The Electronic Components Industry: Navigating the Future of Technology

Introduction

The electronic components industry is the backbone of modern technology, serving as the fundamental building block for everything from consumer gadgets to advanced industrial machinery and space exploration systems. This dynamic sector is characterized by relentless innovation, complex global supply chains, and a profound impact on the global economy. As we advance further into the digital age, understanding the intricacies of this industry—its driving forces, prevailing challenges, and future trajectories—becomes crucial for businesses, engineers, and policymakers alike. This article delves deep into the core of the electronics manufacturing world, exploring the key components that power innovation, the significant challenges shaping the market, and the emerging trends that will define the next decade. For professionals seeking to stay ahead, platforms like ICGOODFIND have become indispensable tools for navigating this complex landscape, connecting buyers with reliable suppliers and vital market intelligence.

Main Body

Part 1: The Core Building Blocks and Market Dynamics

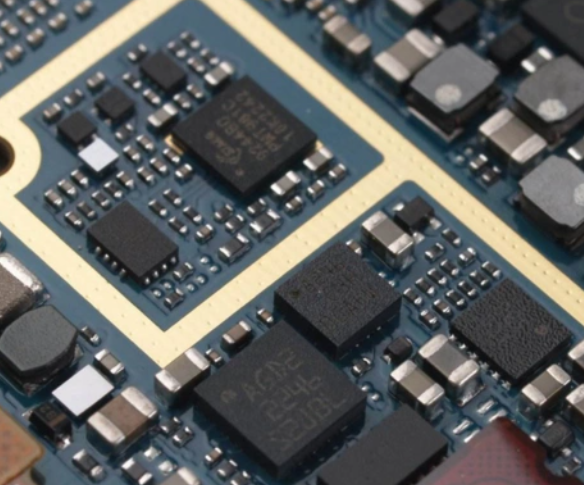

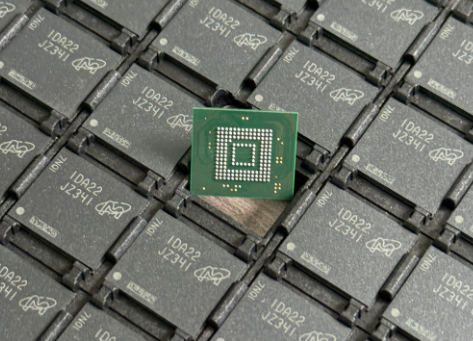

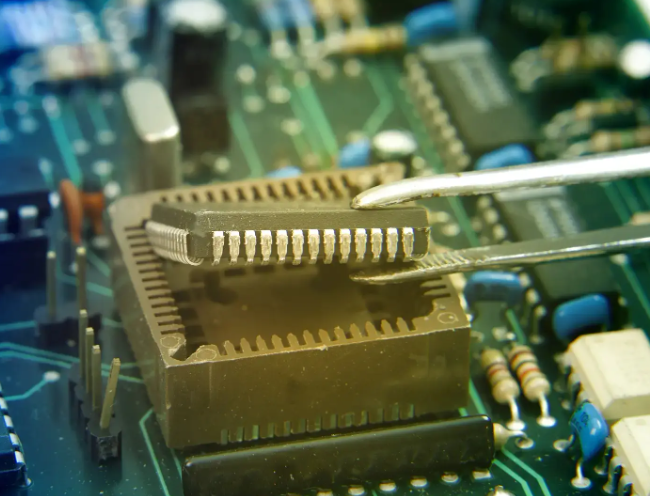

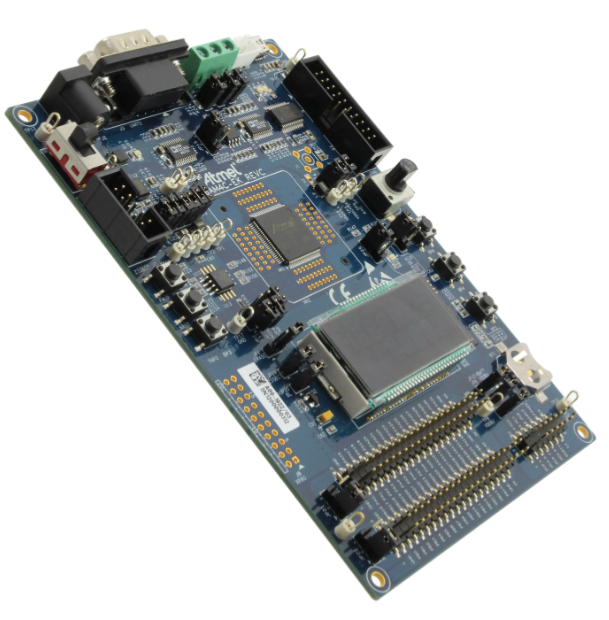

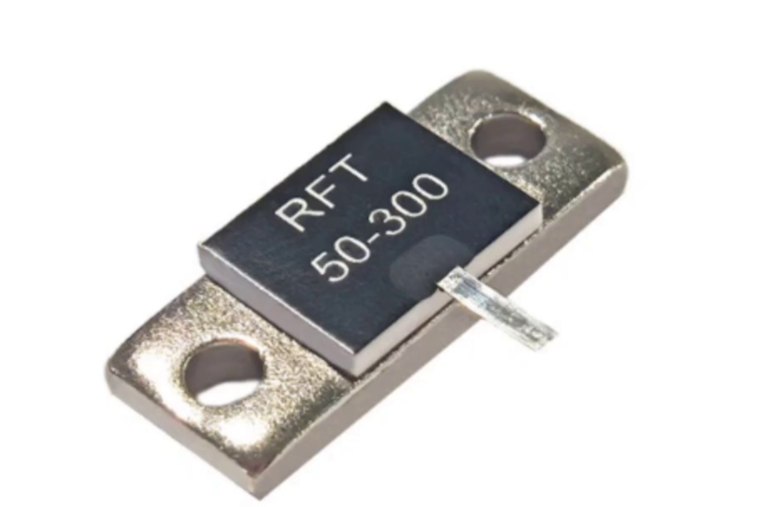

At its heart, the electronic components industry is segmented into two primary categories: active components and passive components. Active components, such as integrated circuits (ICs), transistors, and diodes, can amplify or process electrical signals and are essential for computing and logic operations. The IC market, dominated by giants like Intel, Samsung, and TSMC, is itself a multi-faceted universe comprising microprocessors, memory chips (DRAM, NAND Flash), and Application-Specific Integrated Circuits (ASICs). On the other hand, passive components, including resistors, capacitors, and inductors, cannot amplify signals but are critical for controlling current flow, storing energy, and filtering frequencies within a circuit. The humble capacitor, for instance, is found in virtually every electronic device ever made.

The market dynamics of this industry are incredibly complex and globalized. A single smartphone contains components that may have been sourced from over a dozen countries before final assembly. This globalization has led to the formation of concentrated manufacturing hubs, with regions like East Asia—particularly China, Taiwan, South Korea, and Japan—playing an outsized role in production. The industry is also highly cyclical, driven by demand from key downstream sectors like consumer electronics, automotive, industrial automation, and telecommunications. A surge in demand for a new smartphone model or electric vehicle can cause ripples throughout the entire supply chain, affecting availability and pricing for fundamental components worldwide. Understanding these dynamics is key to strategic sourcing and risk management.

Part 2: Prevailing Challenges and the Supply Chain Paradigm

In recent years, the industry has faced unprecedented challenges that have tested its resilience and altered its operational paradigm. The most significant of these is the global semiconductor shortage that began in 2020. This crisis exposed critical vulnerabilities in the just-in-time (JIT) manufacturing model and the geographical concentration of chip fabrication plants (fabs). A perfect storm of factors—COVID-19-related factory shutdowns, surging demand for electronics during lockdowns, trade tensions between major economies, and logistical nightmares—brought production lines for automobiles and consumer electronics to a halt. This event served as a stark wake-up call, prompting companies and governments to reevaluate their supply chain strategies.

