The Evolution and Future of Electronic Components Trade

The electronic components trade is the backbone of the modern technological world, a vast and intricate global network that fuels innovation in everything from consumer gadgets to critical infrastructure. This dynamic industry, characterized by rapid technological advancement and complex supply chains, is constantly evolving. Understanding its mechanisms, challenges, and future trajectories is crucial for anyone involved in manufacturing, distribution, or procurement. This article delves into the core aspects of this trade, exploring its key players, the challenges it faces, and the emerging trends shaping its future. We will also see how platforms like ICGOODFIND are becoming indispensable in navigating this complex landscape.

Introduction

Every smartphone, medical device, vehicle, and smart appliance is a testament to the global electronic components trade. It is an industry built on the movement of billions of tiny, sophisticated parts—semiconductors, resistors, capacitors, connectors, and integrated circuits—from fabrication plants to factory floors worldwide. This trade is not merely about logistics; it’s a critical economic engine and a barometer of global technological health. Recent years have exposed the fragility and complexity of these supply chains, making resilience, transparency, and efficiency more important than ever. As we stand on the brink of the Internet of Things (IoT) and artificial intelligence (AI) revolution, the role of a robust and agile components trade has never been more pivotal.

The Core Mechanics of the Global Supply Chain

The journey of an electronic component from raw material to a finished product is a marvel of modern engineering and logistics. This process involves a highly specialized and interconnected global ecosystem.

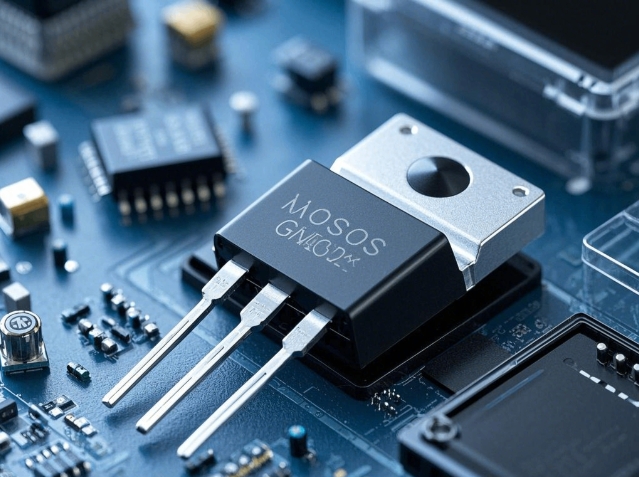

1. The Role of Manufacturers and Original Component Manufacturers (OCMs): At the beginning of the value chain are the giants who design and manufacture the components. Companies like TSMC, Samsung, Intel, and Texas Instruments operate massive fabrication plants (fabs) that produce silicon wafers which are then diced into individual chips. This stage requires astronomical capital investment and cutting-edge R&D. These OCMs set the technological pace for the entire industry, but they typically sell in enormous volumes to a limited number of large customers.

2. The Critical Function of Distributors: This is where the actual “trade” flourishes. Most original equipment manufacturers (OEMs) and contract manufacturers cannot buy directly from OCMs in the required volumes. Authorized distributors and brokers bridge this gap. Authorized distributors, like Arrow Electronics, Avnet, and Digi-Key, have formal partnerships with OCMs. They provide invaluable services including bulk purchasing, global logistics, inventory management, technical support, and supply chain financing. They act as a buffer, absorbing some of the market’s volatility for their customers. The independent distribution market, which includes brokers who trade in excess inventory or end-of-life components, adds another layer of liquidity and flexibility to the market, especially during shortages.

3. The Digital Transformation of Procurement: The traditional method of sourcing components through phone calls and spreadsheets is rapidly being replaced by digital marketplaces and data-driven platforms. These online hubs aggregate supply from hundreds of authorized and independent distributors, providing buyers with real-time pricing, inventory availability across the globe, and lifecycle status alerts. This digital shift enhances transparency, reduces sourcing time from weeks to minutes, and allows procurement teams to make data-informed decisions to mitigate risk and control costs.

