The Rise of Domestic MCU in China: A Comprehensive Overview of 56 Core Enterprises' Technological Layouts and Market Breakthroughs

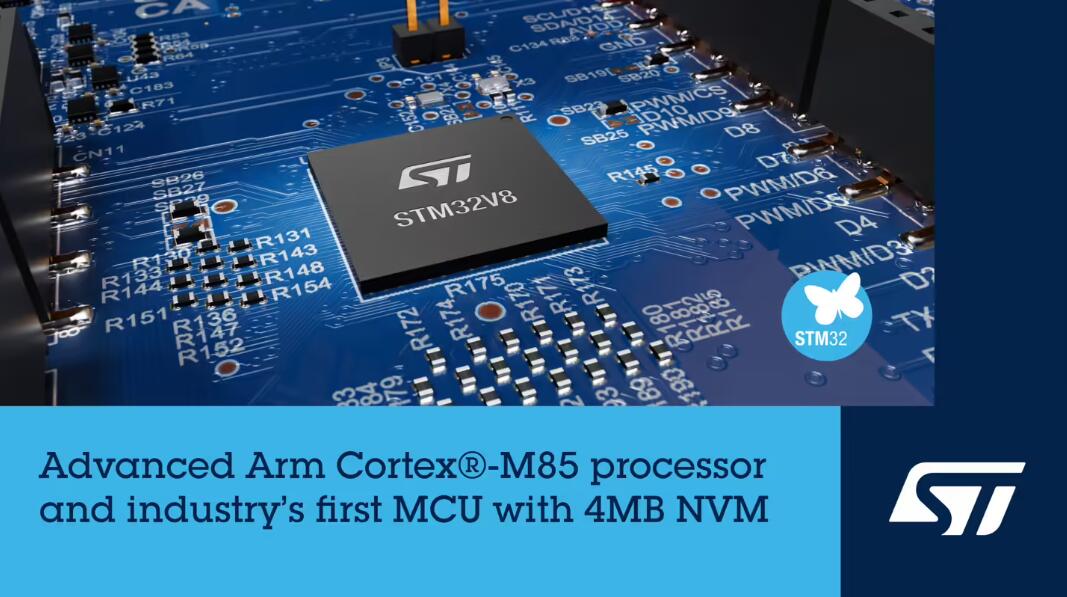

Driven by both the restructuring of the global semiconductor supply chain and domestic policies to "strengthen and supplement the industrial chain," China’s domestic MCU (Microcontroller Unit) industry has witnessed explosive growth in recent years. Breaking out from the mid-to-low-end markets of home appliances and industrial control, and gradually penetrating high-end segments such as automotive-grade and high-reliability industrial control, domestic MCUs are reshaping the global market pattern long dominated by international giants like STMicroelectronics (ST) and NXP Semiconductors. Industry data shows that by 2024, the number of domestic MCU manufacturers in China had exceeded 400, while STMicroelectronics’ MCU sales dropped by 41.3% year-on-year in the same period, indicating an accelerated pace of domestic replacement.

As the "brain" of electronic devices, MCUs are widely used in smart terminals such as smart homes, industrial control, and new energy vehicles. In the past, China was highly dependent on imports for high-end MCUs. Today, however, a number of local enterprises have overcome technical barriers: not only have they formed scale effects in the 8-bit and 32-bit general-purpose MCU markets, but they have also achieved million-level shipments in high-end segments such as automotive-grade and high-reliability industrial control, becoming a vital force in the global MCU market. Below is an analysis of the core layouts of 56 major domestic MCU enterprises (in no particular order).

1. Sino-Wealth Electronics

A "veteran" in China’s MCU sector, Sino-Wealth Electronics has focused on the home appliance main control track since its establishment in 1994. With stable product performance, it has become a core supplier for leading home appliance enterprises such as Midea and Supor. The company’s MCU products cover 8-bit 8051 architecture and 32-bit ARM architecture: 8-bit MCUs hold a dominant share in the main control market of small home appliances, while 32-bit products have entered industrial scenarios such as motor control and smart meters. In 2024, revenue from its MCU product line grew by over 30% year-on-year. Leveraging the synergy of "MCU + BMIC (Battery Management IC) + AMOLED display driver," its solutions have expanded to diverse scenarios including wearable devices and smart homes.

