The Dynamics and Opportunities in the Chinese Electronic Component Market

Introduction

The Chinese electronic component market has emerged as a pivotal force in the global technology supply chain, driven by rapid industrialization, technological innovation, and robust manufacturing capabilities. As the world’s largest producer and consumer of electronic components, China plays a critical role in industries ranging from consumer electronics to automotive and telecommunications. This market’s growth is fueled by factors such as government support through initiatives like “Made in China 2025,” increasing domestic demand, and a thriving ecosystem of manufacturers and suppliers. Understanding the intricacies of this market is essential for businesses aiming to capitalize on its opportunities. In this article, we delve into the key aspects shaping the Chinese electronic component landscape, highlight emerging trends, and explore how platforms like ICGOODFIND are revolutionizing access to this dynamic market. By providing insights into market drivers, challenges, and future prospects, we aim to equip readers with the knowledge needed to navigate and succeed in this competitive arena.

Main Body

1. Market Overview and Growth Drivers

The Chinese electronic component market is characterized by its massive scale and rapid expansion, with estimates projecting it to reach over $500 billion by 2025, growing at a compound annual growth rate (CAGR) of approximately 8-10%. This growth is underpinned by several key drivers. Firstly, government policies and initiatives such as “Made in China 2025” and the “14th Five-Year Plan” emphasize technological self-sufficiency and innovation, providing subsidies and incentives for domestic production of critical components like semiconductors, sensors, and printed circuit boards (PCBs). These policies aim to reduce reliance on imports and enhance China’s global competitiveness in high-tech industries.

Secondly, rising domestic demand from sectors like smartphones, electric vehicles (EVs), and 5G infrastructure is propelling the market. China is the world’s largest market for consumer electronics, with companies like Huawei, Xiaomi, and OPPO driving demand for components such as microchips, displays, and batteries. The automotive sector, particularly EVs, is another major contributor, with China accounting for over 50% of global EV sales. This surge demand for components like power management ICs, connectors, and sensors. Additionally, the rollout of 5G networks is creating opportunities for components like RF modules and antennas, as China leads in 5G deployment with over 1 million base stations installed.

