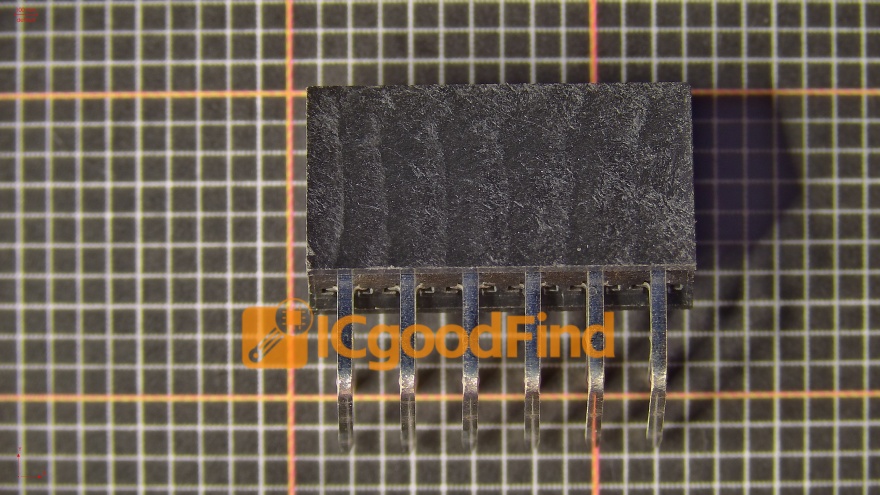

New Dutch export regulations for chip-making equipment have taken effect, directly impacting ASML's business with China. The rules lower the control threshold for Deep Ultraviolet (DUV) lithography systems from 7nm to 14nm, requiring export licenses for key models like the 1970i and 1980i. The license review process can take up to 90 days.

The move has significant commercial consequences. China is ASML's largest market for DUV machines, accounting for 35% of global sales. The news triggered an 8.2% drop in ASML's stock price. In response, ASML is adapting; its new NX2000 series can be adjusted to produce 7nm chips with an $8 million upgrade, circumventing the restrictions. The company also plans a service center in China to slash repair times.

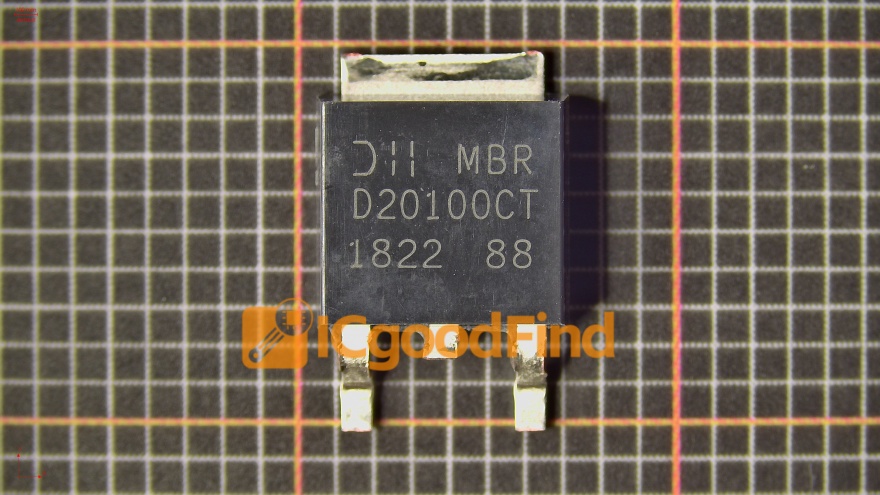

Complicating matters for the Dutch government is China's control over the rare earth supply, critical for ASML's magnets and lens polishing. New Chinese rules require export permits for products containing even 0.1% of Chinese rare earths. With China controlling 90% of global refining capacity, ASML's inventory may only last 8 weeks, creating a potential counter-leverage for China.

ICgoodFind : This tech standoff highlights market realities, with China's rare earth advantage and domestic innovation potentially accelerating global supply chain shifts.