2. CKS (China Electronics Technology Group Corporation Microelectronics)

Affiliated with China Electronics Technology Group (CETC), CKS (established in 1995) is one of the few domestic enterprises with an integrated industrial chain covering chip design, manufacturing, and packaging/testing. Its core advantage lies in "security and controllability": the microcontrollers it launches are deeply integrated with security chips, giving it a unique position in the information security field. Its products are widely used in industrial control, automotive electronics, and IoT terminals, and have become key participants in domestic projects for high-end equipment localization, thanks to military-grade reliability standards.

3. Fudan Microelectronics

With 26 years of experience in the MCU sector, Fudan Microelectronics (established in 1998) has deep expertise in high-reliability and automotive-grade MCU markets. Its automotive-grade MCUs have achieved million-level annual shipments, covering key fields such as smart meters and automotive electronics. In particular, its dedicated MCUs for smart meters, with high-precision metering capabilities, hold a major share in the domestic market. The company’s technical accumulation in high-reliability markets enables its products to operate stably in extreme environments, making them the preferred choice for special fields such as aerospace and rail transit.

4. Sino-Microelectronics

One of the earliest domestic enterprises to independently develop MCUs, Sino-Microelectronics has gradually built a product matrix covering both 8-bit and 32-bit MCUs since launching its first 8-bit MCU in 2005. Its core products include general-purpose MCUs, SoCs, and power devices, with distinctive technical strengths in brushless DC (BLDC) motor control. Its solutions have been mass-applied in home appliance inverter drives and industrial automation equipment. Backed by over 20 years of design experience, the company’s products have entered the mid-end market of consumer electronics and industrial control with cost-effective advantages.

5. Neusoft Carrier

Established in 1993, Neusoft Carrier has core competitiveness in power line carrier communication technology. It deeply integrates MCU with communication functions, becoming a hidden champion in the smart grid field. Its 8-bit/32-bit MCUs are widely used in terminal equipment for power systems, covering scenarios such as smart meters and distribution terminals. In recent years, it has expanded into industrial control and automotive electronics, gaining recognition from industrial IoT customers with its integrated "communication + control" solutions.

6. Silan Microelectronics

A leading domestic enterprise adopting the IDM (Integrated Device Manufacturing) model, Silan Microelectronics (established in 1997) has built a complete industrial chain from chip design to manufacturing and packaging/testing, ensuring stable production capacity for its MCU products. Its MCU product line covers 8-bit and 32-bit MCUs, which synergize with smart power modules (IPMs) and IGBTs to provide comprehensive solution advantages in scenarios such as white goods inverter control and industrial motor drives. In 2024, its automotive-grade MCUs obtained AEC-Q100 certification, gradually penetrating into auxiliary control scenarios of new energy vehicles.

7. STC Macro Crystal

Known as the "No.1 Brand of 8051 Microcontrollers," STC Macro Crystal (established in 1999) was one of the first domestic enterprises to outcompete international rivals in the general-purpose MCU market. Its core products are STC enhanced 8051 series microcontrollers, forming a complete product echelon from the classic STC89 series to the new-generation 32-bit STC32 series. With high reliability and low-cost advantages, its products have penetrated massive scenarios including industrial control, smart homes, and automotive electronics peripherals, with cumulative shipments exceeding 10 billion units.

8. Nationz Technologies

Established in 2000, Nationz Technologies focuses on "security and high performance," launching 28 product series and over 200 MCU models based on ARM Cortex-M0/M4 cores. In recent years, it has performed prominently in the industrial control field: its multi-core heterogeneous high-end MCUs have been applied in servo systems and PLC equipment, while its solutions for photovoltaic inverters and energy storage BMS have achieved large-scale deployment in the new energy sector. Its secure MCUs support national cryptographic algorithms, making them core components for financial terminals and IoT security devices.

9. Rockchip

Focused on high-end SoC design, Rockchip (established in 2001) integrates MCU functions with high-performance processors, forming technical barriers in the AIoT field. Its core products, such as AIoT SoC chips like RK3588, feature self-developed NPU and ISP core IPs, with built-in MCU modules for precise control. Widely used in smart home gateways and industrial edge computing devices, the company holds an important position in the high-end smart hardware market with its integrated "computing + control" capabilities.