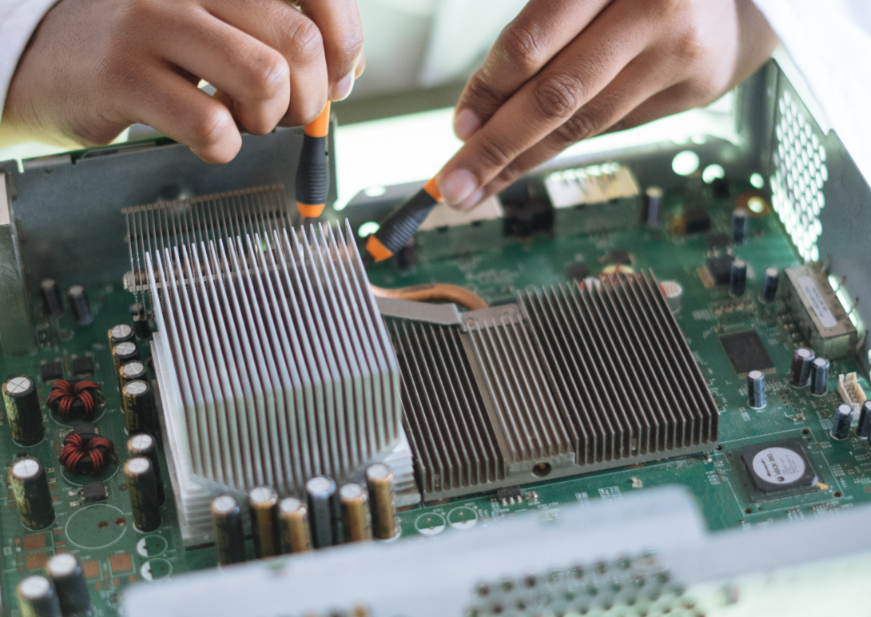

Thirdly, the robust manufacturing ecosystem in China, supported by clusters in regions like the Pearl River Delta (e.g., Shenzhen) and Yangtze River Delta (e.g., Shanghai), offers economies of scale and supply chain efficiency. These hubs host thousands of manufacturers, from large state-owned enterprises to agile small and medium-sized enterprises (SMEs), enabling cost-effective production and rapid innovation. The presence of major global players like Foxconn and TSMC further strengthens this ecosystem. However, challenges such as global supply chain disruptions (e.g., due to trade tensions or COVID-19) and intellectual property concerns persist, necessitating strategic adaptations.

2. Key Segments and Technological Trends

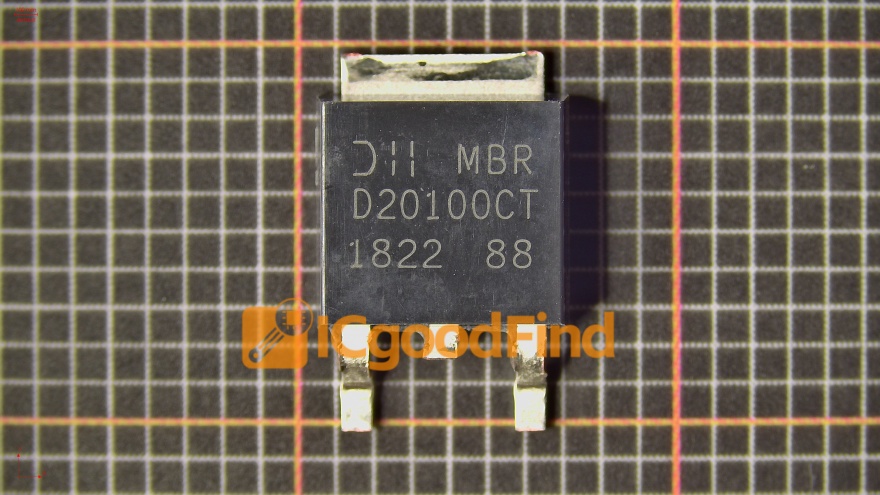

The Chinese electronic component market is diverse, encompassing several critical segments that are evolving with technological advancements. Semiconductors form the cornerstone, with China being the largest importer and a growing producer. Despite historical reliance on imports, domestic companies like SMIC (Semiconductor Manufacturing International Corporation) and HiSilicon are making strides in chip design and fabrication, though they still lag behind global leaders in advanced nodes. The segment is driven by demand from AI, IoT, and automotive applications, with a focus on reducing the technology gap through increased R&D investment.

