Asia Electronic Component Spot Market: Navigating Opportunities and Challenges

Introduction

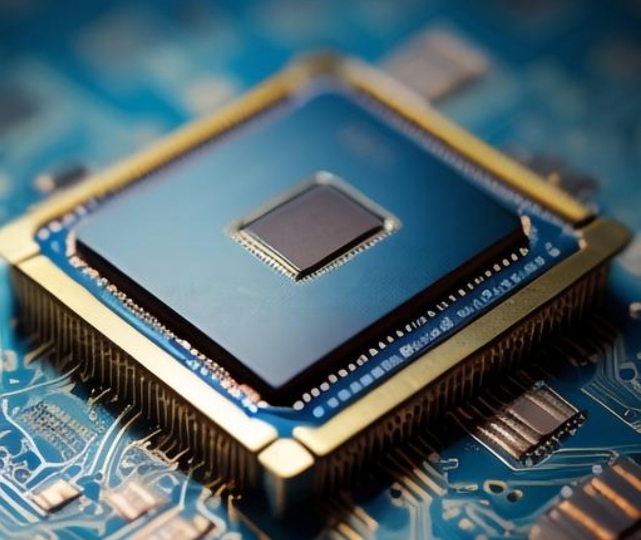

The Asia electronic component spot market represents a dynamic and critical segment of the global electronics supply chain. As the world’s manufacturing hub, Asia’s spot market for components—from semiconductors and resistors to advanced microcontrollers—is a barometer for industry health, technological trends, and supply chain stability. Unlike traditional contract-based purchasing, the spot market involves the immediate buying and selling of components, often at fluctuating prices driven by supply and demand. This market has gained immense significance in recent years, propelled by geopolitical tensions, pandemic-induced disruptions, and the relentless demand for consumer electronics, automotive systems, and industrial automation. For procurement specialists, engineers, and business leaders, understanding the intricacies of this market is not just beneficial; it is essential for maintaining competitive advantage and operational resilience. This article delves into the structure, key drivers, challenges, and strategic approaches for success in the Asia electronic component spot market, highlighting how platforms like ICGOODFIND are revolutionizing access and transparency.

The Structure and Dynamics of the Asia Electronic Component Spot Market

The Asia electronic component spot market is a complex ecosystem comprising manufacturers, distributors, independent traders, and end-users. Its structure is characterized by high volatility, rapid transaction cycles, and a vast network of participants across key regions like China, Taiwan, South Korea, Japan, and Southeast Asia. At its core, this market serves as a balancing mechanism for supply chain gaps. When original equipment manufacturers (OEMs) face shortages due to production delays or unexpected demand spikes, they turn to the spot market to secure critical parts quickly. Conversely, excess inventory from overproduction or canceled orders often finds its way here, allowing sellers to liquidate stock.

One of the defining features of this market is its price volatility. Prices can swing dramatically based on factors such as component scarcity, lead times from original manufacturers, and macroeconomic events. For instance, the global chip shortage that began in 2020 saw prices for certain microcontrollers and logic chips surge by hundreds of percentage points on the spot market. This volatility is both a risk and an opportunity; astute buyers can secure components at reasonable rates during periods of oversupply, while sellers can capitalize on shortages.

