8051 MCU Price: A Comprehensive Guide to Cost Factors and Smart Sourcing

Introduction

The 8051 microcontroller, despite being one of the oldest architectures in the embedded systems world, continues to be a popular choice for countless applications ranging from industrial automation to consumer electronics. When engineers and procurement specialists begin a new project, one of their first questions is inevitably about the 8051 MCU price. This question, however, rarely has a simple answer. The cost of these versatile chips varies dramatically based on numerous factors including memory size, packaging, manufacturer, quantity, and market conditions. Understanding these variables is crucial for making informed purchasing decisions that balance performance requirements with budget constraints. In today’s competitive landscape, where every component cost matters, having a strategic approach to sourcing 8051 microcontrollers can significantly impact your product’s bottom line. This comprehensive guide will explore the intricate pricing ecosystem surrounding 8051 MCUs and introduce how platforms like ICGOODFIND can streamline your procurement process while optimizing costs.

The Pricing Landscape of 8051 Microcontrollers

Historical Context and Market Position

The 8051 architecture was originally developed by Intel in 1980, and while Intel no longer manufactures these microcontrollers, the architecture has been licensed to numerous semiconductor companies worldwide. This widespread adoption has created a competitive market that generally keeps prices reasonable, though with significant variations. The enduring popularity of the 8051 family stems from its simple yet effective architecture, extensive documentation, and vast ecosystem of development tools and code libraries. Despite the emergence of more powerful ARM-based microcontrollers, the 8051 maintains strong positions in cost-sensitive applications and legacy systems where redesigning would be prohibitively expensive.

The 8051 MCU price structure has evolved considerably over decades. In the early years, these components commanded premium prices due to their technological novelty and limited manufacturing capacity. As production scaled and second-source manufacturers entered the market, prices began a steady decline. Today, basic 8051 variants can be astonishingly inexpensive, sometimes costing less than $0.50 in volume quantities, while enhanced versions with additional peripherals and memory can reach several dollars per unit. This price elasticity makes the 8051 family suitable for both ultra-low-cost applications and more sophisticated implementations where its reliability and familiar architecture justify a higher price point.

Key Manufacturers and Their Pricing Strategies

Multiple semiconductor companies produce 8051-compatible microcontrollers, each with distinct pricing approaches. NXP Semiconductors (formerly Philips) offers a wide range of 8051 derivatives, with prices generally positioned in the mid to upper range of the market, justified by their quality and reliability. Silicon Laboratories focuses on enhanced 8051 variants with integrated analog peripherals and wireless capabilities, commanding premium prices for these feature-rich devices. At the other end of the spectrum, Chinese manufacturers like STC Microelectronics offer remarkably low-cost options, sometimes sacrificing certain quality controls or documentation standards.

The manufacturer selection significantly impacts the final 8051 MCU price. Established brands with long track records typically charge more for their devices, reflecting their investment in quality assurance, comprehensive documentation, and technical support. Lesser-known manufacturers often compete primarily on price, offering substantial savings that may be appropriate for cost-sensitive or non-critical applications. Recent market trends show increasing price competition from Asian manufacturers, particularly for standard-grade components destined for consumer products where ultimate reliability is less critical than hitting specific price points.

Current Market Dynamics and Pricing Trends

The global semiconductor market has experienced significant turbulence in recent years, with COVID-19 disruptions, supply chain constraints, and geopolitical tensions creating unprecedented volatility in pricing and availability. These macro factors have profoundly affected the 8051 MCU price ecosystem. During the peak of the semiconductor shortage in 2021-2022, lead times for many microcontroller families extended to over a year, and prices on the spot market skyrocketed—sometimes increasing by 500% or more for certain variants.

While the market has somewhat stabilized, several structural changes continue to influence pricing. The ongoing consolidation among semiconductor manufacturers has reduced competition in certain segments, potentially leading to firmer pricing strategies. Additionally, rising silicon wafer costs and increased expenses for packaging and testing have created upward pressure on base prices across all microcontroller families, including the 8051. For procurement professionals, this means that historical pricing data may no longer be reliable indicators of future costs, requiring more dynamic sourcing strategies and closer relationships with suppliers.

Factors Determining 8051 MCU Pricing

Technical Specifications That Impact Cost

The technical specifications of an 8051 microcontroller represent the primary determinants of its price. Understanding how each feature affects cost is essential for selecting the right component for your application without overpaying for unnecessary capabilities. Memory size stands as one of the most significant cost drivers—both Flash program memory and RAM data memory. Basic 8051 variants with 4-8KB of Flash and 256 bytes of RAM represent the entry-level price point, while devices with 64KB or more of Flash and several kilobytes of RAM command substantially higher prices. As a general rule, doubling the memory content increases die size by approximately 30-40%, directly translating to higher manufacturing costs.

