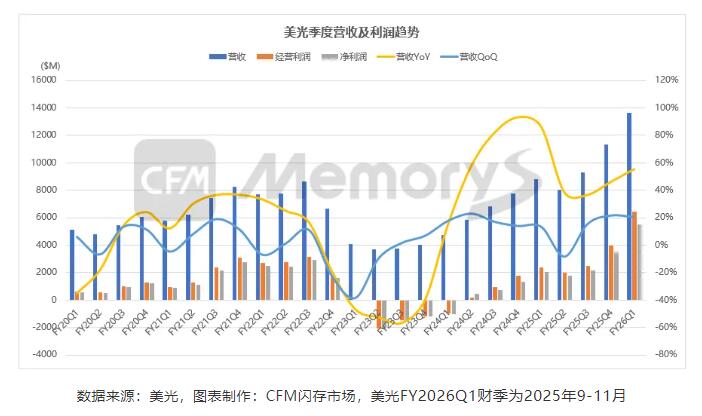

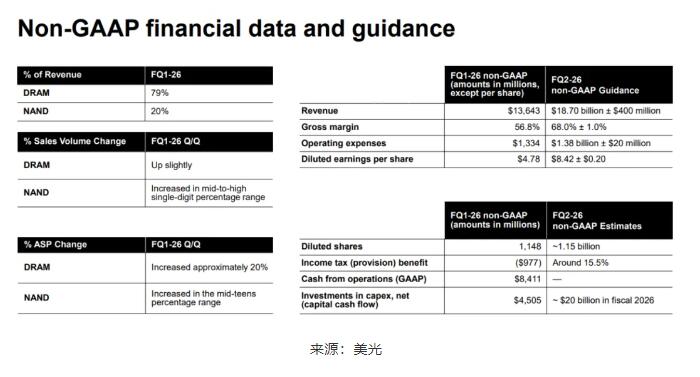

Memory chip giant Micron Technology reported stellar financial results for its fiscal Q1 2026 (Sept-Nov 2025). Revenue hit $13.64 billion, up 55% year-over-year, while non-GAAP operating profit surged to $6.42 billion for a 47% margin. Net income reached $5.48 billion, a staggering 169% increase from the prior year. This performance was driven by significant price increases, with DRAM average selling prices (ASPs) rising approximately 20% and NAND ASPs up about 15% sequentially.

Confident in sustained demand, Micron announced a major capital expenditure boost. The company raised its fiscal 2026 capex forecast to $20 billion, a 48% year-over-year increase. This investment will focus on expanding production for next-generation High Bandwidth Memory (HBM) and its advanced 1-gamma DRAM node. The company is accelerating the construction of multiple new fabs and advanced packaging facilities in Idaho, New York, Singapore, and India to meet future demand.

A key future growth area is HBM. Micron has already secured supply and price agreements for its HBM4 products for the full year of 2026. The company now projects the total addressable market for HBM to reach $100 billion by 2028—two years earlier than prior forecasts—driven by a compound annual growth rate of about 40%.

Micron's guidance for the next quarter is equally bullish, forecasting revenue between $18.3 and $19.1 billion with gross margins of 67% to 69%, which would be new record highs. The company also raised its bit demand growth forecasts for both the DRAM and NAND industries for 2025, signaling its expectation that the current memory upcycle has significant runway.

ICgoodFind's Insight

Micron's blockbuster earnings and aggressive expansion plans are a clear bellwether for the memory industry's strength. The strategic pivot and massive investment into HBM position the company to capture a dominant share of the high-value AI infrastructure market for years to come.