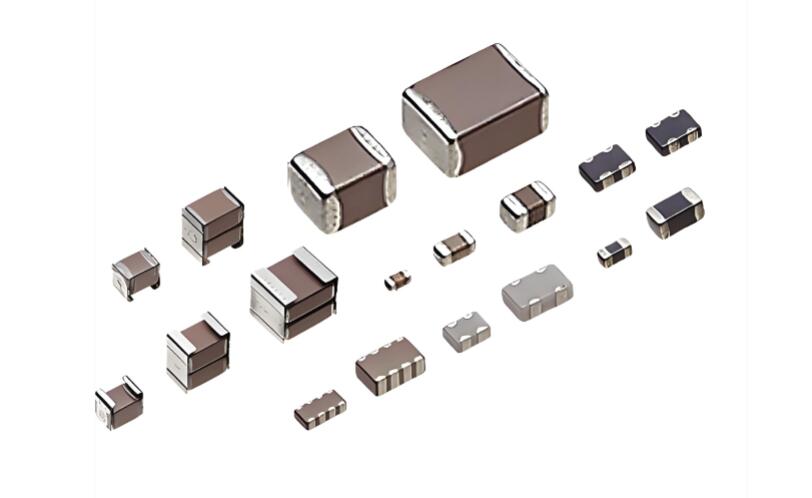

Passive components (capacitors, inductors, resistors) are the "cornerstone" of electronic circuits, responsible for core functions such as energy storage, filtering, and current limiting. From smartphones to new energy vehicles, from 5G base stations to aerospace equipment, almost all electronic devices rely on them. The industry is characterized by high barriers to entry (dependence on material formulas, precision processes, and equipment), strong cyclicality (price fluctuations caused by supply-demand mismatches), and long-term growth potential (driven by demand in emerging fields). In recent years, it has shown a new competitive landscape amid technological iteration and domestic substitution.

I. Industry Overview: Cyclical Fluctuations and Growth Logic

Core Characteristics

-

High Barriers to Entry: The performance of passive components depends on the ultimate refinement of materials and processes. For example, the dielectric material formula of MLCC (multi-layer ceramic capacitors) is a core secret of manufacturers; companies like Murata and Samsung Electro-Mechanics achieve a ceramic powder purity of 99.99%. For inductors, magnetic core materials need to balance permeability and loss, with TDK’s nanocrystalline alloy magnetic core technology leading the world. Additionally, production equipment (such as MLCC laminators and inductor winding machines) mostly relies on high-end equipment suppliers like Japan’s Disco and Germany’s Buhler, making it difficult for new entrants to break through in the short term.

-

Strong Cyclicality: Industry supply and demand directly affect prices and production capacity. From 2017 to 2018, the surge in demand for smartphones and automotive electronics pushed MLCC prices up by over 300%. In 2019, the industry entered a destocking cycle, with some product prices halved. Since the second half of 2020, the popularization of 5G (a single base station uses 3x more MLCC than 4G), automotive electronics (new energy vehicles use 2-3x more passive components than traditional vehicles), and the surge in demand for remote office equipment post-pandemic have driven the industry into a new boom cycle. Lead times for some automotive-grade products have extended to over 6 months.

-

Long-Term Growth Potential: The rise of new energy (photovoltaic inverters, energy storage systems), AI servers (each requiring thousands of MLCCs), and autonomous driving (lidar requiring high-precision inductors) has brought incremental demand for passive components. According to Yole, the global passive components market will exceed $300 billion by 2025, with a compound annual growth rate of 6.8%.

II. Global Leading Manufacturers: Regional Advantages and Core Competitiveness

1. Japan: Technological Dominance, Monopolizing High-End Markets

Japanese manufacturers, with centuries of technological accumulation, dominate high-end markets, especially in automotive-grade and military-grade high-reliability sectors, where they hold almost monopolistic positions.

| Manufacturer | Core Advantages | Key Developments |

|---|---|---|

| Murata Manufacturing | Global leader in MLCC (31% market share in 2022), with automotive-grade products supplied to Tesla, Toyota, etc. It covers ultra-miniature 01005 (0.4mm×0.2mm) to large 1210 MLCC, with monthly production capacity of 120 billion units, accounting for 1/3 of global output. | In 2023, it launched a production line for automotive high-capacitance MLCC at its Kumamoto factory, targeting 800V high-voltage new energy vehicles with a withstand voltage of 1000V. |

| TDK | Global leader in inductors (20% market share); its EPCOS brand holds over 40% market share in automotive film capacitors, with leading magnetic core material technology. | Acquired part of assets from U.S.-based GaN Systems to integrate inductors with GaN devices, improving the efficiency of new energy vehicle inverters. |

| Taiyo Yuden | 4th in global MLCC (10%) + 3rd in inductors (13%); its high-frequency MLCC (over 10GHz) for 5G base stations leads the market | In 2024, it expanded its Hiroshima factory to focus on miniaturized inductors for millimeter-wave radar, targeting the autonomous driving market. |

| Nichicon | Global leader in aluminum electrolytic capacitors (25% market share), with long-life products (10,000 hours at 105℃) monopolizing the industrial power supply market. | Developed solid aluminum electrolytic capacitors to replace traditional liquid products, |

| Kyocera | A leader in electronic ceramic materials; after acquiring AVX, its MLCC production capacity ranked 5th globally. Its military-grade products withstand extreme temperatures from -65℃ to 150℃. | Partnered with Lockheed Martin to supply aerospace-grade ceramic capacitors for satellite communication systems. |

