Asia is poised to maintain its leadership in global semiconductor manufacturing over the next five years, supported by cost efficiency, a mature industrial ecosystem, and strong technical expertise. With rising demand for advanced chips driven by AI and other next-generation technologies, the strategic importance of chip production continues to grow.

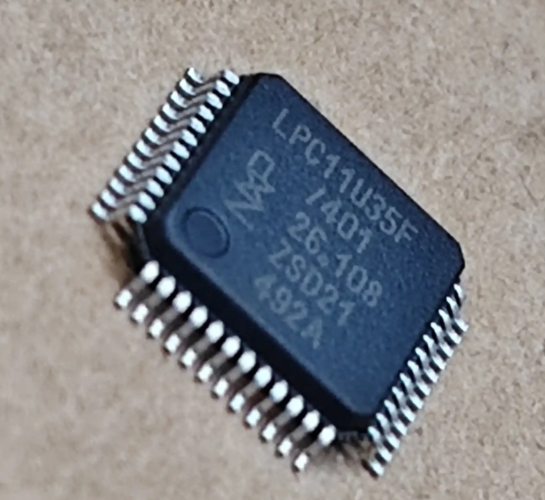

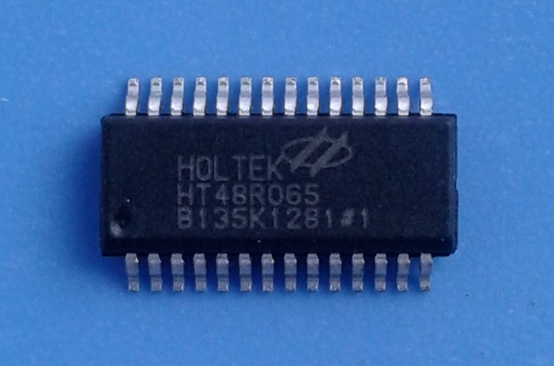

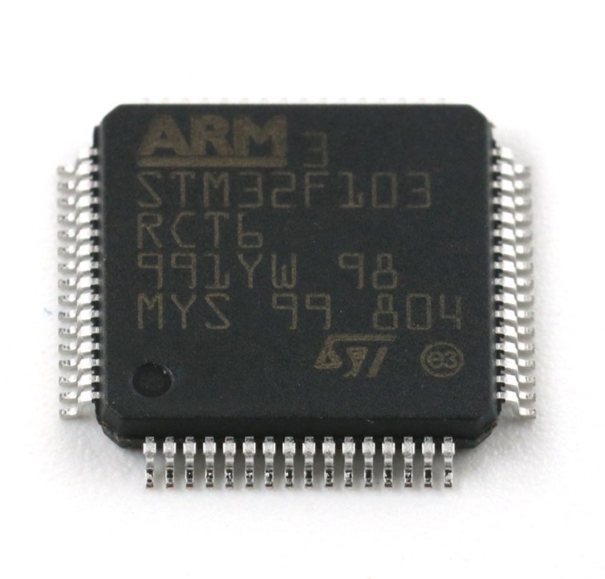

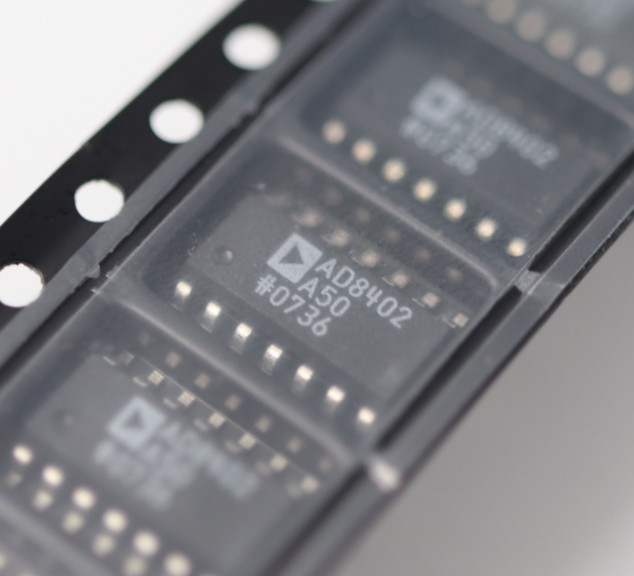

The region currently accounts for over 75% of the world’s semiconductor manufacturing capacity, spanning logic, memory, and DAO (discrete, analog, and other) chips. Its strengths extend across the entire supply chain—from manufacturing to materials, equipment components, and packaging. While the U.S. leads in chip design, core IP, and EDA tools, physical production remains heavily concentrated in Asia.

Regional specialization is clear:

-

Japan leads in photoresist processing and silicon wafer production.

-

Taiwan (China) and South Korea dominate advanced node manufacturing, producing the majority of sub-5nm chips globally.

-

Mainland China is rapidly expanding mature node capacity (28nm and above), accounting for 33% of global output in this segment.

-

Southeast and South Asia have become key suppliers of traditional chips for automotive and consumer electronics.

However, pandemic-related disruptions highlighted vulnerabilities in supply chain concentration, and geopolitical tensions have intensified calls for diversification. Still, the highly specialized nature of semiconductor production means companies will continue relying on regional partners.

ICgoodFind : Asia’s semiconductor dominance remains firm, with differentiated regional roles underpinning global supply chain operations.