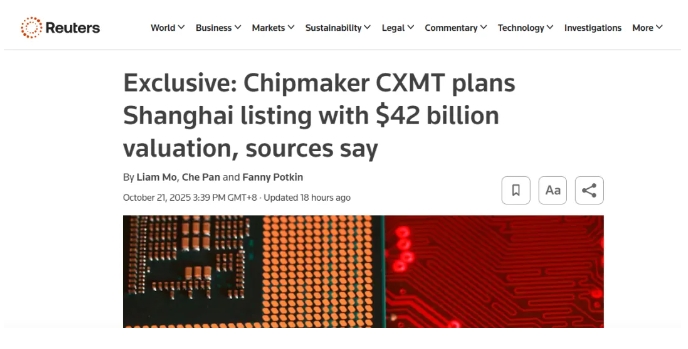

China's leading domestic memory chipmaker, ChangXin Memory Technologies (CXMT), is planning a blockbuster IPO in Shanghai as early as the first quarter of next year. The company is targeting a staggering valuation of up to ¥300 billion (approximately $41 billion).

The IPO could raise around ¥30 billion, with a prospectus potentially submitted to investors as soon as November. This move follows the recent completion of its IPO (tutoring) process with Chinese regulators.

This development is critical for China's semiconductor self-sufficiency strategy, especially after U.S. restrictions on high-bandwidth memory (HBM) chips. CXMT is aggressively expanding, building a new HBM backend packaging facility in Shanghai. The plant aims for initial production by the end of 2025, with a target output of 30,000 HBM wafers per month and plans for HBM3 mass production in 2026.

As a strategic pioneer in the DRAM market, CXMT has already captured about 5% of the global DDR4 market share in 2024, a figure projected to rise to 8% by the end of 2025.

ICgoodFind : This IPO will be a major catalyst for China's domestic memory chip capacity, accelerating breakthroughs in HBM and DRAM.