10. National Chip Technology

Established in 2001, National Chip Technology focuses on domestically independent and controllable embedded CPU technology, achieving major breakthroughs in automotive electronics MCUs. Its automotive-grade MCUs have been mass-applied in self-branded vehicles of BYD, SAIC, and Changan, and have achieved large-scale production in Etak’s domain controller modules. Its core product CCFC3007 series features a multi-core architecture, meeting ISO26262 functional safety ASIL-D level requirements and covering key scenarios such as powertrains and chassis control. In 2024, it received mass orders from multiple Tier 1 suppliers.

11. China Resources Microelectronics

Established in 2003, China Resources Microelectronics has steadily advanced in the high-end MCU market with its integrated industrial chain operations. Its MCU products focus on industrial control and automotive electronics, synergizing with power semiconductors and smart sensors to provide comprehensive solutions. Backed by its own wafer manufacturing capacity, the company can quickly respond to customers’ customized needs, with increasing penetration in industrial servos and new energy vehicle electric drive systems.

12. GigaDevice

Known as the "Pride of Domestic MCUs," GigaDevice (established in 2005) launched its GD32 series—the first domestic general-purpose MCU brand based on the ARM Cortex-M core—with 63 mass-produced series and over 700 MCU models. In 2024, it released the second-generation automotive-grade MCU GD32A7 series, adopting the Cortex-M7 core with a computing power of 763 DMIPS. Meeting ASIL-D functional safety standards and Evita-full information security requirements, the series is suitable for in-vehicle scenarios such as body domain control and battery management. Benefiting from breakthroughs in industrial and automotive markets, the company’s sales in Q3 2024 grew by 42.83% year-on-year.

13. Allwinner Technology

Established in 2007, Allwinner Technology focuses on smart application processor SoCs, integrating MCU functions into high-end processors to provide solutions for the MCU upgrade market. In recent years, it has laid out RISC-V core MCUs, focusing on smart hardware and in-vehicle electronics scenarios. Its chips have been mass-applied in smart cockpit auxiliary control and industrial IoT gateways, reducing customers’ development costs with high integration advantages.

14. Espressif Systems

A global leader in the IoT Wi-Fi MCU field, Espressif Systems (established in 2008) has established its position in the industry with its ESP32 series. By September 2023, its global shipments of IoT chips exceeded 1 billion units, accounting for 27% of the global Wi-Fi MCU market (ranking first worldwide). Backed by a strong open-source ecosystem, it has over 100,000 open-source projects on GitHub, attracting millions of developers globally. Its products cover smart homes and consumer electronics, with overseas demand accounting for 60-70%.

15. Nuvoton Technology

Established in 2008, Nuvoton has deep accumulation in industrial and automotive MCU markets. Its core products are 32-bit MCUs based on the ARM Cortex-M core, widely used in industrial automation and automotive electronic control units (ECUs) thanks to high anti-interference performance and long product lifecycles. The company’s automotive-grade MCUs have obtained AEC-Q100 certification and entered the supply chain of international Tier 1 suppliers, serving global automotive brands.

16. MindMotion Technologies

Established in 2011, MindMotion is one of the leading domestic enterprises in general-purpose 32-bit MCUs. Its MM32 series builds a complete product line based on the ARM Cortex-M core. With outstanding performance in motor control, its dedicated solutions are suitable for industrial servos and home appliance inverters, achieving replacement of international brands such as STM32 with cost-effective advantages. In 2024, its automotive-grade products completed verification and began penetrating the automotive electronics market.

17. BYD Semiconductor

Affiliated with BYD Group, BYD Semiconductor (established in 2004) is a benchmark enterprise for the localization of automotive-grade MCUs. Its automotive-grade MCUs have been mass-installed in all BYD vehicle models, covering core scenarios such as body control, battery management, and motor control, and have successfully entered the supply chain of other mainstream automakers. Leveraging advantages in the new energy vehicle industry, the company’s MCUs synergize with power devices such as IGBTs to form integrated "control + power" solutions.