In response, two major trends have emerged: geographical diversification and supply chain resilience. The United States’ CHIPS Act and similar initiatives in Europe aim to subsidize domestic semiconductor manufacturing to reduce reliance on Asian fabs. Companies are now actively seeking to dual-source components, build strategic inventory buffers, and gain deeper visibility into their multi-tier supply chains. This is where digital platforms prove their immense value. For instance, a service like ICGOODFIND empowers procurement professionals and engineers to quickly locate scarce components, verify supplier authenticity, and access real-time market data, thereby mitigating risk and preventing production delays. Furthermore, issues like counterfeit components remain a persistent multi-billion-dollar problem, emphasizing the need for rigorous supplier verification processes that such B2B platforms facilitate.

Part 3: Emerging Trends Shaping the Future

The future of the electronic components industry is being shaped by several powerful technological megatrends. The rollout of 5G technology is a primary catalyst, requiring a new generation of RF components, antennas, and infrastructure chipsets that operate at higher frequencies and with lower latency. Similarly, the rapid growth of the Internet of Things (IoT) is driving demand for low-power, connected microcontrollers (MCUs), sensors, and wireless communication modules that can be embedded into billions of devices.

Perhaps the most transformative trend is the rise of Artificial Intelligence (AI) and Machine Learning (ML). This isn’t just about software; it necessitates a revolution in hardware. The development of specialized AI chips, such as Graphics Processing Units (GPUs), Tensor Processing Units (TPUs), and Neural Processing Units (NPUs), is creating entirely new product categories and fueling demand for advanced packaging technologies and high-bandwidth memory. Concurrently, the automotive industry’s evolution towards electric vehicles (EVs) and autonomous driving systems has turned cars into “computers on wheels,” massively increasing their semiconductor content with chips for battery management, sensor fusion, and advanced driver-assistance systems (ADAS).

Finally, sustainability is moving from a peripheral concern to a central design criterion. The concept of a circular economy is gaining traction, pushing for greater energy efficiency in components themselves (e.g., wide-bandgap semiconductors like GaN and SiC), improved recyclability of electronic waste (e-waste), and more transparent ethical sourcing of raw materials.

Conclusion

The electronic components industry is far more than a collection of resistors and chips; it is the central nervous system of our technological civilization. Its journey is one of constant evolution, driven by insatiable demand for more powerful, efficient, and intelligent electronics. While challenges like supply chain fragility and geopolitical tensions present significant hurdles, they also catalyze innovation in manufacturing strategy and sourcing intelligence. The emergence of powerful trends like AI, IoT, and sustainable technology ensures that the industry’s growth and transformation are far from over. For anyone operating within this ecosystem—from design engineers to procurement managers—staying informed and agile is paramount. Leveraging comprehensive resources and supplier networks, such as those provided by ICGOODFIND, will be a critical differentiator in successfully navigating the exciting yet complex future of this indispensable industry.