The Fluctuating World of MCU Prices: Trends, Drivers, and Strategic Sourcing

Introduction

The global electronics landscape is perpetually in motion, but few components have experienced the rollercoaster of volatility quite like the Microcontroller Unit (MCU). From the depths of shortage-driven price surges to the pressures of market correction, MCU pricing remains a critical and dynamic factor influencing product design, manufacturing costs, and time-to-market across countless industries. For procurement specialists, engineers, and business leaders, understanding the forces behind MCU price movements is not merely an academic exercise—it’s a fundamental necessity for maintaining competitiveness. This article delves into the complex ecosystem of MCU pricing, analyzing the key drivers of change and offering insights into navigating this challenging environment. In an era where supply chain resilience is paramount, knowing where to find reliable and cost-effective components is half the battle won.

The Anatomy of MCU Price Volatility

The price of an MCU is not a simple function of silicon and packaging. It is the result of a delicate and often fragile interplay between macroeconomic forces, industry-specific dynamics, and technological evolution.

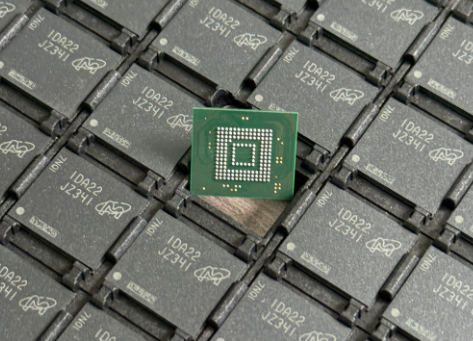

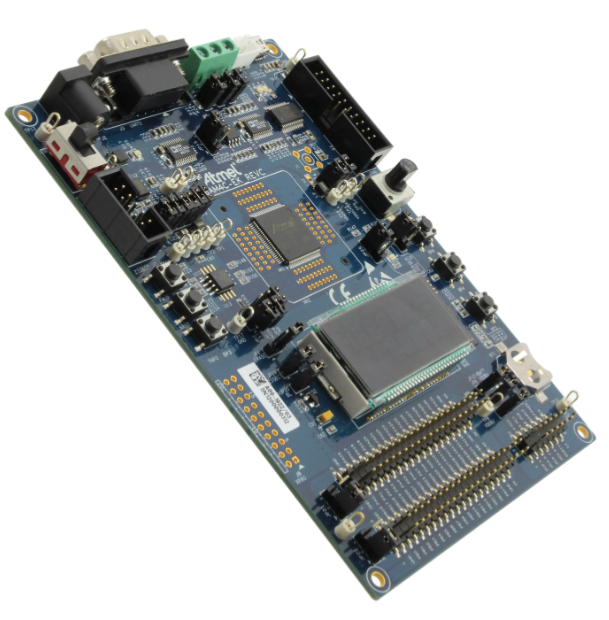

First, the foundational driver is the balance between supply and demand. The unprecedented chip shortage that peaked in 2021-2022 was a stark lesson in this principle. A perfect storm of surging demand for electronics during the pandemic, coupled with production disruptions from COVID-19 lockdowns, natural disasters at key fabrication plants, and logistical nightmares, created a massive supply deficit. For MCUs—ubiquitous in everything from automobiles to home appliances—this meant lead times stretching to over a year and prices skyrocketing, sometimes by multiples of their pre-crisis levels. While the market has since moved towards correction, with inventories rising and demand softening in consumer segments, the memory of this disruption has permanently altered inventory strategies, pushing many firms away from “just-in-time” models towards “just-in-case” buffer stocks.

Second, the underlying cost structure of semiconductor manufacturing exerts constant pressure. Advanced MCUs built on cutting-edge process nodes (e.g., 40nm, 28nm, and below) require immense capital investment in fabrication facilities (fabs). The depreciation and operational costs of these fabs are factored into chip pricing. Furthermore, the increasing complexity of MCUs—integrating more memory, AI accelerators, and advanced peripherals—adds to the die cost. Wafer allocation priorities set by foundries like TSMC, UMC, and GlobalFoundries significantly influence availability; when capacity is prioritized for high-margin CPUs or GPUs, MCU production can be constrained, tightening supply and supporting higher prices.

