On September 15, 2025, Beijing Ingenic, a leading Chinese chip designer, submitted an application to list on the Hong Kong Stock Exchange, advancing its strategy to establish an A+H share structure. Already listed on the Shenzhen Stock Exchange since 2011, the company has broadened its product range through the 2020 acquisition of ISSI, strengthening its presence in automotive, industrial, and medical markets.

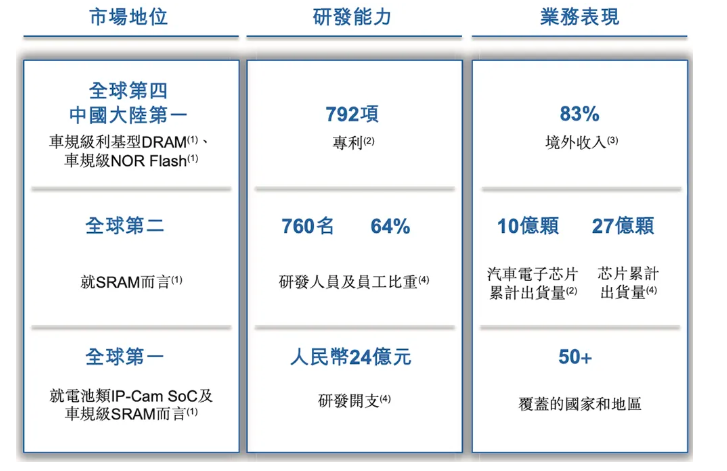

Ingenic holds top global rankings in several niche segments:

-

Niche DRAM: 6th worldwide, 1st in China, 4th in automotive-grade

-

SRAM: 2nd globally, 1st domestically, leading in automotive-grade

-

NOR Flash: 7th globally, 3rd in China

-

IP Cam SoC: 3rd globally, with battery-related products ranking 1st

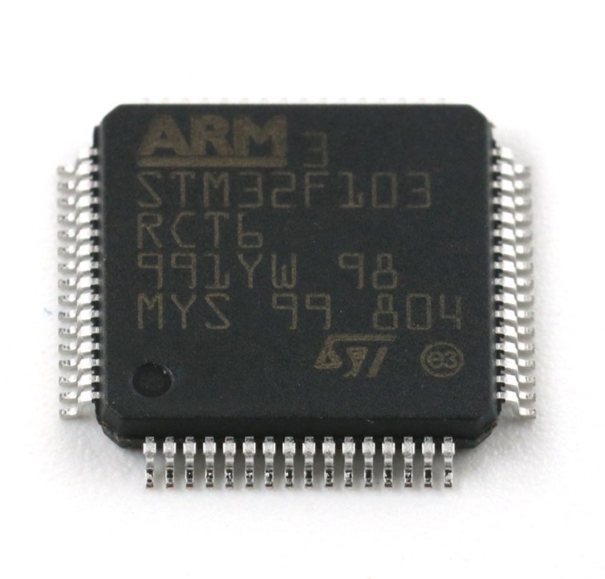

Its chips power devices like robotic vacuum cleaners and industrial robots, with an AI glasses product featuring in-house chips set for 2025. Financially, the company rebounded in H1 2025, with revenue of RMB 2.249 billion (up 6.75% YoY) and net profit of RMB 202 million (up 2.85% YoY). Storage chips contributed over 60% of total revenue, while R&D investment remained steady.

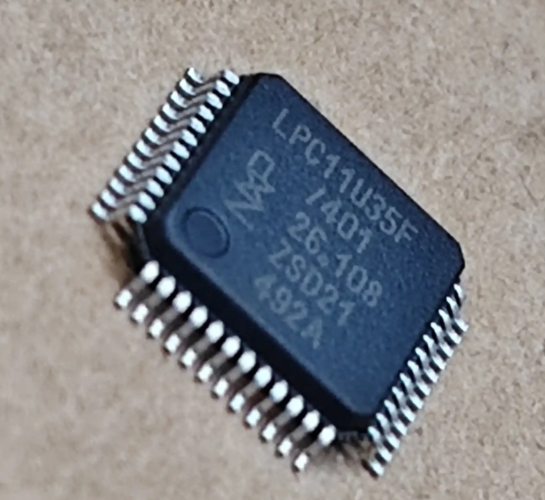

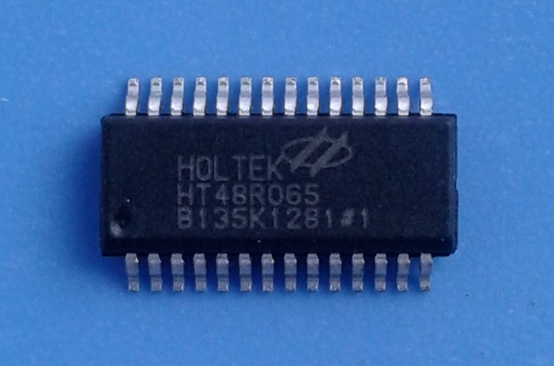

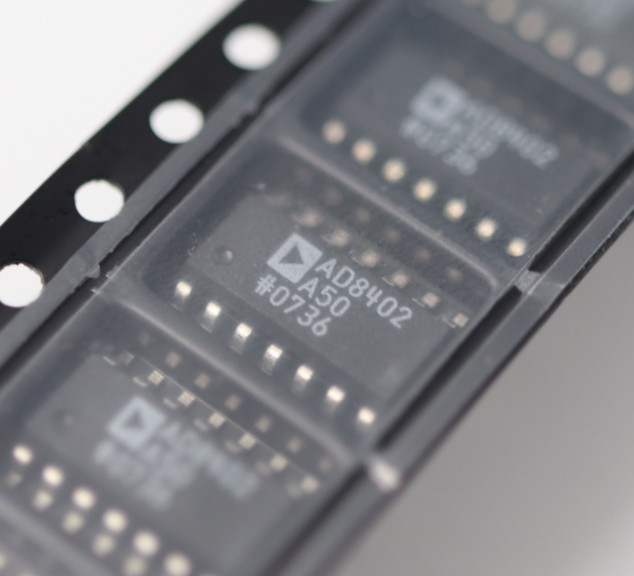

Ingenic’s brand portfolio includes Ingenic for computing chips, ISSI for memory, and Lumissil for analog chips. It is actively developing RISC-V architecture-based solutions and plans to mass-produce 16nm DDR4 products between late 2025 and 2026, targeting growth in AIoT and automotive electronics.

ICgoodFind : Ingenic’s Hong Kong IPO aims to boost funding for AI and automotive chip innovation, reinforcing its competitive edge in global markets.