18. Hangzhou Zhongke Microelectronics

Established in 2004, Hangzhou Zhongke Microelectronics focuses on R&D of dedicated MCUs for navigation positioning and IoT. Its core products integrate MCU with Beidou navigation positioning functions, enabling precise positioning and control in smart transportation and IoT terminals. Its solutions have been applied in in-vehicle navigation and logistics tracking equipment, dominating niche markets with dedicated advantages.

19. Huada Semiconductor

As a core integrated circuit enterprise under China Electronics Corporation (CEC), Huada Semiconductor (established in 2014) has spun off its MCU product line into "Xiaohua Semiconductor." Its HC series general-purpose MCUs cover industrial and consumer scenarios, while its automotive-grade products (with AEC-Q100 certification) are applied in automotive body control and smart cockpit auxiliary equipment. Backed by resources of central enterprises, the company has inherent competitiveness in high-reliability and high-security MCUs.

20. Xiaohua Semiconductor

Spun off from Huada Semiconductor’s MCU business unit in 2021, Xiaohua Semiconductor focuses on R&D of high-reliability and ultra-low-power MCUs. Its core products perform prominently in consumer electronics and industrial control: ultra-low-power MCUs meet the long standby needs of IoT terminals, while automotive-grade products have entered the supply chain of multiple automakers. It has grown rapidly with both technical inheritance and flexible mechanisms.

21. Geehy Semiconductor

Established in 2004, Geehy Semiconductor specializes in high-end industrial-grade and automotive-grade MCUs. Its MCUs feature high anti-interference performance and wide-temperature operation, suitable for harsh scenarios such as industrial automation and automotive electronics. Its printer main control SoCs hold a major share in the global printer market. In 2024, its automotive-grade MCUs obtained ASIL-B certification, further improving its high-end product matrix.

22. Novosense

Established in 2013, Novosense entered the MCU field from sensor and signal chain chips, forming technical characteristics of "sensing + control." Its general-purpose and automotive-grade MCUs synergize with isolation chips and sensors to provide integrated solutions for automotive electronics and industrial control. In 2024, its automotive-grade MCUs entered new energy vehicle battery management systems, achieving large-scale shipments.

23. HS Chip

Established in 2014, HS Chip focuses on R&D of MCUs based on the ARM Cortex-M series core, building a product platform covering general-purpose and automotive-grade MCUs. Its 32-bit MCUs are mass-applied in smart homes and IoT terminals, while its automotive-grade products (with AEC-Q100 certification) have entered the secondary supplier system of automotive electronics, gaining recognition from small and medium-sized customers with rapid response capabilities.

24. Nanjing Qinheng Microelectronics

Established in 2004, Nanjing Qinheng has technical barriers in USB/Ethernet interface chips and IoT MCUs, with interface technology as its core competitiveness. Its Bluetooth/Wi-Fi MCUs integrate high-speed interfaces, widely used in computer peripherals and industrial IoT equipment. With integrated "connection + control" advantages, it has become a preferred supplier for smart hardware manufacturers.

25. AutoChips (a wholly-owned subsidiary of NavInfo)

As a wholly-owned subsidiary of NavInfo, AutoChips (established in 2013) is a core player in China’s automotive-grade MCU market. Its products cover smart cockpit SoCs, automotive-grade MCUs, in-vehicle audio power amplifiers, and dedicated TPMS sensor chips. Among them, its automotive-grade MCUs rank among the top in domestic shipments, covering scenarios such as body control and TPMS. Leveraging NavInfo’s automotive industry resources, the company has established in-depth cooperation with multiple automakers and Tier 1 suppliers.

26. Puya Semiconductor

Established in 2016, Puya Semiconductor focuses on integrated "memory + control" solutions, combining NOR Flash memory technology with MCUs. Its core products include MCUs, NOR Flash, and EEPROM, achieving "memory + control" integration in IoT terminals. Applied in smart homes and automotive electronics, the company’s revenue grew by over 50% year-on-year in the first three quarters of 2024, benefiting from the rapid growth of the IoT market.

