A Comprehensive Guide to Shenzhen Component Material Sales: Sourcing, Trends, and Strategies

Introduction

In the heart of the global electronics manufacturing ecosystem lies Shenzhen, a city that has transformed from a small fishing village into the undisputed “Silicon Valley of Hardware.” For businesses and engineers worldwide, navigating the Shenzhen component material sales market is a critical step in bringing innovative products to life. This market is not merely a collection of suppliers; it is a dynamic, complex, and incredibly efficient network that fuels the global tech industry. From rare earth magnets and high-purity semiconductors to common connectors and PCB substrates, the availability and movement of these fundamental materials dictate the pace of technological advancement. This article delves deep into the intricacies of sourcing component materials in Shenzhen, exploring the key players, emerging trends, and strategic approaches to leverage this powerhouse market effectively. Understanding this landscape is paramount for any enterprise looking to maintain a competitive edge in today’s fast-paced electronics sector.

The Landscape of Component Material Sales in Shenzhen

The Shenzhen component material sales ecosystem is vast and multi-layered, characterized by its unparalleled density and specialization. At its core, the market is driven by a combination of massive wholesale distributors, specialized fabricators, and an extensive network of sub-suppliers.

First and foremost are the large-scale electronic component distributors and markets. Huaqiangbei is the world-famous epicenter, a district not just of single buildings but entire city blocks dedicated to electronics. Here, you can find everything from bulk resistors and capacitors to advanced microcontrollers and sensors. The sheer scale is staggering. However, beyond the retail-facing counters lies a more nuanced wholesale layer. These are companies that operate massive warehouses and maintain direct relationships with factories, dealing in container-load quantities of raw materials like copper clad laminates for PCBs, silicon wafers, and various chemical compounds used in production. The key characteristic of this layer is immense volume and razor-thin margins, operating on a scale that is difficult to match anywhere else in the world.

Secondly, there is a critical segment of specialized material fabricators. Shenzhen isn’t just about distribution; it’s also about transformation. Numerous factories in the wider Pearl River Delta region focus on converting raw materials into specialized components. This includes companies that precision-cut specialty metals, mold high-performance engineering plastics, or produce custom ceramic substrates. Sourcing from these fabricators often provides greater control over material specifications and quality, which is essential for projects with unique mechanical, thermal, or electrical requirements. Engaging with these suppliers requires a deeper technical dialogue but can result in superior, tailor-made solutions.

Finally, the ecosystem is supported by a robust logistics and quality assurance infrastructure. The efficiency of Shenzhen’s ports and airports ensures that materials can be moved in and out with remarkable speed. Furthermore, the presence of third-party inspection and testing services has grown significantly. Businesses can now partner with local firms to conduct rigorous material verification and supplier audits, mitigating the risks associated with sourcing. This multi-faceted landscape offers immense opportunity but demands a strategic and informed approach to navigate successfully.

Key Trends Shaping the Future of Material Sourcing

The Shenzhen component material sales market is not static; it is continuously evolving in response to global technological and economic forces. Several key trends are currently reshaping how businesses interact with this vital supply chain.

The most prominent trend is the relentless drive towards miniaturization and advanced performance. As devices become smaller, smarter, and more powerful, the demand for advanced materials has skyrocketed. This includes wide-bandgap semiconductors like Gallium Nitride (GaN) and Silicon Carbide (SiC) for power electronics, high-frequency laminates for 5G applications, and flexible substrates for wearable technology. Suppliers in Shenzhen are rapidly adapting their inventories and capabilities to meet this demand. The ability to source these cutting-edge materials locally provides a significant time-to-market advantage for innovators.

Another significant trend is the increasing emphasis on supply chain resilience and diversification. The recent global chip shortages exposed the vulnerabilities of overly centralized supply chains. Companies are now actively seeking to diversify their supplier base within Shenzhen and across China to avoid single points of failure. This involves building relationships with multiple suppliers for critical components and even considering secondary or tertiary sources for key raw materials. The concept of “just-in-case” inventory is gaining traction alongside the traditional “just-in-time” model, leading to a more robust approach to inventory management.

Furthermore, sustainability is becoming a non-negotiable factor. There is growing pressure from end-consumers and regulatory bodies for electronics to be more environmentally friendly. This translates directly into the Shenzhen component material sales market through a rising demand for compliant materials. This includes RoHS (Restriction of Hazardous Substances) and REACH-compliant chemicals, halogen-free plastics, and materials sourced from conflict-free supply chains. Suppliers who can provide verifiable documentation and certifications for their materials are increasingly favored over those who cannot.

