Global cellular Internet of Things (IoT) module shipments grew by 10% year-over-year in the third quarter of 2025, according to the latest Counterpoint Research report. This growth was driven primarily by scaled deployments in emerging markets and price-sensitive sectors, signaling a continued shift in the industry from providing basic "hardware connectivity" to delivering more integrated "smart services."

Regional performances varied, reflecting different demand drivers. The Chinese market grew by 7%, fueled by the widespread adoption of smart meters, POS terminals, and the Cat.1 bis standard, which offers a cost-effective, single-antenna design for mid- to low-speed IoT applications. The European market saw stronger growth at 11%, supported by automotive connectivity, router/CPE deployments, and second-wave smart meter projects. In contrast, North American growth was modest at 4%, indicating continued enterprise spending caution.

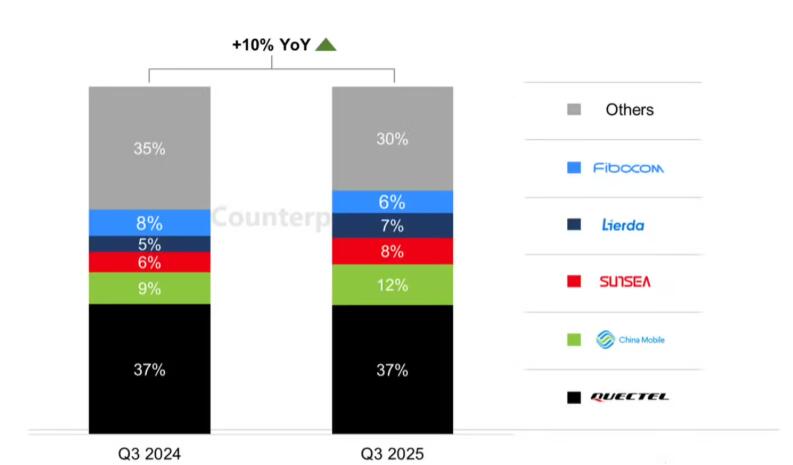

The competitive landscape remained stable, with Quectel leading globally. China Mobile held the second position, leveraging domestic operator-driven demand, and Sunsea AIoT (SIMCom + Longsung) ranked third, supported by strong shipments in POS and smart metering.

In the chipset arena, Qualcomm maintained its dominance in the 5G and high-end LTE segments for high-performance IoT. Meanwhile, Chinese chip designers like ASR Microelectronics, Unisoc, and Shanghai Yixin further solidified their lead in the mainstream Cat.1 bis market, accelerating the localization of mid-to-low-end IoT connectivity.

A key trend is the dominance of Cat.1 bis, which accounted for nearly half of all shipments in Q3 2025, establishing itself as a global mainstream standard for mass IoT. The next wave is anticipated from 5G RedCap (Reduced Capability), a simplified 5G technology. However, Counterpoint notes its mass adoption awaits price reductions to Cat.4/Cat.6 levels and broader 5G standalone network coverage. Concurrently, demand is rising for AI-powered IoT modules in sectors like surveillance, automotive, and industrial applications, as the industry's value increasingly shifts toward edge intelligence and comprehensive lifecycle services.

ICgoodFind's Insight

The Q3 data underscores a mature yet evolving IoT module market. Growth is now strategically segmented between high-volume, cost-driven applications using standards like Cat.1 bis and higher-value, intelligent systems incorporating 5G and AI, defining the next phase of competition.