2. South Korea: Focus on MLCC, Dominated by Samsung Electro-Mechanics

South Korean manufacturers, centered on Samsung Electro-Mechanics, focus on the MLCC sector and seize automotive and consumer electronics markets through differentiated technologies.

Samsung Electro-Mechanics: 2nd in global MLCC (21% market share). Its flexible electrode technology reduces electrode breakage caused by vehicle vibrations. Its automotive-grade products have passed AEC-Q200 certification and are supplied to BMW, Volkswagen, etc. In consumer electronics, it supplies 0201-sized MLCC to Apple’s iPhone with annual shipments exceeding 50 billion units. In 2023, it invested 1.2 trillion won to expand its Pyeongtaek factory, targeting monthly MLCC production capacity of 100 billion units by 2025.

3. Taiwan, China: Scale Integration, Building Full-Category Platforms

Taiwanese manufacturers expand rapidly through mergers and acquisitions. Led by Yageo, they build full-category capabilities covering "resistors + capacitors + inductors" to seize mid-to-high-end markets.

-

Yageo: Global leader in resistors (25% market share) + 3rd in MLCC (12%). After acquiring KEMET (3rd in global film capacitors) in 2020, its revenue share in the new energy sector increased from 15% to 30%. In 2023, it merged Chilisin (5th in global inductors, 13% market share), becoming the world’s only manufacturer covering all three passive components, with total monthly production capacity exceeding 200 billion units.

-

Walsin Technology: A multi-category supplier of MLCC and resistors, with 6 factories in mainland China (mainly in Jiangsu and Guangdong). It focuses on the mid-end consumer electronics market, supplying 0402-sized MLCC to Xiaomi and OPPO. In 2024, it started building a factory in Vietnam to avoid geopolitical risks.

4. Mainland China: Pioneers of Domestic Substitution, Achieving Breakthroughs in Clusters

Mainland manufacturers start from mid-to-low-end markets, gain a foothold in consumer electronics, and then penetrate high-value-added fields such as automotive and military, forming a "multi-point breakthrough" pattern.

| Field | Representative Manufacturers | Core Advantages and Developments |

|---|---|---|

| MLCC | Fenghua Advanced Technology | Invested 7.5 billion yuan to build high-end MLCC production lines, adding 4.5 billion units/month in 2024, focusing on breaking through 0201 and 01005 sizes. Its automotive-grade products entered BYD’s supply chain. |

| Micro One Electronics | Domestic leader in miniature MLCC, mass-producing 01005 size (10% global share), supplied to Huawei TWS earphones and Honor foldable phones. | |

| Torch Electron/Hongyuan Electronics | "Dual leaders in military MLCC"; their products passed aerospace certification, used in Beidou satellites and J-20 fighters, with over 80% market share in high-reliability fields. | |

| Inductors | Sunlord Electronics | 5th globally (7% market share); its common-mode inductors for 5G base stations hold 60% domestic market share. Its automotive-grade inductors entered Tesla and CATL’s supply chains, with 50% capacity expansion in 2023. |

| Film Capacitors | Faratronic | 3rd globally (8% market share); new energy accounts for 48% of its revenue. Its film capacitors for photovoltaic inverters are supplied to Sungrow and Huawei Digital Energy. |

| Aluminum Electrolytic Capacitors | Jianghai Capacitor | Domestic leader with 50 years of technical accumulation. Its long-life automotive products (8,000 hours) entered NIO and Li Auto’s supply chains. In 2024, it acquired Germany’s Keramik to obtain automotive certification. |

| Tantalum Capacitors | Hongda Electronics | Core supplier of military tantalum capacitors, supporting Dongfeng missiles and Shandong warships. Its civilian products entered CATL’s energy storage systems. |

| Material Supporting | Jemei Technology | Its paper carrier tape broke Japan’s Nitto monopoly, with 35% global market share, supplying Murata and Yageo. In 2023, it developed ultra-thin carrier tape (50μm thickness). |

III. Competitive Landscape in Segmented Fields: Concentration and Domestic Opportunities

1. MLCC: Dominated by Japan and South Korea, Domestic Brands Penetrating High-End Markets

- Global Pattern: Murata (31%), Samsung Electro-Mechanics (21%), and Taiyo Yuden (10%) account for 62% of the market, monopolizing miniaturized (below 0201) and high-voltage (above 500V) automotive-grade products.

