SUMCO, a leading global silicon wafer manufacturer, reported disappointing results for Q3 FY2025, recording its first quarterly operating loss and triggering a 16.16% single-day stock drop to a two-month low.

While consolidated revenue edged up 0.7% to ¥99.1 billion, profitability collapsed: the company swung from an operating profit of ¥9.1 billion a year ago to a loss of ¥1.6 billion, and net profit turned from ¥3.6 billion in gains to a ¥3.9 billion net loss.

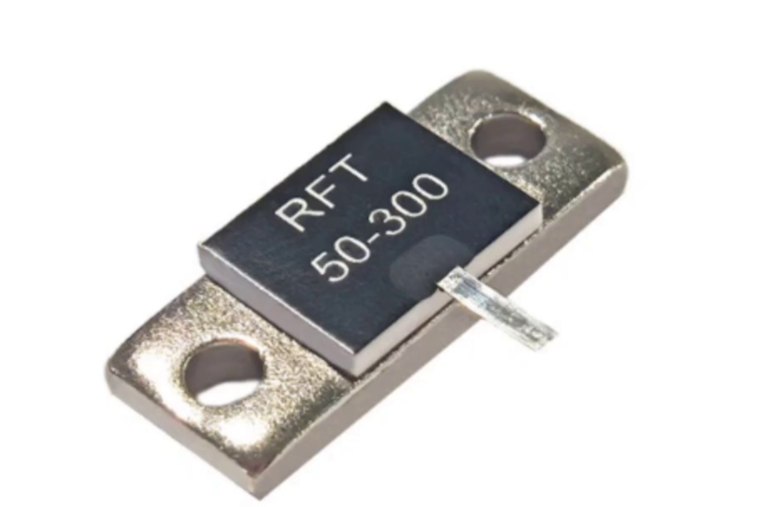

Performance varied sharply by segment. Demand for 12-inch wafers used in advanced logic and memory chips remained steady, supported by AI-related demand. However, 8-inch and smaller wafers faced persistent shipment declines, hurt by customer inventory adjustments and rising competition from Chinese suppliers.

The outlook appears even more challenging. SUMCO forecasts an expanded operating loss of ¥10 billion and a net loss of ¥16 billion in Q4. For the full fiscal year, it now expects a consolidated net loss of ¥16.9 billion—its first annual loss since 2011 and more than triple analyst estimates.

SUMCO attributed the weakness to intensifying competition in 8-inch and smaller wafers, while reaffirming strong demand for 12-inch products. Market analysts linked the steep stock decline to the worse-than-expected losses and persistent pressure in traditional segments.

ICgoodFind:SUMCO’s struggles reflect structural shifts in the silicon wafer sector, with Chinese manufacturers gaining ground in mature process nodes.