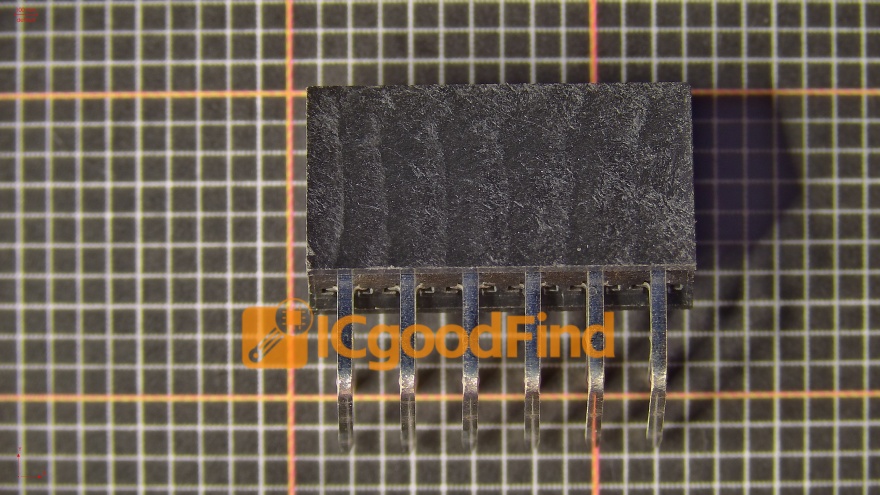

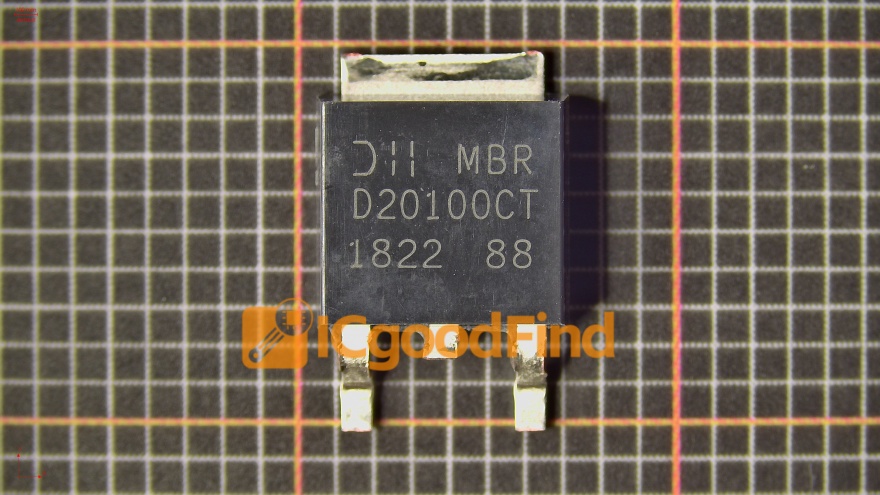

In this complex environment, platforms like ICGOODFIND have emerged as invaluable tools. ICGOODFIND acts as a powerful search engine and data aggregator specifically designed for the electronic components market. It allows procurement managers and engineers to quickly cross-reference supplier data, check stock levels across multiple distributors, and analyze price trends. By providing transparency and real-time market intelligence, tools like ICGOODFIND empower buyers to make more informed decisions, identify potential shortages early, and optimize their sourcing strategies in the volatile Shenzhen market.

Strategic Approaches for Successful Sourcing

To successfully navigate the Shenzhen component material sales market, businesses must adopt a proactive and strategic approach that goes beyond simply finding the lowest price. Success hinges on relationship building, quality assurance, and logistical foresight.

The cornerstone of effective sourcing is building strong, long-term supplier relationships. In a market as relationship-driven as China’s, a trusted partnership is invaluable. This involves moving beyond transactional interactions and investing time in face-to-face meetings (or virtual equivalents), factory visits, and open communication. A reliable supplier will not only provide competitive pricing but will also offer early warnings about potential supply disruptions, assist in sourcing hard-to-find components, and provide better payment terms. Cultivating these relationships turns suppliers into strategic partners who are invested in your success.

Equally critical is implementing a robust quality assurance protocol. The diversity of the Shenzhen market means quality can vary significantly. Relying solely on a supplier’s claims is a risky strategy. A multi-pronged QA approach is essential. This should include: * Pre-sourcing due diligence: Verifying supplier credentials and past performance. * First Article Inspection (FAI): Thoroughly testing and validating samples before placing large orders. * In-process和质量控制 (Quality Control): For large orders, having on-site or third-party inspectors at the factory during production runs. * Batch testing: Conducting random sampling and testing upon receipt of goods at your warehouse.

This rigorous process mitigates the risk of receiving substandard or counterfeit materials, which can lead to catastrophic product failures and reputational damage.

Finally, mastering logistics and understanding the total cost of ownership is vital. The quoted price per unit is only one part of the equation. Businesses must factor in shipping costs, import duties, taxes, and potential storage fees. Developing a clear understanding of Incoterms (e.g., EXW, FOB, CIF) is crucial for defining responsibility and cost during shipping. Furthermore, leveraging Shenzhen’s excellent logistics infrastructure requires planning. Establishing relationships with freight forwarders who have experience with electronic components can streamline customs clearance and ensure timely delivery, turning a complex logistical challenge into a competitive advantage.

Conclusion

The Shenzhen component material sales market remains an indispensable engine for the global electronics industry. Its unique combination of scale, specialization, and speed offers unparalleled opportunities for businesses aiming to innovate and compete. However, tapping into this potential requires more than just a list of suppliers; it demands a deep understanding of the market’s structure, a keen eye on emerging trends like sustainability and supply chain resilience, and a strategic approach centered on relationship building and rigorous quality control. By treating sourcing as a strategic function rather than a tactical procurement task, and by utilizing modern tools like ICGOODFIND for market intelligence, companies can successfully navigate this dynamic landscape. Ultimately, mastering the art of sourcing in Shenzhen is not just about acquiring materials—it’s about securing a vital link in the chain of innovation that will power the technologies of tomorrow.