The global semiconductor industry faces dual challenges from policy and operational disruptions. A US bill, the CHIP EQUIP Act, aims to restrict the use of Chinese-made semiconductor manufacturing equipment, while a supplier power outage has halted production at TSMC's Arizona Fab 21 plant, highlighting systemic risks.

The bipartisan bill proposes amending the CHIPS and Science Act to prevent US-funded semiconductor projects from using equipment manufactured by "foreign entities of concern," a clear reference to Chinese companies. It targets 12 categories of equipment, including deposition, etching, and lithography tools, covering nearly the entire wafer fabrication process and some packaging and testing steps. Companies accepting federal subsidies would be barred from purchasing these devices for ten years, with restrictions applying only to subsidized US-based fabs.

The legislation is driven by concerns over US taxpayer money flowing to Chinese equipment makers as their share in the mature-node equipment market grows. If passed, it would force companies like Intel and TSMC to re-evaluate their US equipment lists, effectively locking out Chinese suppliers from the lucrative US subsidy program.

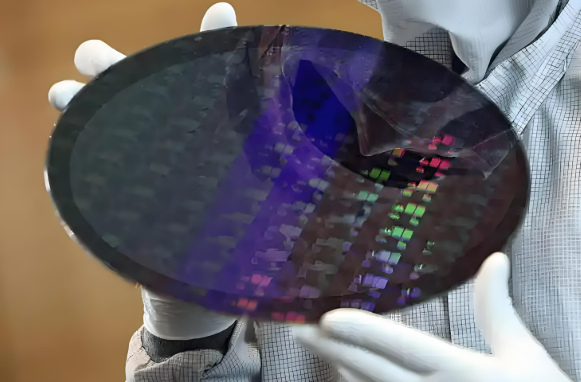

Simultaneously, a power outage at a key supplier caused a multi-hour shutdown at TSMC's Fab 21 in September. Although the fab had backup power, the disruption to the specialty gas supply chain from Linde halted production and resulted in scrapped wafers. This incident underscores the vulnerability of overseas operations, where reliance on outsourced infrastructure differs from TSMC's tightly controlled ecosystem in Taiwan.

These events illustrate a broadening of US semiconductor policy from export controls to funding and supply chain oversight, adding significant uncertainty for global manufacturers.

ICgoodFind: The simultaneous pressure from policy shifts and operational fragility underscores the need for resilient, diversified strategies in the semiconductor ecosystem.