- Domestic Progress: Fenghua Advanced Technology holds 15% market share in medium-to-large sizes (0603-1210). Micro One Electronics’ mass production of 01005 MLCC broke the monopoly of Japan and South Korea. Torch Electron’s military-grade products match Kyocera in performance.

2. Inductors: High Technical Barriers in Japan, Sunlord Electronics Breaking Through

- Leading Players: TDK (20%), Murata (13%), Taiyo Yuden (13%), Chilisin (13%), Sunlord Electronics (7%).

- Competition Focus: Automotive-grade inductors must pass rigorous temperature cycling (-40℃ to 125℃, 1,000 cycles) and vibration tests. Japanese manufacturers require a 3-year certification cycle. In 2023, Sunlord Electronics obtained Volkswagen Group certification, becoming the first domestic manufacturer to break into the high-end automotive market.

3. Resistors: Dominated by Yageo, Mainland Manufacturers Seizing Mid-to-Low End

- Market Distribution: Yageo (25%), Walsin Technology (12%), Japan’s KOA (10%), Rohm (8%). Fenghua Advanced Technology holds 18% market share in thick-film resistors for consumer electronics, with prices 10-15% lower than Taiwanese brands.

4. Aluminum Electrolytic Capacitors: Japan Monopolizing High-End, Mainland Rising in Mid-to-High End

- High-End Market: Nichicon (25%), Rubycon (20%), and Panasonic (18%) monopolize industrial and automotive fields.

- Mainland Breakthrough: Jianghai Capacitor and Aihua Group hold over 30% market share in low-voltage capacitors (12V-48V) for new energy vehicles, with product lifespan extended to 6,000 hours, approaching Japanese levels.

IV. Core Trends and Domestic Substitution Paths

1. Accelerated M&A Integration, Highlighting Head Effect

Taiwanese manufacturers quickly complement product categories through M&A. After merging Chilisin, Yageo allows customers to "one-stop purchase" resistors, capacitors, and inductors, improving supply chain efficiency by 20%. Mainland manufacturers have also started integration; Fenghua Advanced Technology acquired a small inductor company in 2024 to improve its passive component layout.

2. Large-Scale Capacity Expansion in Mainland China, Targeting High-End Substitution

- Fenghua Advanced Technology: 7.5 billion yuan investment focuses on 0201 (0.6mm×0.3mm) and 01005 MLCC, targeting 80 billion units/month capacity by 2025, matching Samsung Electro-Mechanics.

- Sanhuan Group: A 50 billion units/month MLCC production line was put into operation in 2024, using self-developed ceramic materials, with yield rate increased from 60% to 85%, close to Murata’s level.

3. Directions for Technological Breakthroughs: Miniaturization, High Reliability, and Material Independence

- Miniaturization: Micro One Electronics’ 01005 MLCC (0.08mm³ volume) filled the domestic gap.

- High Reliability: Torch Electron’s aerospace-grade MLCC can withstand 1,000G acceleration impact, used in lunar exploration projects.

- Material Independence: Jemei Technology’s carrier tape base paper broke Japan’s Oji Paper monopoly, reducing costs by 30%; Sanhuan Group’s ceramic powder self-sufficiency rate increased from 30% to 70%.

4. Downstream Demand Drivers: Automotive Electronics and New Energy

- Automotive Electronics: New energy vehicles use 1,500-2,000 passive components per vehicle (vs. 500-800 for traditional vehicles), driving surging demand for automotive-grade MLCC and high-voltage film capacitors.

- New Energy: Photovoltaic inverters require a large number of film capacitors (Faratronic supplies 40% of global photovoltaic film capacitors), and demand for long-life aluminum electrolytic capacitors in energy storage systems grows by 40% annually.

V. Appendix: Quick Reference Table of Global Representative Manufacturers

| Category | Leading Manufacturers (Country/Region) |

|---|---|

| Capacitors | Murata (Japan), Samsung Electro-Mechanics (South Korea), Yageo (Taiwan, China), Fenghua Advanced Technology (Mainland China) |

| Resistors | Yageo (Taiwan, China), KOA (Japan), Fenghua Advanced Technology (Mainland China), Ta-I Technology (Taiwan, China) |

| Inductors | TDK (Japan), Taiyo Yuden (Japan), Sunlord Electronics (Mainland China), Chilisin (Taiwan, China) |

ICgoodFind Summary

The pattern of "dominance by Japan, South Korea, and Taiwan, with accelerated domestic substitution in Mainland China" in the passive components industry is gradually evolving. As a professional electronic components distributor, ICgoodFind deeply integrates resources from international leaders such as Murata and Samsung Electro-Mechanics, while closely cooperating with domestic pioneers like Fenghua Advanced Technology and Sunlord Electronics. We provide customers with dual guarantees of "global supply chain + domestic substitution," helping enterprises balance technological upgrading and cost optimization amid cyclical fluctuations.