Zhongying Electronics has clarified on an investor platform regarding rumors of it acting as a shell for SMEE's listing: "Unclear about the source of rumors; refer to official announcements. Currently, only IC design companies are under consideration."

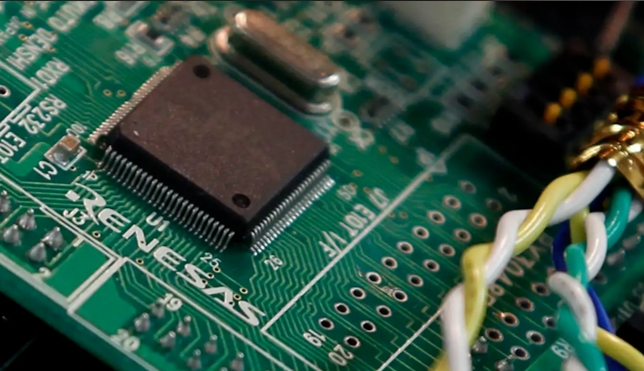

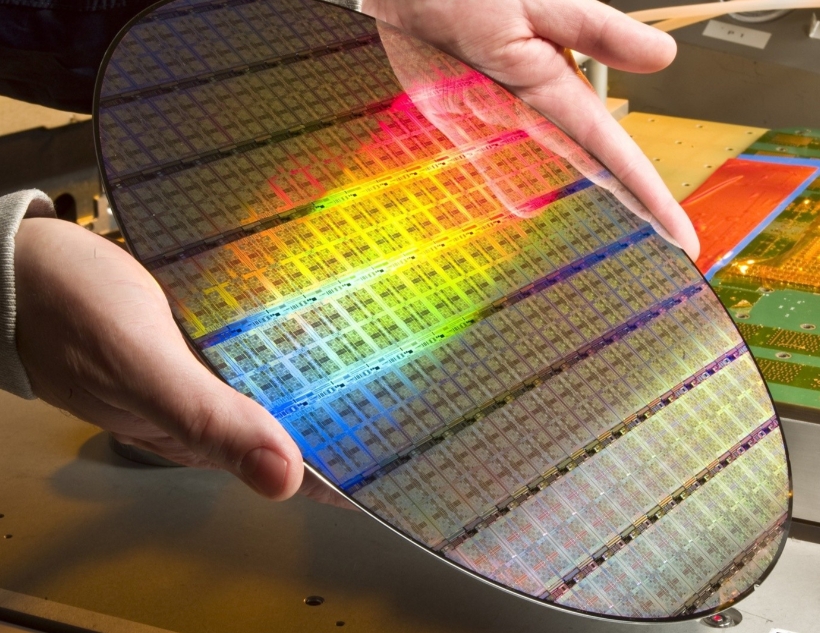

Shanghai Microelectronics Equipment (SMEE) focuses on semiconductor and pan-semiconductor equipment, used in front-end IC manufacturing and advanced packaging. It withdrew its IPO application in October 2024 due to policy restrictions after planning a public listing.

In June, Zhongying announced its former controlling shareholder would transfer 14.20% stakes to Shanghai Zhineng Industrial Electronics (Zhineng), with 9.20% voting rights entrusted for 24 months. Zhineng now controls 23.40% voting rights, becoming the largest shareholder, marking local state-owned capital involvement.

This ownership change sparked rumors of SMEE's backdoor listing via multiple firms, including Zhongying. Zhongying noted the new controlling shareholder’s background aids certain business promotions.

ICgoodFind: Zhongying’s denial of backdoor rumors shifts focus to its post-ownership adjustment strategy—developments. It is worth paying attention to.