27. Silanna Microelectronics

Established in 2008, Silanna Microelectronics develops intelligent power chips integrated with MCU cores based on high-performance analog chips. Its products combine power management with precise control functions, providing intelligent power solutions for consumer electronics, servers, and automotive electronics. With high efficiency and low power consumption advantages, it has gained recognition from leading customers such as Huawei and Xiaomi.

28. Huaxin Microelectronics

Established in 2000, Huaxin Microelectronics focuses on R&D of ultra-low-power MCUs and RFID chips, deeply integrating MCU with RFID technology. Its core products are applied in smart homes and IoT terminals: ultra-low-power MCUs meet the long standby needs of smart door locks and sensor nodes. After obtaining ISO9001 certification in 2023, it further expanded its customer base among small and medium-sized home appliance enterprises.

29. Apollo Microelectronics

Established in 2005, Apollo Microelectronics is a leading enterprise in smart meter chips. Its dedicated MCUs for smart meters synergize with energy metering chips and carrier communication chips, holding a major share in domestic smart grid terminals. Applied in smart meters and distribution terminals, its products have become core suppliers for State Grid and China Southern Power Grid, thanks to high-precision metering and stable control capabilities.

30. Sinhmicro

Established in 2003, Sinhmicro has built a dual-technology platform of "analog + MCU," providing one-stop services including chips, algorithms, and solutions. Its MCUs integrate with sensing and power technologies, finding applications in smart terminals, industrial energy storage, and automotive electronics. In the first three quarters of 2024, its revenue grew by over 50% year-on-year, with significantly improved inventory turnover efficiency, demonstrating strong market resilience.

31. StarSem

Established in 2015, StarSem focuses on the coordinated development of "memory + control + AI," with core products including NOR Flash, 32-bit MCUs, and memory-computing integrated AI chips. Its MCUs synergize with memory chips, applied in mobile phones, wearable devices, and smart homes. Its memory-computing integrated AI chips further expand the application space of AIoT, making it a distinctive enterprise in the "memory + control" field.

32. Siflower Microelectronics

Established in 2010, Siflower has built a full-range MCU product matrix covering 8-bit and 32-bit MCUs, including 8051 architecture, ARM Cortex-M series, and RISC-V architecture. Its products are widely used in consumer electronics, smart homes, and industrial control, meeting the differentiated needs of various customers with multi-architecture and full-series product advantages. In 2024, its shipments in automotive electronics peripheral scenarios achieved growth.

33. Fortior Technology

Established in 2010, Fortior Technology is a leading enterprise in dedicated MCUs for BLDC motor drive control. Its chips focus on BLDC motor control, with mass applications in home appliance inverters, power tools, and automotive electronics. Leveraging core algorithm advantages, it improves the efficiency of motor systems by 5-10%, becoming a core supplier for home appliance enterprises such as Midea and Gree.

34. Artery Technology

Established in 2016, Artery Technology focuses on the ARM Cortex-M4/M0+ cores, launching the AT32 series of 32-bit MCUs. Its products cover industrial control, automotive electronics, and IoT, quickly rising in the mid-to-high-end general-purpose MCU market with high performance and cost-effective advantages. In 2024, its automotive-grade products entered the verification phase.

35. HPMicro

Established in 2020, HPMicro focuses on R&D of high-performance embedded MCUs. Its HPM6000 series, adopting the ARM Cortex-M7 core, is among the first high-performance MCU products in China. With computing power and memory configuration comparable to international high-end products, it is suitable for high-end industrial control, edge computing, and AIoT scenarios, gaining recognition from industrial automation customers with technical advancement.

36. Geehy (Zhuhai)

As the core MCU business brand under Geehy Semiconductor, Geehy (Zhuhai) (established in 2019) focuses on R&D of industrial-grade and automotive-grade general-purpose MCUs. Its APM32 series is compatible with the pinouts and software ecosystems of mainstream international MCUs, reducing customers’ replacement costs. It has achieved large-scale replacement in industrial control and smart energy scenarios, while its automotive-grade products (with AEC-Q100 certification) have entered the automotive electronics supply chain.

37. Ling Ou Chuangxin

Established in 2015, Ling Ou Chuangxin focuses on dedicated MCUs for motor drive control, with a complete technology chain covering processors, analog circuits, and algorithms. Its products are suitable for electric vehicles, home appliances, and drones: its BLDC motor control solutions enable precise speed regulation and energy efficiency, holding a major share in the electric two-wheeler market.

