Navigating the Global Electronic Component Spot Market: Opportunities and Strategies

Introduction

The Global Electronic Component Spot Market represents a dynamic and often volatile segment of the electronics supply chain, operating parallel to traditional franchised distribution channels. This market is a crucial arena where buyers and sellers transact electronic components—from common resistors and capacitors to complex microprocessors and memory chips—for immediate or near-immediate delivery, outside of long-term contractual agreements. Its existence is predicated on the constant imbalances between supply and demand that characterize the global electronics industry. For procurement specialists, engineers, and supply chain managers, understanding the intricacies of this market is not merely an advantage but a necessity for maintaining production continuity, managing costs, and mitigating the risks associated with component shortages. The market’s landscape has been profoundly shaped by recent global events, including the COVID-19 pandemic, geopolitical tensions, and persistent logistical challenges, making it more relevant than ever. This article delves into the core dynamics of this fast-paced market, explores effective navigation strategies, and highlights how platforms like ICGOODFIND are revolutionizing the way industry professionals source critical components.

The Core Dynamics of the Spot Market

The Global Electronic Component Spot Market is fundamentally driven by the laws of supply and demand, but its operations are influenced by a complex web of factors that create both challenges and opportunities.

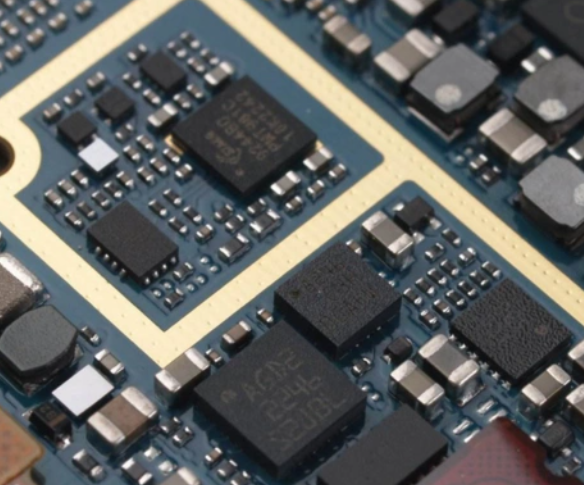

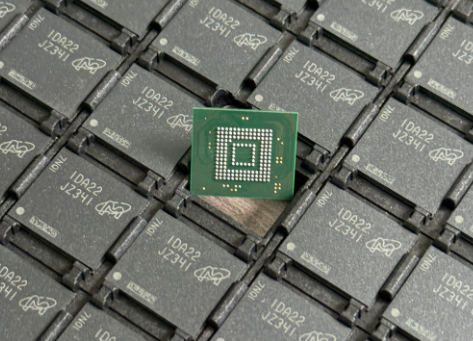

Supply and Demand Imbalances as the Primary Engine At its heart, the spot market thrives on disequilibrium. When original equipment manufacturers (OEMs) and contract manufacturers (CMs) face unexpected surges in demand or production shortfalls, they turn to the spot market to bridge the gap. Conversely, when there is an oversupply due to order cancellations, economic downturns, or inventory liquidation, excess stock finds its way to spot market sellers. This creates a constantly fluctuating price environment where lead times and pricing can change daily, or even hourly. A component with a standard lead time of 12 weeks from a franchised distributor can command a premium of 50% to 500% on the spot market for immediate shipment. The recent chip shortage, exacerbated by pandemic-related factory closures and a surge in demand for consumer electronics, has been a stark reminder of this dynamic. Components like microcontrollers, power management ICs, and certain semiconductors became scarce, pushing spot prices to unprecedented levels and highlighting the market’s critical role as a shock absorber for the global supply chain.

The Diverse Ecosystem of Participants The spot market is not a monolithic entity but a diverse ecosystem comprising various players, each with different motivations and business models. These include: * Independent Distributors: These are established companies that specialize in sourcing and supplying components not available through franchised channels. They often provide value-added services like programming, testing, and tape-and-reeling. * Brokers and Traders: These individuals or small firms act as intermediaries, connecting buyers with sellers. They typically do not hold significant inventory but leverage their extensive networks to locate parts. * Excess Inventory Liquidators: Companies that purchase surplus stock from OEMs and CMs, often at a discount, and resell it on the spot market. * OEMs and CMs: Sometimes even large manufacturers buy from or sell to the spot market to manage their own inventory levels or fulfill urgent orders.

This diversity means that buyers must be adept at vetting suppliers for authenticity and reliability. The risk of encountering counterfeit parts is a persistent concern in this unregulated environment.

