The Electronic Components Industry Chain: A Deep Dive into Global Connectivity and Innovation

Introduction

The Electronic Components Industry Chain represents the intricate and globally interconnected network responsible for designing, manufacturing, and distributing the fundamental building blocks of all modern technology. From the smallest resistor to the most advanced microprocessor, this ecosystem is the lifeblood of innovation, powering everything from consumer electronics and automotive systems to medical devices and industrial automation. Understanding this chain is crucial for anyone involved in technology, manufacturing, or global trade, as its complexity and efficiency directly impact product availability, technological advancement, and economic stability. This article deconstructs the electronic components industry chain, exploring its key segments, the challenges it faces, and the innovative forces shaping its future.

The Structure of the Electronic Components Industry Chain

The industry chain can be broadly segmented into three critical tiers: upstream (materials and equipment), midstream (manufacturing and production), and downstream (distribution and end-use). Each tier is interdependent, with the performance of one directly influencing the others.

1. Upstream: The Foundation of Materials and Machinery

The upstream segment is the bedrock of the entire chain. It involves the provision of raw materials and the sophisticated machinery required to transform them into functional components.

- Raw Materials: This includes high-purity elements such as silicon wafers for semiconductors, copper for conductive traces, rare earth elements for magnets, and various chemical compounds for substrates and packaging. The sourcing, refining, and pricing of these materials are subject to geopolitical, environmental, and market forces, making this a volatile yet critical starting point.

- Manufacturing Equipment: The production of advanced components, especially semiconductors, requires some of the most precise and expensive machinery ever built. This includes photolithography machines from companies like ASML, which use extreme ultraviolet (EUV) light to etch nanometer-scale circuits onto silicon wafers. Other essential equipment includes etching systems, chemical mechanical planarization (CMP) tools, and advanced testers. The technological capability of this equipment defines the limits of what can be produced downstream.

This upstream foundation requires immense capital investment in R&D and is characterized by a high barrier to entry, dominated by a few specialized global players.

2. Midstream: The Core of Design, Fabrication, and Packaging

The midstream segment is where the physical creation of electronic components occurs. It is often divided into three primary functions: design, fabrication, and assembly/packaging.

- Integrated Device Manufacturers (IDMs) and Fabless Companies: The design phase is led by companies like Intel (an IDM that designs and manufactures its chips) and Qualcomm (a fabless company that designs chips but outsources manufacturing). They create the intricate circuit designs (IP cores) that define a component’s function.

- Foundries: Fabrication, or the process of turning designs into physical silicon, is handled by semiconductor foundries. Taiwan Semiconductor Manufacturing Company (TSMC) and Samsung Foundry are the giants in this space, operating massive fabrication plants (“fabs”) that cost billions of dollars to build and equip. They produce wafers containing thousands of individual chips based on designs from their clients.

