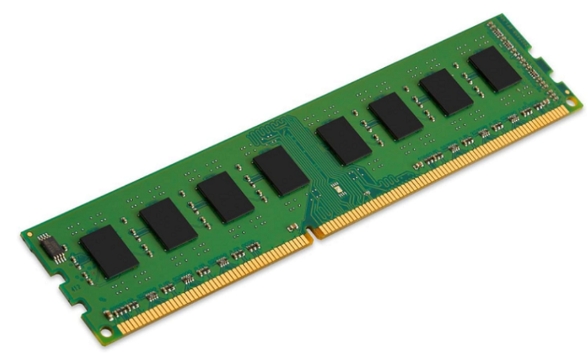

SK Hynix’s HBM dominance is challenged by ChangXin Memory Technologies (CXMT), which has accelerated HBM3 sample supply—earlier than its year-end plan.

CXMT has provided HBM3 samples to clients like Huawei, which plans to use them in AI semiconductors alongside domestic GPUs. Huawei already has its Ascend 910C.

CXMT aims to finish HBM3 mass production certification by year-end and launch HBM3E in 2027 (three years behind SK Hynix), advancing China’s AI semiconductor autonomy. Tech gaps are narrowing: its wafer bit density, 1.87x that of top rivals in Q1 2024, fell to 1.63x in Q1 2025, projected at 1.18x by Q1 2026.

Boosted by domestic demand, CXMT’s sales grew from RMB8B (2022) to RMB16.5B (2024), with 95% from China, pressuring giants. Taiwanese firms like Nanya and Yosun are also entering, co-developing custom HBM for 2026-end launches.

The HBM3 market, currently led by Samsung, SK Hynix and Micron, will shift from "triopoly" to "multipolarity" with CXMT and Taiwanese players. Mainland firms may narrow gaps via domestic demand.

ICgoodFind: CXMT’s accelerated HBM3 progress boosts domestic AI semiconductor autonomy, set to reshape the HBM market.