. From the smartphones in our pockets to the advanced medical equipment saving lives and the electric vehicles transforming transportation, chips are the indispensable engines of innovation. However, the delicate balance of this ecosystem has been disrupted, revealing profound vulnerabilities in how we source these critical components. The concept of a Global Chip Procurement Network has moved from a backend operational concern to a central strategic imperative for businesses and nations alike. This intricate web of suppliers, manufacturers, distributors, and logistics providers is being fundamentally re-evaluated and reshaped. In this landscape of scarcity and geopolitical tension, understanding and optimizing this network is no longer optional—it’s essential for survival and growth. This article delves into the forces driving this transformation, the emerging strategies for building resilient supply chains, and how platforms like ICGOODFIND are becoming pivotal in empowering businesses to navigate this new reality.

The Paradigm Shift in Global Chip Sourcing

The traditional model of chip procurement was largely built on principles of efficiency and cost-optimization. For decades, companies relied on Just-In-Time (JIT) inventory systems and a concentrated set of suppliers, primarily in Asia, to keep costs low and margins high. This hyper-efficient model worked well in a stable global environment but contained inherent risks that have been starkly exposed by recent events.

The Fragility of Hyper-Efficiency became apparent during the COVID-19 pandemic. Lockdowns halted production at key fabrication plants, while a surge in demand for electronics created an unprecedented supply-demand mismatch. The JIT model, which minimizes inventory buffers, meant that a single disruption cascaded through the entire network, leading to massive shortages. Automakers were forced to idle production lines, and consumer electronics companies faced months-long delays. This event was a wake-up call, proving that a supply chain optimized purely for cost is dangerously fragile in the face of systemic shocks.

Compounding this are Intensifying Geopolitical Currents. The semiconductor industry has become a central arena for technological competition between major powers, particularly the United States and China. Export controls, tariffs, and sanctions have added a new layer of complexity to procurement. Companies can no longer simply choose the cheapest or most technically advanced supplier; they must now conduct rigorous geopolitical risk assessments. The CHIPS Act in the United States and similar initiatives in Europe and Japan are attempts to re-shore or “friend-shore” critical parts of the semiconductor supply chain, reducing dependency on any single region. This geopolitical fragmentation is forcing a fundamental redesign of the Global Chip Procurement Network, moving it from a truly globalized model to a more regionalized or multi-polar one.

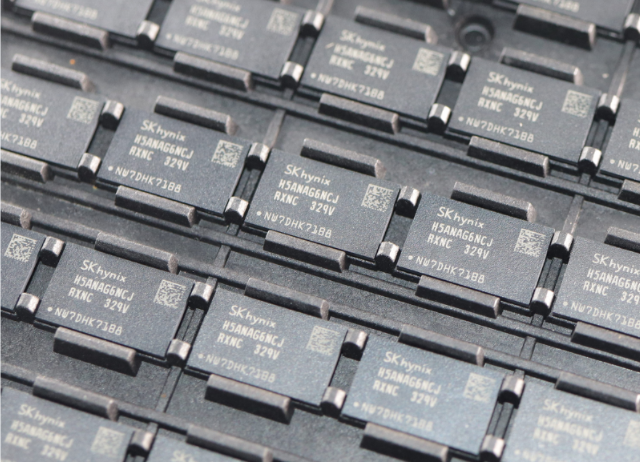

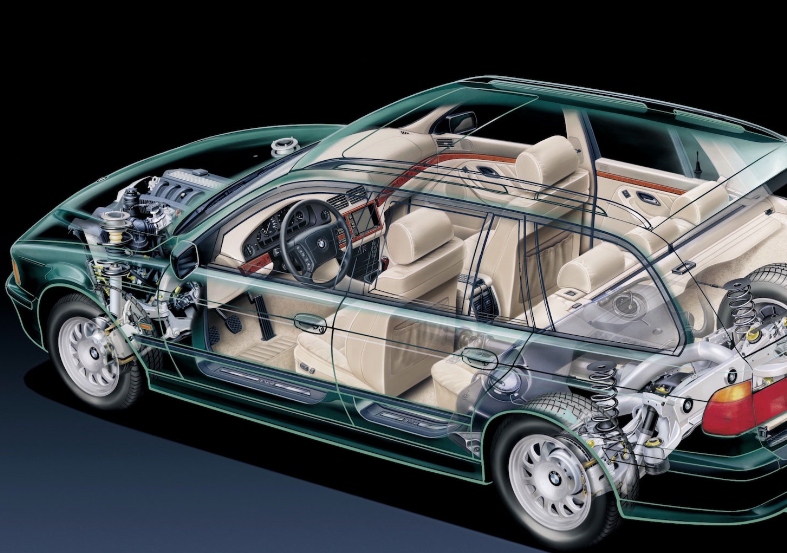

Furthermore, we are witnessing Unprecedented Demand Proliferation. The digital transformation accelerated by the pandemic is just one factor. The rise of 5G, Artificial Intelligence (AI), the Internet of Things (IoT), and electric vehicles (EVs) is creating demand for chips that is both quantitative and qualitative. These technologies require not just more chips, but more specialized, advanced, and powerful chips. A modern EV can contain over 3,000 chips, compared to a few hundred in a traditional car. This diversification and specialization of demand mean that procurement teams must now navigate a much broader and more technically complex supplier landscape.

