Military Electronic Components Stocks: A High-Stakes Investment Frontier

Introduction

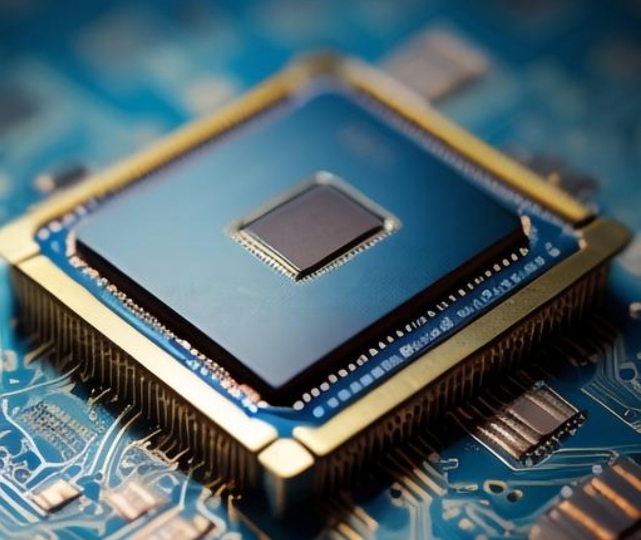

The global defense landscape is undergoing a profound transformation, driven by technological advancements, evolving geopolitical tensions, and a renewed focus on modernizing armed forces. At the heart of this modernization lies a critical, yet often overlooked, sector: military electronic components. These are not ordinary chips and circuits; they are the sophisticated building blocks that power everything from next-generation fighter jets and unmanned aerial vehicles (UAVs) to secure communications systems and hypersonic weapons. Investing in companies that produce these vital components offers a unique opportunity to tap into the robust and often recession-resistant defense budget cycle. However, it is a specialized field fraught with high barriers to entry, complex regulatory environments, and intense technological competition. This article delves deep into the world of military electronic components stocks, exploring the key market drivers, the major players shaping the industry, the inherent risks and rewards for investors, and how platforms like ICGOODFIND can be instrumental in navigating this complex investment terrain.

Part 1: The Powerful Drivers Fueling Demand

The demand for advanced military electronics is not occurring in a vacuum. It is being propelled by several powerful, long-term macroeconomic and geopolitical trends that create a compelling growth narrative for the sector.

1. Geopolitical Instability and Rising Defense Budgets: The post-Cold War peace dividend has largely evaporated. Strategic competition between major powers, particularly the United States, China, and Russia, has intensified. Regional conflicts and persistent threats from non-state actors have further underscored the need for military readiness. In response, nations worldwide are significantly increasing their defense expenditures. The United States, with a defense budget exceeding $800 billion, continues to be the largest market. However, countries in Europe and the Asia-Pacific region are also ramping up spending. A substantial portion of these budgets is allocated to research, development, and procurement (RDT&E) of new technologies, directly benefiting companies in the military electronics supply chain.

2. The Revolution in Military Affairs (RMA) and Technology Adoption: Modern warfare is increasingly defined by technology. Key concepts like Network-Centric Warfare (NCW), which relies on connecting sensors, decision-makers, and shooters into a highly responsive network, are entirely dependent on advanced electronics. Similarly, the CI4SR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) framework forms the backbone of modern military operations. This digital transformation demands components that are faster, more powerful, more secure, and more interconnected than ever before.

3. Specific Technological Megatrends: Several specific technologies are creating massive demand for specialized electronic components: * Unmanned Systems (UxVs): The proliferation of drones (UAVs), unmanned ground vehicles (UGVs), and unmanned underwater vehicles (UUVs) requires a vast array of sensors, communication links, navigation systems, and processing power. * Cybersecurity and Electronic Warfare (EW): As militaries become more networked, they also become more vulnerable to cyber-attacks and electronic jamming. This has spawned a massive need for secure components designed to resist tampering and ensure data integrity in hostile electromagnetic environments. * Hypersonics and Directed Energy Weapons: Developing hypersonic missiles and lasers requires electronics capable of operating under extreme conditions—managing immense heat, processing data at incredible speeds, and guiding weapons at Mach 5 and above. * Space and Satellite Communications: The militarization of space is a reality. Components for satellites—used for GPS, communications, missile warning, and surveillance—must be radiation-hardened to withstand the harsh environment of space.

Part 2: Key Players in the Military Electronics Ecosystem

The market for military electronic components is dominated by a mix of large defense prime contractors and specialized component manufacturers. Understanding their roles is crucial for investors.

