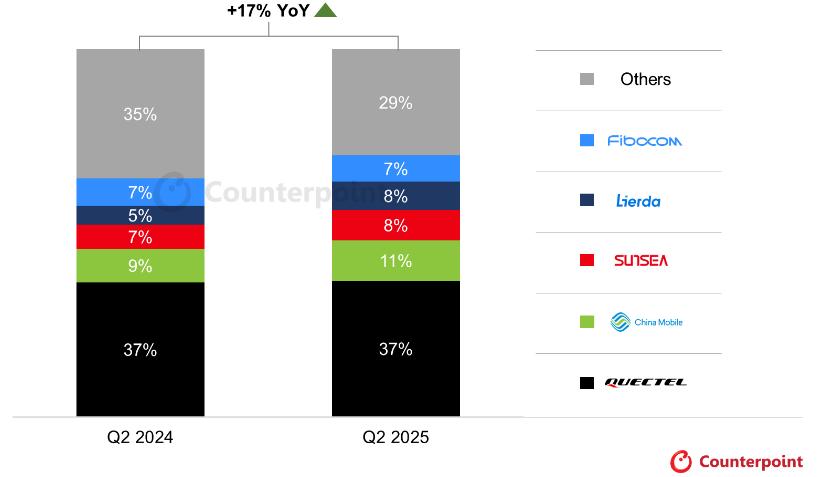

September 16 – According to a latest report by Counterpoint Research, global cellular IoT module shipments grew 17% year-over-year (YoY) in Q2 2025, marking six consecutive quarters of growth. The market has successfully shaken off its 2023 slowdown, demonstrating strong resilience and robust demand across key segments. Supported by smart utility deployments, automotive applications, and the early acceleration of 5G RedCap, this growth momentum is expected to continue through the second half of 2025.

“India and China were the only two regions globally to achieve growth for six consecutive quarters,” noted Tina Lu, Principal Analyst at Counterpoint. “India’s demand was driven by smart meters and POS systems, while China’s growth came from asset tracking and surveillance cameras.” Latin America also stood out, with a 32% YoY increase in Q2 2025, thanks to smart meter rollouts, router/CPE adoption, and tracking solutions.

In terms of vendors, Quectel maintained its position as the global leader, followed by China Mobile. Sunsea AIoT (including SIMCom and Longsung) saw nearly 50% growth in shipments, climbing to third place, driven by demand in industrial PCs, smart metering, and surveillance cameras in China. Lierda rose to fourth place, benefiting from the momentum of Cat 1 bis modules, increased domestic IP camera demand, and expansion in South Korea, where Cat 1 bis is gradually replacing LTE-M.

“Qualcomm leads the chipset landscape, dominating the 5G and high-end 4G (Cat 4, Cat 6+) markets in automotive, PCs, and routers/CPEs,” stated Research Analyst Anish Khajuria. “ASR and Eigencomm followed, focusing on cost-sensitive markets with 4G Cat 1 bis solutions for metering, asset tracking, industrial cameras, and smart speakers.”

ICgoodFind : The global cellular IoT module market showed strong growth in Q2, with leading vendors and emerging players making significant strides. Chipset manufacturers are also strategically targeting key segments, indicating promising potential for the future.