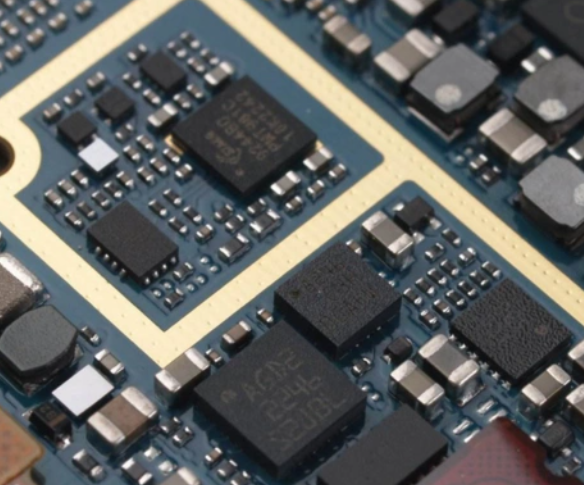

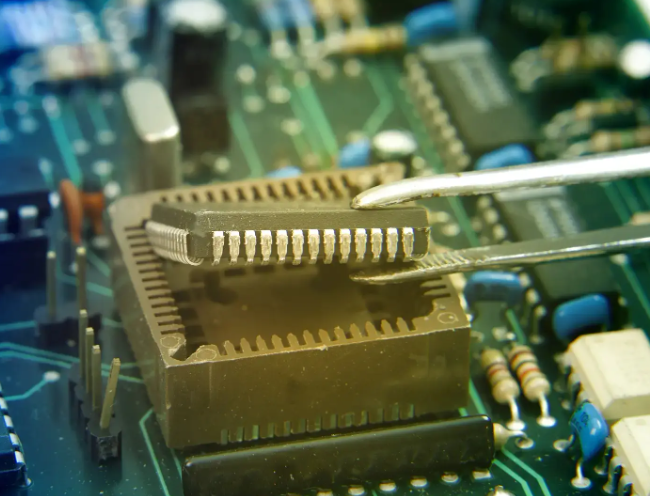

The role of independent distributors and online platforms has become increasingly pivotal. Traditional authorized distributors often operate on fixed contracts and long-term relationships, but the spot market thrives on agility. Independent distributors and digital marketplaces facilitate transactions by connecting buyers with sellers globally, offering real-time inventory data and pricing insights. This is where solutions like ICGOORDFIND demonstrate their value by aggregating listings and providing verified suppliers, thereby reducing the risk of counterfeit parts—a perennial concern in the spot market. The market’s liquidity is further enhanced by the presence of large electronic component hubs in Shenzhen (China), Taipei (Taiwan), and Seoul (South Korea), where physical and digital exchanges coalesce.

Moreover, the market is segmented by component type and application. Commodity components like resistors and capacitors may see more stable trading, while advanced semiconductors—such as those used in artificial intelligence or 5G infrastructure—command premium prices and are subject to intense competition. Understanding these segments is crucial for participants to navigate pricing trends and availability effectively.

Key Drivers Fueling Growth and Volatility

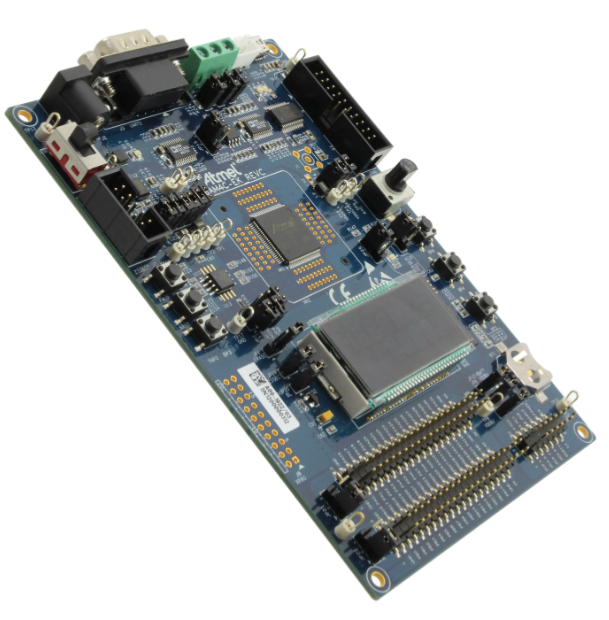

Several interconnected factors drive the growth and volatility of the Asia electronic component spot market. The relentless expansion of the Internet of Things (IoT), automotive electronics, and 5G technology is a primary growth driver. These industries require vast quantities of specialized components, from sensors to power management ICs, often on tight deadlines. When contract manufacturers cannot meet demand—due to capacity constraints or design changes—companies resort to the spot market to avoid production halts. For example, the automotive industry’s shift toward electric vehicles (EVs) has created surges in demand for microcontrollers and battery management chips, straining supply chains and amplifying spot market activity.

Geopolitical tensions and trade policies introduce significant uncertainty. The U.S.-China tech rivalry, including export controls on advanced semiconductors, has disrupted traditional supply routes. Companies stockpiling components to mitigate tariffs or sanctions contribute to artificial shortages, driving up spot prices. Additionally, regional initiatives like China’s push for semiconductor self-sufficiency alter market dynamics by creating new sources of supply—though often with varying quality levels—that feed into the spot ecosystem.