38. Fuman Microelectronics

Established in 2001, Fuman Microelectronics is an integrated solution provider for integrated circuits. Its MCU product line synergizes with power management and LED driver chips, finding applications in consumer electronics and IoT smart devices. With high integration advantages, it reduces the cost of terminal products, and its shipments in smart home scenarios achieved double-digit growth in 2024.

39. Huichun Technology

Established in 2007, Huichun Technology focuses on R&D of MCUs for consumer electronics, integrating photoelectric imaging and touch recognition technologies with MCUs. Its core products are applied in smart home control panels and consumer electronics touch devices, gaining mass orders from consumer electronics manufacturers with integrated "sensing + control" advantages.

40. Core Source Semiconductor (a wholly-owned subsidiary of Wuhan Liyuan Info)

As a wholly-owned subsidiary of Wuhan Liyuan Info, Core Source Semiconductor (established in 2018) focuses on R&D of the CW32 series of MCUs, covering general-purpose, secure, wireless, and automotive-grade products. Its secure MCUs support national cryptographic algorithms, while its automotive-grade products (with AEC-Q100 certification) are applied in consumer electronics, industrial control, and automotive electronics. Leveraging Liyuan Info’s channel advantages, it quickly expands its market.

41. ReneSas Microelectronics

Established in 2004, ReneSas Microelectronics focuses on R&D of dedicated MCUs for smart grid metering. Its dedicated MCUs for meters synergize with metering chips, holding a high market share in the energy metering field. Applied in smart meters and distribution terminals, its products have become core suppliers for power equipment manufacturers, thanks to high-precision metering and stable control capabilities.

42. ChipON Microelectronics

Established in 2012, ChipON Microelectronics has an independent KungFu core processor architecture, focusing on industrial-grade and automotive-grade MCUs. Its core products are based on the independent core, featuring independent controllability advantages, and are applied in automotive electronics, industrial control, and power electronics. It achieves a balance between performance and power consumption through architectural innovation.

43. Jinghua Microelectronics

Established in 2005, Jinghua Microelectronics focuses on high-performance analog and mixed-signal MCUs. Its core products include high-precision ADC chips, medical health MCUs, and industrial control MCUs. Its medical health MCUs are suitable for blood pressure monitors and blood glucose meters, while its industrial control MCUs are applied in instrumentation. It gains recognition in niche markets with high-precision analog performance.

44. Saimicro Electronics

Established in 2011, Saimicro Electronics focuses on R&D of 8-bit and 32-bit MCUs, providing cost-effective products and solutions. Its core products include general-purpose MCUs and touch MCUs, widely used in smart homes, consumer electronics, and IoT. It meets the personalized needs of small and medium-sized customers with rapid customization capabilities.

45. Xuanzhi Technology

Established in 2014, Xuanzhi Technology’s predecessor was the motor product line division of Fairchild Semiconductor (US), inheriting technical accumulation in motor control. Its core products are MCU/SoCs for motor drive control, suitable for home appliances, drones, and industrial motor control. Its solutions have technical advantages in precise control of BLDC motors.

46. Sino-Micro Love Core

Established in 2004, Sino-Micro Love Core focuses on R&D of display drivers and MCUs, with products covering display driver chips, MCUs, and logic chips. Its MCUs synergize with display driver chips, applied in consumer electronics display panels and industrial control terminals. It gains recognition from panel manufacturers with integrated "display + control" advantages.

47. Qipuwei

Established in 2013, Qipuwei focuses on automotive semiconductor chips, providing automotive-grade MCUs and memory chips. Its core products meet AEC-Q100 standards, covering automotive body control, battery management, and in-vehicle networks. It has entered the domestic automotive supply chain, achieving small-scale mass production.

48. Huimang Microelectronics

Established in 2005, Huimang Microelectronics focuses on MCUs and mixed-signal SoCs, providing combined solutions of "MCU + PMIC + EEPROM." Its products are applied in smart homes, consumer electronics, and industrial control, becoming a preferred supplier for small and medium-sized home appliance enterprises with high integration and low-cost advantages.

