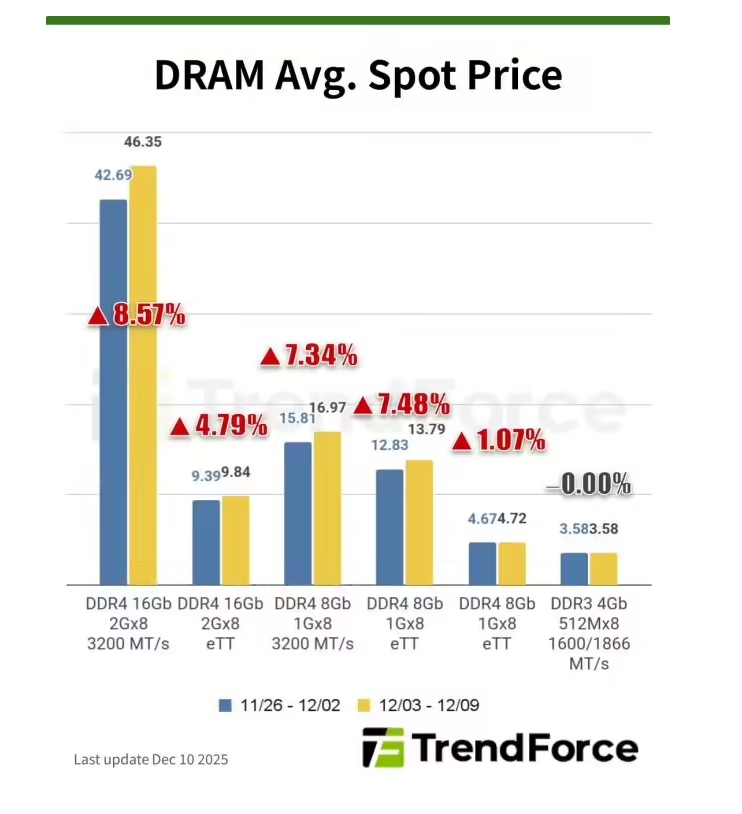

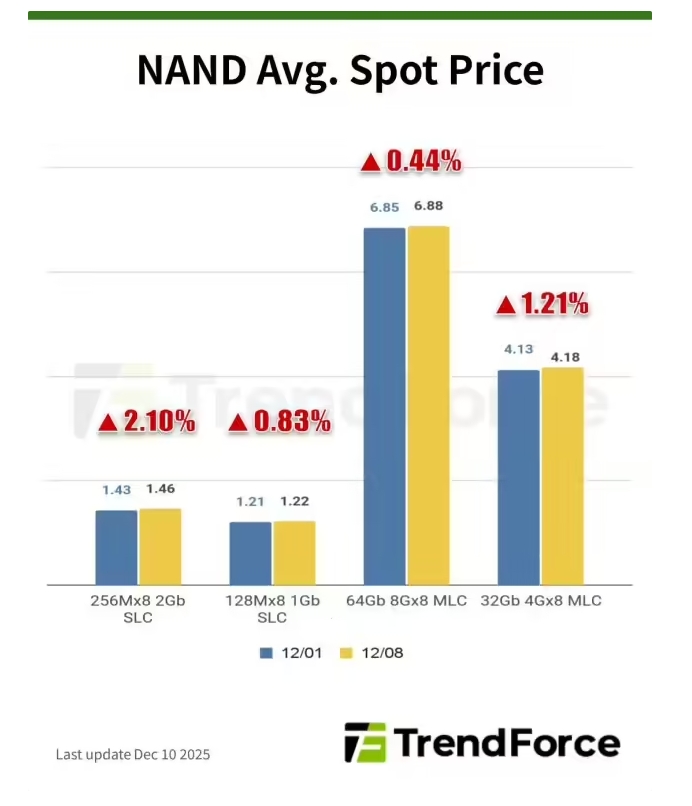

As the year draws to a close, the memory market is displaying a split personality. According to the latest TrendForce report, while prices for DDR5 and DDR3 memory chips saw a slight pullback following previous sharp gains, DDR4 prices, especially for 16Gb chips, continue their strong upward trajectory. Meanwhile, NAND Flash spot prices have hit new historical highs, underscoring sustained industry-wide supply pressures.

The temporary softening in DDR5 and DDR3 is attributed to year-end profit-taking by spot traders and is viewed as a short-term fluctuation. The analyst firm emphasizes that this does not alter the fundamental structural shortage gripping the market. Global memory giants are prioritizing production for high-margin HBM and DDR5, drastically reducing capacity for mature nodes. This has created a supply crunch for DDR4 that is expected to persist at least through the first half of 2026. For instance, the average spot price for mainstream DDR4 chips rose 2.00% in a single week.

The NAND Flash market remains resilient at elevated levels. Despite a slight slowdown in the weekly price increase rate, suppliers have not ramped up wafer output ahead of the new year, keeping supply tight. On December 9th, the spot price for 512Gb TLC wafers still edged up 0.28% to a record $9.634.

ICgoodFind's Insight

The current memory cycle is being reshaped by AI-driven structural demand, diverging from historical patterns. The strategic shift in capacity by major manufacturers ensures that the supply tightness and high-price environment for mainstream products like DDR4 and certain NAND segments are likely to persist in the near term.