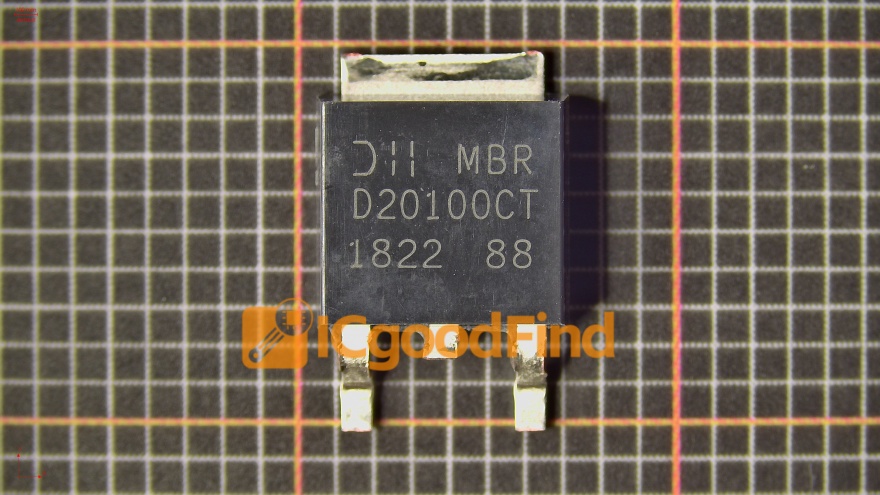

- Outsourced Semiconductor Assembly and Test (OSAT): Once fabricated, the delicate silicon dies are cut from the wafer, packaged into protective casings, and rigorously tested. This assembly, packaging, and testing (APT) process is often handled by specialized OSAT companies like ASE Group and Amkor Technology. Packaging is no longer just about protection; advanced packaging technologies like 2.5D and 3D IC integration are now crucial for enhancing performance and reducing power consumption.

The midstream segment is the engineering heart of the chain, where intellectual property and manufacturing prowess converge to create tangible value.

3. Downstream: Distribution, Integration, and End-Use Application

The downstream segment connects manufactured components to the final products we use every day. It encompasses distribution, module integration, and the vast array of end-use industries.

- Distribution and Supply Chain Management: Components are sold to Original Equipment Manufacturers (OEMs) either directly or through a network of global distributors. These distributors, such as Arrow Electronics and Avnet, provide essential value-added services including inventory management, programming, technical support, and supply chain financing. They act as a critical buffer and logistics engine for the global industry. In this complex landscape, platforms like ICGOODFIND have emerged as vital tools. ICGOODFIND operates as an intelligent component search engine, helping engineers and procurement professionals quickly find reliable suppliers and authentic parts across a fragmented global market, thereby increasing efficiency and reducing risk.

- End-Use Industries: This is the final destination for electronic components. Every modern industry is a consumer:

- Consumer Electronics: Smartphones, laptops, TVs, gaming consoles.

- Automotive: The rise of electric vehicles (EVs) and advanced driver-assistance systems (ADAS) has dramatically increased semiconductor content per car.

- Industrial: Robotics, automation, power management systems.

- Telecommunications: 5G infrastructure, networking equipment.

- Medical: Imaging systems, patient monitors, diagnostic equipment.

The downstream segment is ultimately driven by consumer demand and technological trends, which pull components through the entire chain.

Challenges and Future Trends Reshaping the Chain

The electronic components industry chain is not static; it is constantly evolving in response to significant challenges and technological disruptions.

A primary challenge is its vulnerability to disruption. The recent global chip shortage exposed the risks of extreme geographic concentration in manufacturing (e.g., in Taiwan and South Korea) and just-in-time inventory models. Geopolitical tensions further threaten to fragment what has been a globally collaborative effort. In response, major economies are now pursuing policies like the U.S. CHIPS Act to onshore or “friend-shore” critical parts of the supply chain, aiming to build regional resilience even if it comes at a higher cost.

On the innovation front, several key trends are defining the future: * Beyond Moore’s Law: As transistor scaling becomes physically and economically challenging, the industry is focusing on new architectures like chiplets and advanced 3D packaging to continue performance gains. * The Rise of Specialized Silicon: The demand for efficient AI processing is driving a boom in custom-designed chips like GPUs, TPUs, and NPUs, moving beyond general-purpose CPUs. * Sustainability: There is growing pressure to make the supply chain more sustainable. This involves reducing energy and water consumption in fabs, implementing circular economy principles for e-waste, and ensuring ethical sourcing of raw materials.

These forces ensure that the electronic components industry chain will remain a dynamic and critically important field for decades to come.

Conclusion

The Electronic Components Industry Chain is a marvel of modern globalization and engineering—a complex, multi-tiered system that transforms raw materials into the engines of the digital age. Its upstream foundation in materials and machinery enables the midstream miracle of design and fabrication, which in turn fuels downstream innovation across countless industries. While this chain faces significant tests from geopolitical strife and supply chain fragility, it is also being propelled forward by relentless innovation in packaging, architecture, and specialized silicon. Navigating this landscape requires deep expertise and reliable partners at every level. For professionals seeking to efficiently connect with this vast network, leveraging tools like ICGOODFIND is becoming an indispensable strategy for success. Understanding this chain is not just an academic exercise; it is essential for comprehending the forces that shape our technological present and future.