49. Huaxin Microtech

Established in 2014, Huaxin Microtech focuses on 32-bit ARM Cortex-M0/M3 core MCUs, with a core team having rich semiconductor experience. Its products are suitable for motor control, industrial applications, and consumer electronics, accumulating a good reputation among small and medium-sized customers with stable performance and rapid services.

50. Aptchip

Established in 2012, Aptchip focuses on 32-bit MCUs based on RISC-V and ARM Cortex cores, and is a well-known domestic MCU solution provider. Its core products include general-purpose MCUs and smart touch chips, applied in smart homes and industrial control. Its RISC-V architecture products demonstrate low-power advantages.

51. Xinsheng Electronics

Established in 2009, Xinsheng Electronics focuses on 8-bit 8051 core and 32-bit ARM Cortex-M0 core MCUs, with products known for high reliability and cost-effectiveness. Covering consumer electronics, smart homes, IoT, and industrial control, it has a stable customer base thanks to mature 8051 technical accumulation.

52. Guangxin Microelectronics

Established in 2017, Guangxin Microelectronics focuses on low-power MCUs for industrial IoT and high-end consumer electronics, with core products integrating wireless RF functions. Suitable for industrial IoT terminals and smart meters, its ultra-low-power features meet long standby needs, and its shipments in smart water meters and gas meters achieved growth in 2024.

53. Sigmastar

Established in 2018, Sigmastar is a leading enterprise in automotive-grade chips, with products covering automotive-grade MCUs, smart cockpit SoCs, and gateway chips. Its MCUs are suitable for core scenarios such as body control and domain controllers, meeting AEC-Q100 and ISO26262 certifications. It has entered the supply chain of multiple automakers, with domain controller MCUs achieving large-scale vehicle installation in 2024.

54. Yuntu Semiconductor

Established in 2020, Yuntu Semiconductor focuses on R&D of automotive-grade MCUs, building a product matrix covering different body scenarios. Its core products meet AEC-Q100 standards, covering body control, power management, and motor control. Gaining sample orders from automakers with high reliability, it accelerates the replacement process of domestic automotive-grade MCUs.

55. Zhixin Microelectronics

Established in 2004, Zhixin Microelectronics covers the entire industrial chain of chip design, manufacturing, and packaging/testing. Its MCUs focus on industrial control and automotive electronics, with high anti-interference performance, applied in industrial automation, automotive electronics, and energy power. Backed by the entire industrial chain advantages, it ensures stable product supply.

56. Taxmicro

Established in 2019, Taxmicro focuses on "MCU +" platform-based chips for IoT, with core products including smart touch MCUs, pressure touch MCUs, and automotive-grade MCUs. Its products are applied in consumer electronics, IoT, and automotive electronics: its distinctive "MCU + touch" solutions have gained recognition from smart hardware manufacturers, while its automotive-grade products entered the verification phase in 2024.

Breakthroughs and Challenges of Domestic MCUs

Currently, domestic MCUs have achieved a leap from "low-end replacement" to "high-end breakthrough": in the automotive sector, products from enterprises such as GigaDevice and BYD Semiconductor have entered the core supply chain; in the industrial sector, Fortior Technology and HPMicro have achieved technical breakthroughs in motor control and high-end industrial control; in the IoT sector, Espressif and Nanjing Qinheng have occupied global market shares with dedicated advantages.

However, the industry still faces challenges: in 2024, intensified market competition led to price wars, putting pressure on the profitability of some enterprises—even leading to cases like Sigmastar dissolving its MCU team. Issues such as product homogeneity and shortage of high-end talents also need to be addressed. In the future, enterprises with core technologies, stable production capacity, and ecological advantages will stand out in the competition.

ICgoodFind Summary

ICgoodFind has deeply integrated resources from 56 domestic MCU enterprises including GigaDevice, Espressif, and BYD Semiconductor, building a product matrix covering general-purpose, automotive-grade, and industrial control scenarios. Relying on its platform supply chain capabilities, it accurately matches the needs of customers in home appliances, new energy vehicles, and IoT, while supporting customers in accessing high-end domestic replacement resources. It provides support for industry cost reduction, efficiency improvement, and technological upgrading.