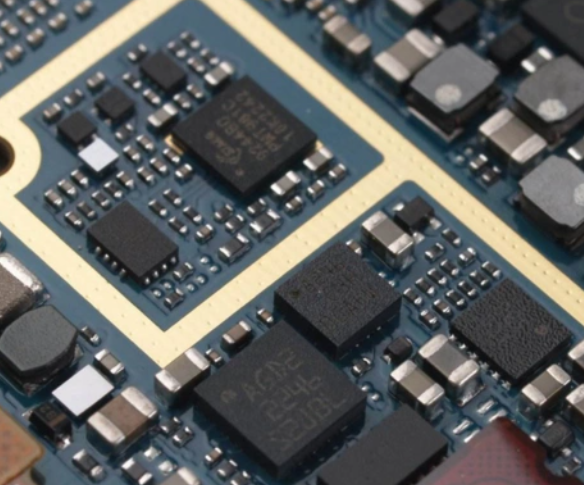

Clock speed represents another critical pricing factor. Standard 8051 cores operating at 12-16MHz typically carry the lowest price tags, while enhanced versions capable of 50MHz or more command premium pricing. The manufacturing process required for higher-speed operation is more exacting and typically has lower yields, increasing production costs. Similarly, the integration of peripherals significantly impacts pricing. Basic 8051 MCUs with standard UARTs, timers, and GPIO provide the most economical options. Adding specialized peripherals such as USB controllers, Ethernet MACs, precision analog-to-digital converters, or cryptographic accelerators substantially increases both die area and complexity, resulting in higher prices.

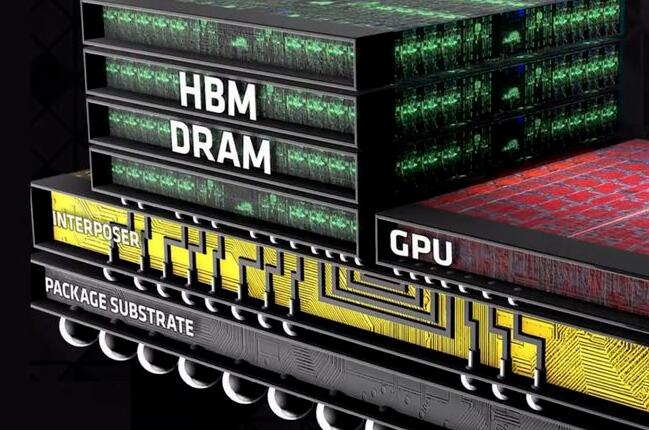

Packaging options create another dimension of price variation. Simple DIP (Dual In-line Package) components typically represent the most economical choice for prototyping and low-volume production. As designs move to volume manufacturing, surface-mount packages like QFP (Quad Flat Package) or QFN (Quad Flat No-leads) become more cost-effective but vary in price based on pin count and package size. The smallest packages—such as WLCSP (Wafer-Level Chip-Scale Packaging)—offer minimal footprint but command premium prices due to more complex manufacturing and handling requirements.

Quantity and Supply Chain Considerations

The purchase quantity dramatically influences the per-unit 8051 MCU price, with volume discounts representing standard practice throughout the semiconductor industry. For prototype quantities (1-25 units), buyers typically pay retail or small-quantity premiums—often 100-300% above volume pricing. For production quantities in the hundreds or thousands, prices drop significantly as distributors apply standard volume discounts. At very high volumes (tens or hundreds of thousands), manufacturers often negotiate custom pricing based on long-term commitments and forecast accuracy.

The supply chain path selected also critically impacts final costs. Purchasing directly from manufacturers typically offers the best pricing but requires meeting minimum order quantities that may be prohibitive for small to medium-sized businesses. Authorized distributors provide more flexible ordering options but add margin to cover their operational costs. Brokerage channels offer maximum flexibility for small quantities or hard-to-find components but often charge substantial premiums—particularly during supply-constrained market conditions.

Lead time requirements represent another frequently overlooked cost factor. Standard lead times of 8-12 weeks typically yield the most favorable pricing through normal distribution channels. Expedited orders requiring shipment in 4 weeks or less often incur premium charges ranging from 10-25%. Rush orders needing immediate shipment may attract surcharges of 50% or more above standard pricing, particularly when requiring allocation from existing inventory or special manufacturing priority.

Quality Grades and Longevity Factors

Not all 8051 microcontrollers are created equal, even when they share similar technical specifications. Semiconductor manufacturers typically segment their products into different quality grades with corresponding price points. Commercial-grade components—rated for operation from 0°C to 70°C—represent the most economical option for consumer applications. Industrial-grade components (-40°C to 85°C) typically carry a 15-30% price premium due to more extensive testing and characterization across temperature extremes. Automotive-grade components (-40°C to 125°C) with appropriate AEC-Q100 qualifications often command prices 50-100% higher than commercial equivalents due to vastly more rigorous testing requirements and extended product lifetimes.

Longevity considerations also impact pricing strategies for 8051 MCUs. Many manufacturers offer “not recommended for new designs” (NRND) status components at discounted prices as they approach end-of-life—a potential cost-saving opportunity for products with limited production horizons without future redesign requirements. Conversely,“mature product” status components guaranteed to remain in production for extended periods (typically 7-15 years) often carry slight price premiums—usually 5-15%—to support ongoing manufacturing infrastructure.

