On September 27, 2025, Wingtech Technology announced the completion of a major stake reduction by its second-largest shareholder, Wuxi Guolian Integrated Circuit Investment Center. Through centralized bidding, the entity sold 12.42 million shares—nearly 1% of Wingtech—cashing out approximately ¥496 million.

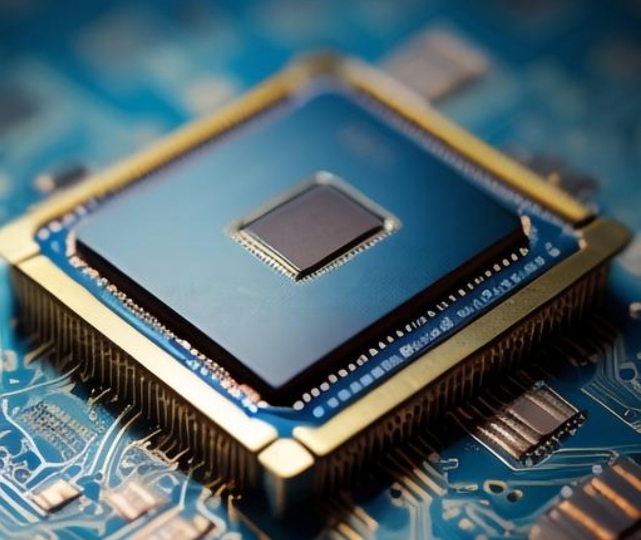

Post-sale, Wuxi Guolian’s stake fell from 8.77% to 7.77%, yet it remains the company’s second-largest shareholder. Wingtech’s core strength lies in its subsidiary Nexperia, a global leader in discrete and power semiconductors with nearly 16,000 product types. In 2024, Nexperia ranked third worldwide and first in China in power discrete device revenue.

Despite a 24.56% decline in H1 2025 revenue to ¥25.34 billion, Wingtech’s net profit surged 237.36% to ¥474 million. A strong recovery was seen in Q2, with revenue rising from ¥3.71 billion to ¥4.11 billion quarter-over-quarter and net profit increasing from ¥578 million to ¥683 million. This performance is attributed to a refocus on semiconductors, overseas market recovery, and domestic substitution trends. The semiconductor business alone posted an 11.23% revenue growth with a 37.89% gross margin.

ICgoodFind : While the stake reduction drew attention, Wingtech’s operational rebound and strategic focus on its semiconductor segment remain the real story.