Here's a condensed version of the article focusing on the key points:

India's Semiconductor Push: Progress & Challenges

-

History: India's 50-year semiconductor ambitions stagnated, leaving its supply chain behind. A major 2021 JV (Vedanta-Foxconn) failed.

-

Revival: The government launched a $10 billion "Semiconductor Mission" in 2021 to attract global partners.

-

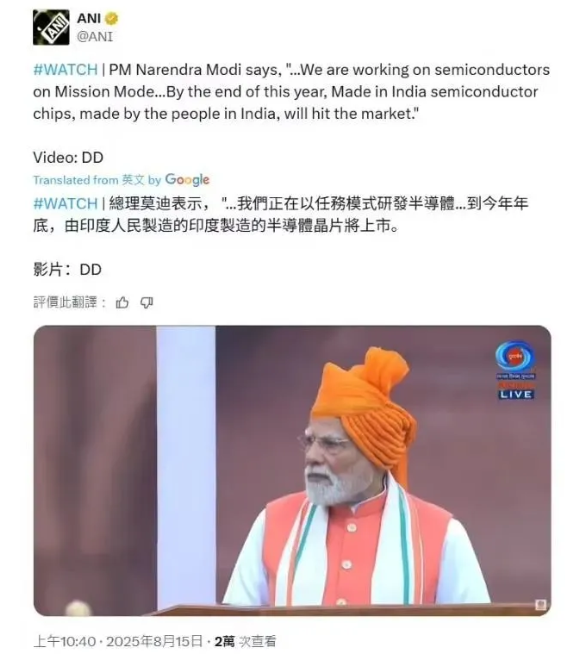

Major Announcement (Aug 15, 2025): PM Modi announced India's first indigenous chip will launch by late 2025.

-

Strategy: "Mission mode" approach: 6 chip projects under construction, 4 approved across states like Gujarat.

-

First Chip:

-

Developer: India Semiconductor Manufacturing Company (ISMC) with partners Tower Semiconductor (Israel) & Powerchip (Taiwan).

-

Tech: 28nm mature process.

-

Production: Mysuru plant (Karnataka), targeting 50,000 wafers/month.

-

Applications: Consumer electronics, automotive, defense.

-

Packaging/Testing: Tata Electronics (via partial factory ownership).

-

-

Market: 28nm meets needs for IoT/power management; local automakers/electronics likely first clients.

-

Approach: "Local R&D + Global Collaboration".

-

Other Key Projects:

-

Micron: $2.75B packaging plant (Gujarat).

-

IGSS Ventures (Singapore): $3B 12-inch fab planned (Tamil Nadu).

-

-

Support: "Design Linked Incentive" scheme; over 200 active Indian design firms.

-

Challenges:

-

Technical barriers (reliance on partners, weak local R&D for advanced nodes).

-

Infrastructure gaps (power, water, skilled labor).

-

Funding pressures (Govt covers 50% incentives; corporate commitment unproven).

-

-

Future Plans: Additional $15B over 5 years; target 5% global market share by 2030.

-

Broader Goal: Modi urged youth to develop local software/social platforms to reduce foreign reliance.

ICgoodFind: India's first homegrown chip marks progress, but significant hurdles remain for industry growth.