Characteristics of the Electronic Components Industry

Introduction

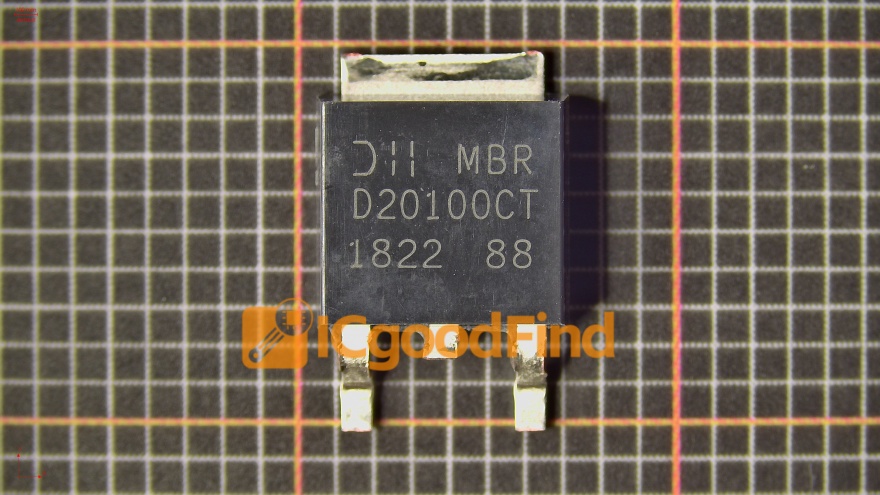

The electronic components industry forms the fundamental bedrock of the modern technological landscape. It is the intricate, often unseen, ecosystem that designs, manufactures, and supplies the essential building blocks—resistors, capacitors, integrated circuits (ICs), connectors, and more—that breathe life into every piece of technology we interact with daily. From the smartphone in your pocket to the sophisticated medical equipment saving lives and the satellites orbiting our planet, none would function without this critical sector. Understanding the characteristics of this industry is paramount for investors, engineers, supply chain managers, and policymakers alike. It is a domain defined by relentless innovation, complex global interdependencies, and cyclical market dynamics. This article delves into the core characteristics that shape the electronic components industry, exploring its driving forces, structural nuances, and future trajectory. For professionals seeking to navigate this complex supply chain, platforms like ICGOODFIND provide invaluable resources for component sourcing and market intelligence.

The Core Driving Forces: Innovation and Miniaturization

The most defining characteristic of the electronic components industry is its relentless pace of innovation, primarily fueled by the pursuit of miniaturization, performance enhancement, and power efficiency. This drive is perfectly encapsulated by Moore’s Law, the observation that the number of transistors on a microchip doubles approximately every two years, though its pace has slowed in recent years. This principle has been the north star for decades, pushing manufacturers to develop smaller, faster, and more powerful components.

-

The Pursuit of Miniaturization: The journey from room-sized vacuum tube computers to today’s nanoscale semiconductors is a testament to this characteristic. The industry continuously develops new materials and fabrication processes, such as Extreme Ultraviolet Lithography (EUV), to create components measured in nanometers. This miniaturization enables the creation of increasingly compact and portable devices without sacrificing—and often enhancing—their computational capabilities.

-

Performance and Power Efficiency: Innovation is not solely about size. There is an equally intense focus on boosting processing speeds, memory capacity, and energy efficiency. The rise of mobile computing and the Internet of Things (IoT) has made low-power consumption a critical performance metric. Components are now designed to deliver maximum performance per watt, extending battery life and reducing the environmental footprint of electronic devices.

-

Specialization and Diversification: Beyond general-purpose processors, the industry has seen an explosion in specialized components. Application-Specific Integrated Circuits (ASICs) and Field-Programmable Gate Arrays (FPGAs) are designed for specific tasks like AI acceleration, cryptocurrency mining, or high-frequency trading, offering superior performance for their targeted applications compared to generic chips. This diversification highlights the industry’s adaptability to emerging technological paradigms.