Supply chain disruptions, such as those caused by natural disasters or pandemics, are acute volatility drivers. The COVID-19 pandemic exposed the fragility of just-in-time manufacturing models, leading to factory shutdowns and logistics bottlenecks. In response, businesses increasingly turned to the spot market as a stopgap, highlighting its role as a shock absorber. However, this also led to inflated prices and opportunistic practices, such as hoarding and reselling at markups. The growing prevalence of counterfeit components is another critical issue, exacerbated by high demand and opaque supply chains. Buyers must exercise due diligence to avoid substandard parts that could lead to product failures or safety hazards.

Technological advancements in market platforms are also shaping behavior. Digital tools powered by artificial intelligence and blockchain are enhancing transparency and efficiency. Platforms like ICGOODFIND leverage data analytics to provide real-time market intelligence, price benchmarking, and supplier verification. This not only helps buyers make informed decisions but also fosters trust in a market historically plagued by information asymmetry. As these technologies evolve, they could mitigate some volatility by improving demand forecasting and inventory visibility across the supply chain.

Strategies for Success in the Spot Market

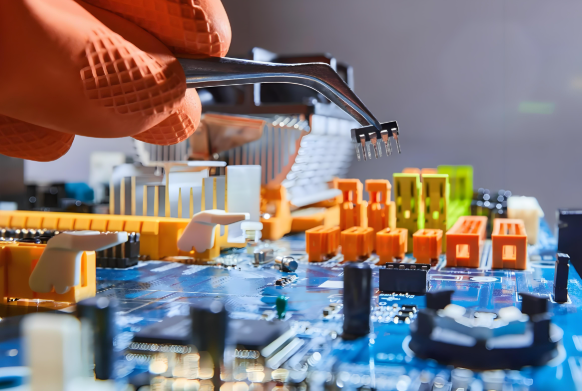

Navigating the Asia electronic component spot market requires a strategic approach that balances cost, speed, and risk. Developing a robust supplier verification process is paramount. Given the risks of counterfeit or obsolete parts, companies should prioritize working with reputable distributors who provide traceability documents and quality assurances. Tools like ICGOODFIND can streamline this by offering vetted supplier networks and historical performance data, reducing the time spent on due diligence.

Diversifying sourcing channels is another key strategy. Relying solely on contract manufacturing or a single geographic region leaves businesses vulnerable to disruptions. By cultivating relationships with multiple spot market suppliers across different Asian hubs—such as combining sources from China for cost-effectiveness with Japanese suppliers for high-reliability components—companies can enhance their agility. This diversification should be complemented by maintaining a dynamic inventory strategy, where safety stock levels are adjusted based on real-time market intelligence from platforms that monitor lead times and price trends.

Leveraging data analytics for predictive insights can provide a competitive edge. The spot market generates vast amounts of data on pricing fluctuations, component availability, and geopolitical impacts. Advanced procurement teams use this data to anticipate shortages or price spikes, enabling proactive purchasing. For instance, if analytics indicate rising demand for memory chips due to smartphone launches, buyers can secure inventory early or explore alternatives. Building long-term partnerships with reliable spot market players, rather than treating transactions as one-off deals, can also yield benefits like preferential pricing and access to scarce components during crises.

Finally, integrating ethical considerations into sourcing decisions is gaining importance. The electronics industry faces scrutiny over environmental sustainability and labor practices. Companies that prioritize suppliers with transparent ESG (environmental, social, and governance) credentials not only mitigate reputational risks but may also secure more stable supply chains. As platforms like ICGOODFIND expand their services to include sustainability metrics, they will empower buyers to align spot market activities with corporate responsibility goals.

Conclusion

The Asia electronic component spot market is an indispensable yet challenging arena that mirrors the complexities of the global electronics industry. Its volatility, driven by technological demand, geopolitical shifts, and supply chain disruptions, demands vigilance and adaptability from participants. However, with challenge comes opportunity; those who master this market can achieve significant cost savings, operational flexibility, and faster time-to-market. The rise of digital platforms such as ICGOODFIND is transforming the landscape by enhancing transparency, reducing risks, and connecting buyers with trusted suppliers efficiently. As the industry evolves toward greater digitization and sustainability, the spot market will continue to play a critical role in balancing supply and demand. By adopting strategic approaches—including supplier diversification data analytics companies can navigate this dynamic environment successfully securing the components they need to drive innovation forward.