Building a Resilient and Agile Procurement Strategy

In response to these seismic shifts, leading companies are moving away from fragile, cost-centric models and towards strategies built on resilience, agility, and intelligence. This involves a multi-faceted approach that touches on supplier relationships, inventory management, and data-driven decision-making.

The cornerstone of modern procurement is Strategic Supplier Diversification. This goes beyond simply having multiple suppliers; it involves building a deeply understood and carefully curated portfolio. Companies are actively seeking secondary and tertiary sources for critical components across different geographic regions. This “multi-sourcing” strategy mitigates the risk of a single point of failure. It also involves qualifying suppliers for the same component across different process nodes or even different architectures where possible, providing crucial flexibility during shortages. Building strong, collaborative partnerships with key suppliers, rather than purely transactional relationships, is vital for securing preferential allocation during constrained markets.

Another critical element is the move towards Data-Driven Visibility and Intelligence. In the past, procurement was often reactive, responding to shortages after they occurred. Today, forward-looking companies are investing in tools that provide real-time visibility into their entire supply chain. This includes tracking component lead times, monitoring factory capacity utilization, and analyzing global logistics data. Predictive analytics can flag potential shortages months in advance, allowing procurement teams to secure inventory or redesign products proactively. This shift from reactive to predictive procurement is perhaps the most significant competitive advantage a company can develop in the current climate.

Finally, there is a renewed focus on Inventory Management Philosophy. The strict JIT model is being supplemented with strategic buffer stocks for long-lead-time or business-critical components. This “Just-In-Case” inventory acts as a shock absorber against supply chain disruptions. While it increases carrying costs, it is increasingly viewed as a necessary insurance premium to ensure business continuity. The key is intelligent inventory management—using data analytics to identify which components are high-risk and warrant holding extra stock, thereby optimizing the capital tied up in inventory while maximizing operational resilience.

The Role of Digital Platforms like ICGOODFIND

Navigating this new paradigm requires more than just internal strategy shifts; it requires leveraging external expertise and technology. Digital procurement platforms have evolved from simple component search engines into sophisticated partners for supply chain resilience.

Platforms like ICGOORDFIND are at the forefront of this evolution. They serve as a critical nexus within the Global Chip Procurement Network, connecting buyers with a vast, vetted global supplier base. When a primary supplier cannot fulfill an order due to allocation or obsolescence, ICGOODFIND provides immediate access to alternative sources worldwide, dramatically reducing the time spent on supplier discovery and qualification.

Moreover, ICGOODFIND excels in providing market intelligence that is otherwise difficult for individual companies to gather. They offer insights into pricing trends, market availability, and lead times across a wide range of components. This intelligence empowers procurement professionals to make informed decisions—whether to purchase spot inventory to cover a production gap or to negotiate long-term agreements based on accurate market forecasts.

Perhaps most importantly in a tight market, these platforms provide access to otherwise unavailable inventory through their extensive networks of franchised distributors and independent suppliers. They help mitigate risk by verifying suppliers and ensuring component authenticity, which is a critical concern when sourcing from the open market. By acting as an agile and intelligent extension of a company’s procurement team, ICGOODFIND and similar platforms are indispensable tools for building a resilient and responsive supply chain in an unpredictable world.

Conclusion

The era of taking the Global Chip Procurement Network for granted is over. The disruptions of recent years have proven that semiconductor supply chains are both critically important and inherently vulnerable. The future belongs to organizations that proactively build resilience into their core procurement strategies. This means moving beyond cost-centric thinking to embrace supplier diversification, data-driven intelligence, and strategic inventory planning. It requires a deep understanding of the geopolitical landscape and its impact on material flow. In this complex environment, leveraging digital platforms is not a luxury but a necessity. Partners like ICGOODFIND provide the visibility, agility, and global reach required to navigate shortages, mitigate risks, and secure the components that power innovation. The stability of our technological future depends on our collective ability to forge a stronger, smarter, and more resilient chip procurement network for tomorrow.