A Globally Interconnected and Fragile Supply Chain

The electronic components industry is a masterpiece—and sometimes a victim—of globalized production. Its supply chain is a highly complex, interconnected web spanning continents, characterized by deep specialization at different geographical nodes. This structure creates immense efficiencies but also introduces significant vulnerabilities.

-

Geographical Concentration: The industry is marked by pronounced geographical concentration at various stages. Chip design is often centered in hubs like the United States (Silicon Valley) and the UK. The manufacturing of raw silicon wafers is concentrated in regions like Taiwan, South Korea, and Japan. The intricate process of fabrication, especially for advanced nodes, is dominated by a few key players like TSMC in Taiwan and Samsung in South Korea. Finally, assembly, testing, and packaging (ATP) are heavily concentrated in China and Southeast Asia.

-

Supply Chain Vulnerabilities: This concentration creates a fragile ecosystem. Natural disasters, geopolitical tensions, trade disputes, or public health crises (as demonstrated by the COVID-19 pandemic) can severely disrupt the flow of components. A single factory fire or a drought in a key manufacturing region can trigger global shortages, impacting industries from automotive to consumer electronics. The recent chip shortage underscored this characteristic painfully, halting production lines and highlighting the world’s dependency on this intricate supply chain.

-

The Role of Distribution and Sourcing: Navigating this complex global network requires sophisticated logistics and market knowledge. This is where component sourcing platforms prove their worth. A service like ICGOODFIND acts as a critical node in this network, helping engineers and procurement specialists find scarce components, verify supplier authenticity, and manage supply chain risk by providing visibility across a global marketplace of distributors.

Dynamic Market Structures and Cyclicality

The electronic components industry does not operate on a steady, predictable growth curve. Instead, it is characterized by distinct cyclicality and a market structure split between highly competitive segments and those dominated by a few giants.

-

Boom and Bust Cycles: The industry is notoriously cyclical, swinging between periods of shortage (“boom”) and oversupply (“bust”). These cycles are driven by several factors: the long lead times and massive capital required to build new fabrication plants (fabs), fluctuating demand from downstream sectors (e.g., PC and smartphone markets), and inventory hoarding during periods of scarcity. Companies must navigate these cycles carefully, as over-investing during a peak can lead to significant losses when demand contracts.

-

Oligopolistic vs. Fragmented Markets: The market structure varies significantly by component type. The market for high-end semiconductors (CPUs, GPUs) and advanced memory chips is an oligopoly, dominated by a handful of colossal companies like Intel, Samsung, TSMC, and SK Hynix, which command significant pricing power due to their technological lead and capital intensity. In contrast, the market for passive components (resistors, capacitors), connectors, and many discrete semiconductors is far more fragmented, with numerous manufacturers competing fiercely on price, delivery time, and reliability.

-

Capital Intensity and High R&D Investment: A barrier to entry in many segments of this industry is astronomically high. Building a state-of-the-art semiconductor fab can cost tens of billions of dollars. Furthermore, companies must invest heavily in Research & Development (R&D) to keep pace with technological advancements. This characteristic ensures that leadership is maintained only through continuous, massive investment in both physical infrastructure and intellectual capital.

Conclusion

The electronic components industry is a fascinating paradox: it is both the enabler of global technological progress and a source of significant geopolitical and economic tension. Its characteristics are defined by a relentless drive for innovation rooted in Moore’s Law, a complex and fragile global supply chain that demands resilience, and dynamic market cycles that challenge even the most seasoned players. Understanding these traits—the push for miniaturization, the risks of geographical concentration, and the patterns of cyclicality—is essential for anyone operating within or adjacent to this vital sector. As we move into an era dominated by AI, IoT, and quantum computing, the demands on this industry will only intensify. Success will belong to those who can effectively manage supply chain complexity, invest wisely in innovation cycles, leverage intelligence tools such as ICGOODFIND, and adapt to the ever-evolving landscape of global technology.