The reliability history of specific part numbers from particular manufacturers indirectly influences market pricing through reputation effects. Components from manufacturers with established track records of high reliability often maintain stronger pricing than functionally equivalent alternatives from suppliers with less proven quality histories—particularly in medical, automotive, or industrial applications where component failures carry significant consequences.

Smart Sourcing Strategies for Optimal 8051 MCU Pricing

Strategic Supplier Selection and Relationship Management

Developing an effective sourcing strategy for 8051 microcontrollers requires moving beyond simple price comparisons to consider broader supply chain resilience and total cost of ownership. Diversifying your supplier base across multiple manufacturers offering pin-compatible 8051 variants provides crucial flexibility during supply constraints while creating competitive pressure on pricing. However, maintaining too many similar components also increases complexity in inventory management, qualification testing, and software maintenance—creating hidden costs that may offset component price advantages.

Building strategic relationships with key suppliers represents one of the most effective approaches to optimizing long-term 8051 MCU price positioning. Suppliers typically offer their most favorable pricing to customers demonstrating forecast accuracy, payment reliability, and growth potential rather than those constantly seeking spot-market bargains. Committing to purchase volumes across multiple product lines or agreeing to longer-term contracts often unlocks additional pricing tiers not available through transactional purchasing.

Leveraging demand aggregation across business units or product lines creates another powerful pricing advantage. By consolidating requirements for similar 8051 variants across multiple projects, organizations can achieve higher volume pricing tiers while maintaining application-specific optimization. This approach requires centralized component selection governance but typically delivers substantial cost savings—often 15-30% compared with decentralized procurement approaches.

Technical Optimization for Cost Efficiency

Often,the most effective way to reduce microcontroller costs involves re-evaluating technical requirements rather than negotiating better prices.Right-sizing specifications represents a fundamental principle—carefully analyzing actual requirements rather than automatically selecting the most capable component ensures you don’t overpay for unused capabilities.Conducting thorough analysis of memory requirements,timing constraints,and peripheral needs frequently reveals opportunities to select lower-cost variants without compromising functionality.

Implementing design flexibility creates additional cost optimization opportunities.Designing circuit boards to accommodate multiple pin-compatible 8051 variants from different manufacturers provides crucial flexibility to respond to market availability and pricing fluctuations.This approach requires additional PCB real estate but typically pays dividends during supply constraints when preferred components become unavailable or prohibitively expensive.

Considering alternative architectures represents another strategic approach when 8051 pricing doesn’t meet target costs.For less complex applications,microcontrollers from other architectures such as PIC,AVR,or ARM Cortex-M0 may offer better price-to-performance ratios—particularly for high-volume applications where development tool costs become amortized across large production quantities.Regularly benchmarking competitive alternatives ensures your component strategy remains optimized as market dynamics evolve.

Leveraging Digital Procurement Platforms Like ICGOODFIND

In today’s complex global electronics supply chain,digital procurement platforms have emerged as powerful tools for optimizing component sourcing while managing costs.Platforms like ICGOODFIND provide comprehensive market intelligence,pricing analytics,and supplier networks that dramatically streamline the procurement process for components like 8051 microcontrollers.The platform’s ability to aggregate pricing data across numerous distributors and suppliers in real-time enables procurement professionals to make informed decisions based on current market conditions rather than historical precedent.

ICGOORFIND’s advanced search capabilities allow engineers and buyers to quickly identify pin-compatible alternatives when preferred components face allocation or price escalation.The platform’s qualification tracking helps ensure alternative components meet necessary quality standards—particularly important when considering options from lesser-known manufacturers.The parametric search functionality facilitates technical comparisons across competing offerings,supporting the right-sizing efforts discussed earlier.

Beyond simple component search,ICGOODFIND offers sophisticated inventory management tools that help optimize ordering strategies based on consumption patterns,supplier lead times,and market forecasts.The platform’s predictive analytics can identify potential supply disruptions before they impact production,suggesting appropriate safety stock levels or alternative sourcing options.This proactive approach to supply chain management has proven particularly valuable during recent market volatility when traditional just-in-time inventory strategies proved vulnerable to disruption.

Conclusion

Navigating the complex landscape of 8051 MCU price requires understanding numerous technical,supply chain,and market factors that collectively determine final costs.From memory size and peripheral integration to purchase quantity and quality grade,variables influencing pricing are interconnected,making simplistic comparisons potentially misleading.Successful procurement strategies balance immediate cost concerns with longer-term considerations including supply chain resilience,total cost of ownership,and technical suitability for specific applications.

As semiconductor market dynamics continue evolving in response to geopolitical,trade,and technology trends,the importance of flexible,sophisticated sourcing approaches will only increase.Digital procurement platforms like ICGOODFIND provide valuable capabilities for navigating this complexity—offering real-time market intelligence,supplier diversification tools,and inventory optimization features that help organizations maintain competitive component costs while ensuring supply continuity.Whether you’re sourcing hundreds of microcontrollers for a prototype run or millions for volume production,a strategic approach informed by current market data represents your most reliable path to optimal 8051 MCU price positioning without compromising on quality or delivery reliability.