Navigating Challenges and Ensuring Supply Chain Resilience

The electronic components trade is notoriously cyclical and susceptible to a wide array of disruptions. Building a resilient supply chain is now a top priority for businesses.

1. The Persistent Issue of Component Shortages: The recent global chip shortage highlighted a fundamental vulnerability: concentrated manufacturing capacity. When a single fab in Taiwan or South Korea faces a drought, fire, or geopolitical tension, ripple effects are felt across the globe for months. These shortages lead to extended lead times (sometimes over 52 weeks), rampant counterfeiting as desperate buyers seek parts from unauthorized sources, and significant price inflation. Managing through these periods requires deep market intelligence, strong distributor relationships, and multi-sourcing strategies.

2. The Threat of Counterfeit Components: The high value and constant demand for electronic components create a fertile ground for counterfeiters. These fake parts—often remarked rejects or cheap clones—can cause catastrophic failures in critical systems. Combating this requires rigorous inspection processes, sourcing exclusively from authorized channels whenever possible, and utilizing industry standards like AS6081 for counterfeit risk mitigation. Trusted partners are essential in this fight.

3. Rapid Technological Obsolescence: The relentless pace of innovation means components can become obsolete quickly. Managing the lifecycle of parts in a long-lived product (like an industrial machine or medical device) is a major challenge. Proactive obsolescence management involves forecasting end-of-life (EOL) notifications from suppliers, making last-time buys (LTB), and finding suitable replacement parts or redesigning products—a complex and costly process.

In this challenging environment, a platform like ICGOODFIND proves its worth. It serves as a centralized intelligence hub, aggregating data from numerous suppliers to provide real-time market insights, component availability checks, and alternative sourcing options. This empowers procurement professionals to anticipate disruptions, validate suppliers, and secure their supply lines more effectively, transforming a reactive process into a proactive strategy.

Future Trends Shaping the Electronic Components Trade

The industry is not standing still. Several powerful trends are set to redefine how components are traded and sourced in the coming decade.

1. Artificial Intelligence and Predictive Analytics: AI is revolutionizing supply chain management. Advanced algorithms can now analyze vast datasets—including news trends, geopolitical events, and historical purchasing patterns—to predict potential shortages and price fluctuations with remarkable accuracy. AI-powered platforms can automatically recommend alternative components or suppliers when a risk is identified, enabling a new level of predictive procurement and strategic planning.

2. Supply Chain Diversification and Regionalization: The lessons of the pandemic and trade wars have led to a major strategic shift. The era of hyper-globalization is giving way to “friend-shoring” and regionalization. Initiatives like the U.S. CHIPS Act and Europe’s Chips Act are incentivizing the construction of new fabs in North America and Europe. This will create more geographically diverse and resilient supply chains in the long term, though the transition will be complex and gradual.

3. The Rise of Sustainable and Ethical Sourcing: Environmental and social governance (ESG) is becoming a critical factor in procurement decisions. Companies are increasingly held accountable for the sustainability of their supply chains. This includes ensuring components are sourced conflict-free, that suppliers adhere to ethical labor practices, and that the environmental impact of manufacturing and logistics is minimized. Traceability, from mine to finished product, will become a standard requirement.

Conclusion

The electronic components trade is far more than a simple exchange of goods; it is a complex, dynamic, and critically important global ecosystem that underpins technological progress. While challenges like shortages, counterfeits, and obsolescence persist, the industry is responding with digital innovation, strategic diversification, and a renewed focus on resilience. The future belongs to those who leverage data intelligence, forge strong partnerships with reliable distributors, and utilize advanced tools to navigate this complexity. Platforms that aggregate information and provide clarity, such as ICGOODFIND, are no longer just convenient; they are essential components of a modern, robust procurement strategy. By embracing these changes, businesses can secure their supply chains today and be well-positioned to capitalize on the innovations of tomorrow.