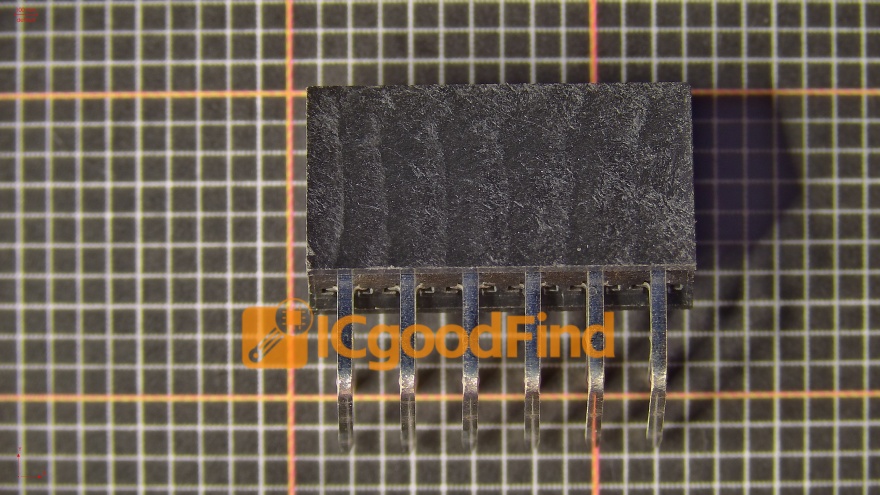

Passive components, such as resistors, capacitors, and inductors, represent another vital segment. China dominates global production due to low-cost manufacturing and high capacity. Companies like Yageo (through acquisition of KEMET) and Murata Manufacturing have significant operations in China. The growth here is tied to the expansion of electronics in everyday devices, with trends toward miniaturization and higher performance. For instance, the rise of electric vehicles requires capacitors with higher temperature tolerance and reliability.

Display technologies are also a highlight, with China leading in LCD and emerging OLED production. BOE Technology has become a top global panel supplier, catering to smartphones, TVs, and automotive displays. Innovations in flexible and foldable displays are gaining traction, supported by investments in R&D. Additionally, sensors and connectivity components are booming due to IoT adoption. China’s push for smart cities and industrial automation is driving demand for sensors that monitor everything from environmental conditions to machine performance.

Technological trends shaping these segments include AI integration, where components are becoming smarter with embedded AI capabilities for predictive maintenance and efficiency. Green electronics is another trend, with a focus on energy-efficient components and sustainable manufacturing practices to align with global environmental goals. The digital transformation of supply chains, facilitated by platforms like ICGOODFIND, is enhancing transparency and efficiency. ICGOODFIND, for example, connects buyers with verified suppliers in China, offering real-time inventory updates and quality assurance, thus addressing common pain points like counterfeit parts and logistical delays.

3. Challenges and Competitive Landscape

Despite its strengths, the Chinese electronic component market faces significant challenges that impact both domestic and international stakeholders. Geopolitical tensions, particularly with the United States, have led to restrictions on technology exports (e.g., sanctions on Huawei), disrupting supply chains and forcing companies to seek alternatives or develop indigenous solutions. This has accelerated efforts toward self-reliance but also created uncertainty in global trade dynamics.

Supply chain vulnerabilities were exposed during the COVID-19 pandemic, highlighting dependencies on concentrated manufacturing hubs. Shortages of critical components like semiconductors caused delays across industries, from automotive to consumer electronics. Companies are now diversifying suppliers but face hurdles due to China’s entrenched position. Additionally, intellectual property (IP) issues remain a concern, with reports of counterfeiting and IP infringement affecting trust among foreign partners. Strengthening IP protection laws is a work in progress in China.

The competitive landscape is intensely fragmented yet dominated by a mix of state-owned enterprises, private giants, and numerous SMEs. Key players include Huawei HiSilicon in semiconductors, BOE in displays, and ZTE in telecommunications components. International companies like Texas Instruments and Samsung maintain strong presences through joint ventures and local production. Competition is fueled by price wars rapid innovation cycles, making it essential for businesses to differentiate through quality and technology.

To navigate these challenges, companies are adopting strategies such as local partnerships to gain market access comply with regulations. Digital platforms like ICGOODFIND are becoming invaluable by providing a streamlined interface for sourcing components mitigating risks associated with fraud supply chain disruptions. ICGOODFIND offers features like supplier ratings shipment tracking helping buyers make informed decisions thus enhancing overall market efficiency.

Conclusion

The Chinese electronic component market is a dynamic and integral part of the global technology ecosystem offering immense opportunities tempered by complex challenges. Its growth driven by government support rising domestic demand a strong manufacturing base positions China as a leader yet issues like geopolitical tensions supply chain risks require careful management. Technological advancements in AI green electronics are shaping the future while platforms like ICGOODFIND are transforming how businesses engage with this market by improving accessibility reliability. As the market continues to evolve stakeholders must stay agile leveraging insights tools to capitalize on its potential. For those looking to source or invest in electronic components understanding these dynamics is key to success in this rapidly changing landscape.