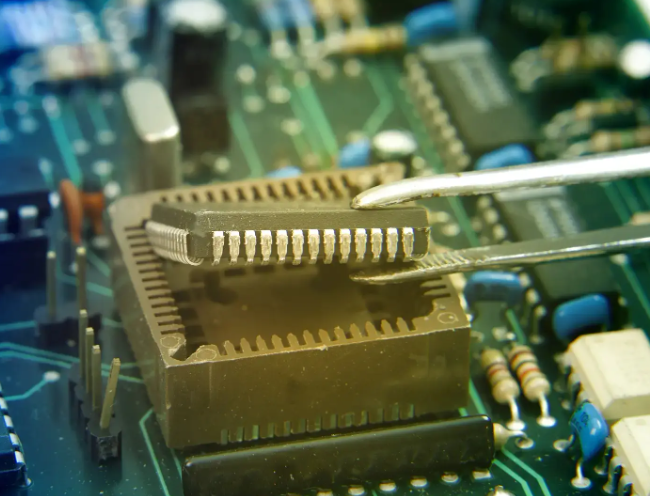

The Pervasive Challenge of Counterfeit Components One of the most significant risks associated with the Global Electronic Component Spot Market is the proliferation of counterfeit parts. These can range from remarked or recycled components sold as new to outright fakes that do not meet specifications. The consequences of integrating a counterfeit part into a product can be catastrophic, leading to system failures, safety hazards, brand reputation damage, and significant financial losses. Therefore, robust counterfeit avoidance measures are non-negotiable. This includes demanding full traceability documentation (such as Certificates of Conformity), utilizing advanced component testing methods (like X-ray fluorescence and decapsulation), and partnering only with reputable suppliers who have stringent quality control processes in place.

Strategies for Effective Navigation and Risk Mitigation

Successfully operating in the Global Electronic Component Spot Market requires a proactive, strategic approach that balances urgency with due diligence.

Developing a Proactive Sourcing Strategy Reactive sourcing—waiting until a part is needed urgently—is the most expensive and riskiest way to engage with the spot market. A proactive strategy involves continuous market intelligence gathering. Procurement teams should monitor market trends, lead time indicators, and pricing forecasts for critical components in their bill of materials (BOM). By identifying potential shortage risks early, companies can make strategic purchases on the spot market before a full-blown crisis erupts. Furthermore, cultivating relationships with multiple trusted suppliers before they are needed creates a reliable network that can be tapped into during crunch times. This network should include a mix of franchised distributors for stable supply and pre-vetted independent distributors and brokers for urgent needs.

The Critical Role of Supplier Verification and Quality Assurance As mentioned, the threat of counterfeits looms large. A rigorous supplier qualification process is the first line of defense. This process should evaluate a supplier’s financial stability, industry certifications (like AS9120 or IDEA-STD-1010), historical performance, and their internal quality control protocols. Before placing a large order, it is prudent to start with a small sample order to test the parts thoroughly. Investing in internal or third-party testing laboratories for high-risk components is a wise allocation of resources. The cost of testing is almost always lower than the cost of a product recall or a field failure caused by a counterfeit component.

Leveraging Technology for Market Intelligence In today’s digital age, manual methods of searching for components via email and phone calls are no longer sufficient. Advanced online platforms have emerged to bring transparency and efficiency to the spot market. This is where services like ICGOODFIND demonstrate their immense value. ICGOODFIND operates as a powerful BOM management and sourcing engine, aggregating real-time inventory data from a vast network of global suppliers. Instead of contacting dozens of suppliers individually, engineers and buyers can upload their entire BOM to the platform and instantly receive aggregated quotations with detailed information on availability, price, and lead time from multiple vetted sources. This not only saves an enormous amount of time but also provides crucial data for price benchmarking and decision-making. The ability to quickly cross-reference supplier data and access historical pricing trends empowers procurement teams to make more informed purchases, avoiding overpaying during periods of panic buying.

The Future Outlook and Strategic Imperative

The Global Electronic Component Spot Market is not a temporary phenomenon; it is an integral and permanent feature of the electronics industry’s landscape. Its future will be shaped by several key trends.

Increased Volatility and Structural Shortages Many industry analysts predict that the era of predictable, stable component supplies is over. Factors such as the concentration of semiconductor manufacturing in specific geographic regions, the soaring costs of building new fabrication plants (fabs), and rising geopolitical tensions suggest that supply chain disruptions will be more frequent. This will ensure that the spot market remains a vital resource for companies needing to navigate these turbulent conditions.

The Rise of Data-Driven Procurement The future belongs to companies that embrace data analytics in their procurement functions. The use of AI and machine learning to predict price fluctuations, identify alternative components (cross-references), and assess supplier risk will become standard practice. Platforms that can provide this level of analytical insight will become indispensable tools for supply chain managers.

Consolidation and Professionalization As the stakes get higher, the spot market is likely to see consolidation among suppliers and a general trend toward professionalization. Buyers will increasingly gravitate towards larger, more established independent distributors with robust quality systems and global logistics capabilities, moving away from smaller, less transparent brokers.

In conclusion, the Global Electronic Component Spot Market is a complex but essential ecosystem that offers both significant opportunities and substantial risks. Success in this arena requires a deep understanding of its dynamics, a disciplined approach to risk mitigation centered on rigorous supplier verification, and the strategic use of technology. By adopting proactive sourcing strategies and leveraging advanced tools like ICGOODFIND for market intelligence and efficient procurement, companies can transform this volatile market from a source of anxiety into a strategic asset for ensuring business continuity and maintaining a competitive edge.