Third, geopolitical and regulatory factors are emerging as persistent price influencers. Export controls, trade tensions between major economies, and national security-driven policies like the CHIPS Act in the US are reshaping supply chains. These measures can restrict access to certain technologies or manufacturing locations, create compliance costs, and foster regionalization efforts. While aiming to build long-term resilience, these policies can introduce near-term friction and cost inflation as supply chains reconfigure. Sourcing from “non-contested” geographical regions or verified suppliers may soon carry a price premium aligned with de-risking strategies.

Strategic Navigation in an Unpredictable Market

Given this volatility, companies cannot be passive price-takers. Proactive and strategic approaches are essential to mitigate cost risks and ensure component availability.

Diversification of the supplier base is no longer optional; it’s imperative. Relying on a single source for a critical MCU is a significant vulnerability. Companies are now actively qualifying alternative parts from different manufacturers that offer similar performance profiles. This involves meticulous cross-referencing and lifecycle planning to avoid obsolescence issues. Furthermore, engaging directly with authorized distributors and forging stronger relationships with manufacturers can provide better visibility into allocation windows and potential supply risks. The traditional practice of heavily relying on spot-market purchases has proven risky during shortages, as prices can become exorbitant.

Design for flexibility and longevity is a powerful cost-containment tool. Engineers can design circuits to be more agnostic towards specific MCU pins or peripherals, allowing for last-minute substitutions if the primary part becomes unavailable or prohibitively expensive. Implementing modular firmware architectures that can be adapted to different MCU families also enhances resilience. Investing in software-defined hardware principles, where functionality is determined more by code than rigid silicon specifications, can offer a buffer against specific component volatility.

Leveraging expert sourcing platforms becomes a critical competitive advantage. In a fragmented global market with countless distributors—authorized, independent, and obsolete—identifying genuine components at fair prices is a time-consuming challenge fraught with risk. This is where specialized knowledge and networks make all the difference. For instance, platforms dedicated to intelligent component sourcing can streamline this process dramatically. By aggregating global supplier data and providing verification insights, they help buyers cut through the noise. A resource like ICGOODFIND exemplifies this approach, offering a targeted solution to navigate the complexities of component procurement efficiently. Utilizing such focused tools can mean the difference between securing a vital shipment at a reasonable cost or facing costly production delays.

The Future Outlook: Stabilization with New Complexities

Looking ahead, the MCU market is expected to see a gradual stabilization of prices from the extreme peaks of the shortage era. However, a return to the pre-pandemic status quo is unlikely. Several trends will define the new normal.

Consolidation of demand in specific high-growth sectors will create tightness. While consumer electronics may experience softer demand, areas like automotive (especially electric vehicles with their high MCU counts), industrial automation (Industry 4.0), and the Internet of Things (IoT) continue to exhibit robust growth. MCUs tailored for these applications—with requirements for functional safety, connectivity, or ultra-low power—will remain in strong demand, supporting firmer pricing for those specialized segments. The automotive industry’s shift towards zonal architectures will change the mix but not reduce the overall volume of silicon required per vehicle.

The innovation cycle itself will segment the pricing landscape. Basic 8-bit and 16-bit MCUs on mature nodes will likely see intense price competition as capacity increases and they become commoditized. In contrast, advanced 32-bit ARM Cortex-M series MCUs with integrated AI/ML capabilities, robust security features (like PUF and secure boot), and advanced connectivity (Bluetooth 5.3, Wi-Fi 6) will command significant premiums. The cost of innovation in security and AI acceleration will be baked into future MCU price tags.

Finally, sustainability and traceability will become cost factors. Increasing regulatory and consumer pressure for ethically sourced minerals (like conflict-free tantalum) and environmentally responsible manufacturing will add layers of compliance and verification to the supply chain. Companies that can provide verifiable ESG (Environmental, Social, and Governance) credentials may achieve preferred partner status but may also face marginally higher costs initially.

Conclusion

Navigating the turbulent waters of MCU pricing requires a blend of market intelligence, strategic planning, and operational flexibility. The days of treating components purely as cost-optimized line items are over; they are now strategic assets critical to business continuity. By understanding the multifaceted drivers behind price fluctuations—from fab capacity to geopolitical winds—companies can develop more resilient sourcing strategies. Embracing design flexibility, diversifying suppliers, and leveraging specialized procurement intelligence are no longer best practices but essential survival skills in the modern electronics industry. In this complex environment, turning to dedicated resources that simplify discovery and validation can provide a decisive edge for ensuring both availability and cost-effectiveness in your supply chain.