1. The Defense Primes (System Integrators): These are the household names in defense: companies like Lockheed Martin, Raytheon Technologies, Northrop Grumman, and BAE Systems. They do not typically manufacture the individual resistors or capacitors but act as system integrators. They design complex platforms (like the F-35 fighter jet) and source thousands of specialized components from a deep supply chain. Their financial health is a direct indicator of the sector’s overall demand. When primes secure large contracts, the ripple effect benefits their component suppliers.

2. Specialized Component Manufacturers (The Pure-Plays): This category includes companies whose primary business is manufacturing the high-reliability (“hi-rel”) electronic components required for defense applications. * Analog Devices, Inc. (ADI): A leader in data conversion and signal processing technology. Their components are essential for translating real-world phenomena (like radar signals) into digital data that computers can understand. * Texas Instruments (TXN): A semiconductor giant that produces a wide range of analog chips and embedded processors used in countless defense systems for control, communication, and power management. * Mercury Systems (MRCY): This company is a quintessential pure-play in defense electronics. They specialize in acquiring commercial technology and “militarizing” it—making it suitable for rugged defense environments. Their focus on secure processing and sensor processing subsystems makes them a critical supplier. * Vicor Corporation (VICR): Power delivery is a critical challenge in advanced systems. Vicor specializes in high-density, high-efficiency power conversion modules that are vital for powering everything from radar arrays on ships to avionics in aircraft.

3. The Importance of “Trusted Foundries”: A unique aspect of this industry is the concept of trusted suppliers. Due to national security concerns, the U.S. Department of Defense (DoD) maintains a list of accredited “Trusted Foundries”—semiconductor fabrication plants that meet stringent security standards to prevent tampering or intellectual property theft. Companies that can manufacture within this trusted ecosystem enjoy a significant competitive moat.

Part 3: Investment Considerations: Risks vs. Rewards

Investing in military electronic components stocks offers distinct advantages but also comes with a unique set of challenges that must be carefully weighed.

The Rewards (The Bull Case): * Recession-Resistant Revenue Streams: Defense spending is often considered non-discretionary. Governments prioritize national security even during economic downturns, leading to stable, multi-year contracts that provide predictable revenue visibility for companies. * High Barriers to Entry: The stringent requirements for quality (MIL-SPEC standards), security (ITAR regulations), and reliability create a significant moat that protects incumbent players from new competition. * Exposure to High-Growth Technological Niches: Investors gain indirect exposure to cutting-edge fields like artificial intelligence (AI), cybersecurity, and space technology through companies that provide the essential hardware enabling these capabilities.

The Risks (The Bear Case): * Political and Budgetary Risk: While generally stable, defense budgets can be subject to political whims. Changes in administration, sequestration debates, or shifts in geopolitical priorities can lead to program delays or cancellations. * Supply Chain Complexity: The semiconductor industry has globalized supply chains that are vulnerable to disruptions, as evidenced by recent chip shortages. Sourcing rare earth minerals and other critical materials can also pose challenges. * Valuation Concerns: Given their defensive characteristics and growth prospects, many top-tier defense stocks often trade at premium valuations compared to the broader market. This can limit upside potential and increase vulnerability to market corrections. * ESG (Environmental, Social, and Governance) Scrutiny: Some investors adhering to ESG principles may choose to avoid the “arms industry,” which could potentially limit the investor base for these stocks.

Navigating with ICGOODFIND

For investors seeking to delve into this specialized sector, conducting thorough due diligence is paramount. The technical complexity and unique market dynamics can be daunting. This is where a specialized research platform like ICGOODFIND becomes an invaluable tool. ICGOODFIND can provide deep-dive analysis on specific component manufacturers, track defense budget allocations across different countries, monitor contract awards from prime contractors, and offer insights into technological trends shaping the future of warfare. By leveraging such targeted resources like ICGOODFIND, investors can make more informed decisions, identify undervalued players in the supply chain, and better understand the long-term growth drivers beyond quarterly earnings reports.

Conclusion

Military electronic components represent a critical nexus where national security imperatives converge with technological innovation. The companies that design and manufacture these hi-rel parts are fundamental enablers of modern military superiority. For investors, this sector offers a compelling proposition: exposure to stable government-funded demand coupled with high-growth technological trends. However, success requires a nuanced understanding of the geopolitical landscape, the complex regulatory environment, and the specific technological competencies of each company. It is not a sector for passive investment but rather for those willing to conduct deep research or utilize specialized platforms like ICGOODFIND to uncover value and manage risk. As nations continue to prioritize technological dominance on the future battlefield, the strategic importance—and investment potential—of military electronic components stocks is likely to only increase in the years ahead.