In a reversal of previous forecasts, TrendForce reports that NAND Flash prices are not stabilizing in Q4 but are instead rising across the board, with projected average contract price increases of 5–10%.

This trend is driven by a significant improvement in supply-demand dynamics. Proactive production cuts and prioritized inventory reduction by suppliers in the first half of the year have effectively eased oversupply. Manufacturers are now concentrating on higher-margin products, moving away from price competition to improve profitability—firmly supporting the price uptick.

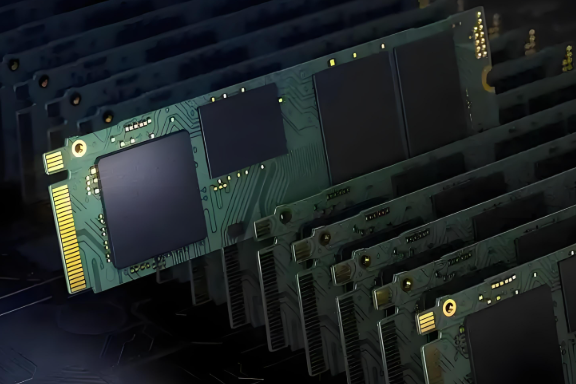

Structural demand growth is another key driver. While consumer demand remains soft, Server OEMs and CSPs have cleared excess inventory. Coupled with the ramp-up of NVIDIA's Blackwell GPUs and tightening HDD supply, demand for Enterprise SSDs has surged. The data storage needs of generative AI are further accelerating the shift of suppliers toward QLC NAND production.

Price increases are expected across all segments:

-

Client SSDs are balanced, with high-capacity QLC products in short supply.

-

Enterprise SSDs see heightened demand for 120TB+ capacities, increasing QLC output.

-

eMMC/UFS prices are rising due to supplier profit goals, despite weak demand.

-

NAND Flash Wafers face a supply gap amid technology transitions, pushing prices up.

Looking ahead, the rollout of QLC capacity, rising enterprise demand, and persistent HDD shortages will further tighten the market, reinforcing the price support and signaling an industry shift from price wars to value-based competition.

ICgoodFind : The memory market has entered a clear upward price cycle, urging supply chain participants to strategically manage inventory and costs.