Amid accelerating domestic semiconductor substitution and booming demand in emerging sectors, China's power semiconductor industry is witnessing intensified competition. Silan Micro and CR Micro, both leading IDM companies, have demonstrated contrasting strategies in Q3 2025—aggressive expansion versus steady consolidation.

-

Silan Micro:

-

Q3 revenue reached ¥3.377 billion, up 16.88% YoY.

-

Net profit surged 56.62% to ¥84.27 million in Q3, with a staggering 1108.74% growth for the first three quarters.

-

Operating cash flow soared 722.37% to ¥1.199 billion, reflecting improved operational efficiency.

-

-

CR Micro:

-

Q3 revenue grew 5.14% to ¥2.851 billion.

-

Net profit declined 14.73% to ¥187 million, impacted by losses from affiliated enterprises.

-

Maintained a robust cash position of ¥9.223 billion with minimal debt.

-

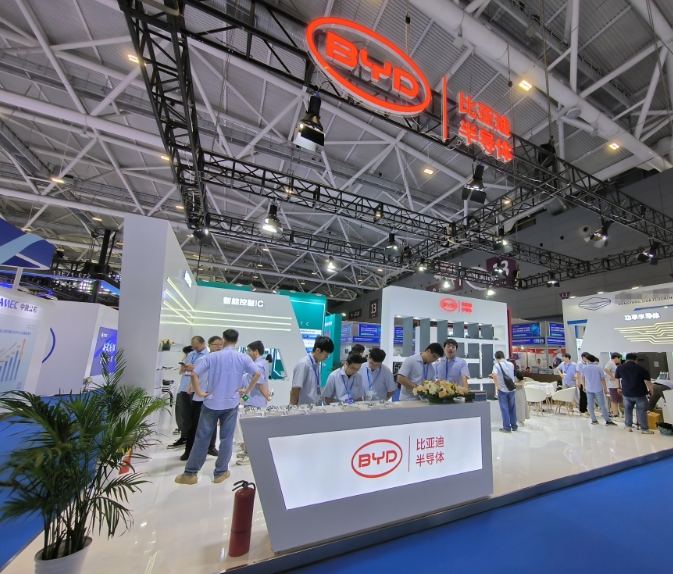

Silan is aggressively targeting high-growth segments like automotive and renewables. Its SiC MOSFET production has reached 10,000 wafers/month, with IGBT and SiC modules supplied to major automakers like BYD and Geely. It has also become a key supplier for solar inverter giant Sungrow.

In contrast, CR Micro remains focused on consumer electronics and industrial power, with limited penetration in automotive sectors. While it launched a 1200V SiC MOSFET module, mass adoption remains pending.

Silan leveraged expansion, with long-term loans up 70.7% and a debt-to-asset ratio of 48.97%. CR Micro maintained a conservative 17.62% ratio, with financial expenses generating net income.

ICgoodFind Insight:

Silan’s bold expansion in high-growth sectors contrasts with CR Micro’s steady approach, highlighting diverse strategies shaping China’s power semiconductor landscape.