Top global chip equipment makers show divergent profits—some hit by slowing China sales, others boosted by AI chip demand.

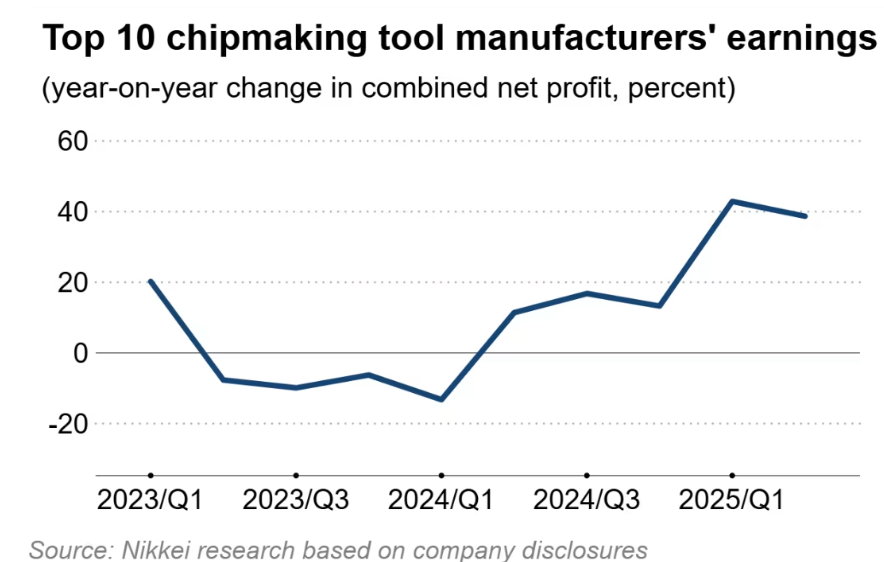

Of 10 leading Japanese, U.S., and European manufacturers, 5 saw Q2 net profit drop YoY or grow slower than last year. However, driven by demand for advanced AI chip-related equipment, their combined net profit rose ~40% for the fifth straight quarter, reaching $9.4 billion.

Lam Research’s net profit surged 69%, KLA grew 44%, and ASML’s profit rose faster than last year. In contrast, TEL and Teradyne saw profits fall; Applied Materials and Disco’s growth slowed (Disco’s from 87% to 0.2%).

Slowing China sales are a key factor. Nine firms reporting China revenue saw a 5% drop to $9.3 billion, accounting for 30% of total sales (down from ~40% earlier). TEL’s China share fell 11 percentage points to 39%. Screen’s president noted rising Chinese suppliers in memory and power semiconductors, with the tech gap narrowing.

Except Applied Materials, five U.S. and European firms expect Q3 sales growth; analysts predict four Japanese firms may also rise.

ICgoodFind: Semiconductor equipment makers diverge in China; rising local suppliers could reshape the market.