Produced by Dale Ford, Chief Analyst of the Electronic Components Industry Association (ECIA), this report analyzes the global electronic component distribution industry across seven key regions: United States, Taiwan, China, Japan, Europe, South Korea, and Singapore.

Global Revenue & Regional Distribution

-

2024 Global TOP50 Total Revenue: **$1,888 billion** (up $86 billion from $1,802 billion in 2023)

-

Country/Region Revenue Share:

| Region | No. of Companies | 2024 Revenue Share | 2023 Revenue Share |

|---|---|---|---|

| Taiwan | 7 | 36.9% | 30% |

| United States | 10 | 33.4% | 40.1% |

| China | 19 | 15.3% | 13.2% |

| Japan | 8 | 10.7% | 12.8% |

| Europe | 2 | 2.7% | 3% |

| South Korea | 1 | 0.7% | 0.5% |

| Singapore | 1 | 0.3% | 0.3% |

- Regional Revenue Distribution:

- Asia-Pacific: 74.6% (up from 68.9% in 2023) - $1,408 billion

- Americas: 14.2% (down from 16.2% in 2023) - $268 billion

- EMEA: 11.2% (down from 14.9% in 2023) - $211 billion

Top 10 Distributors by Region

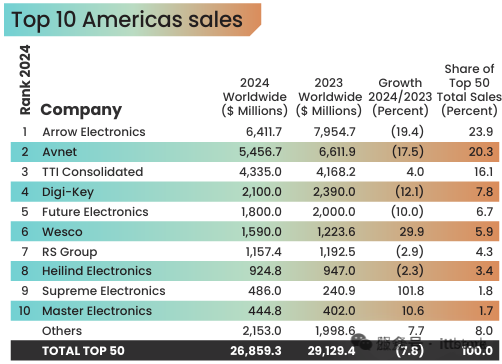

Americas Top 10 (2024)

- Arrow Electronics: $64.12B

- Avnet: $54.57B

- TTI: $43.35B

- DigiKey: $21B

- Future Electronics: $18B

- Wesco: $15.9B

- RS Components: $11.57B

- DAC/Heilind: $9.25B

- Sager: $4.86B

- Master Electronics: $4.45B

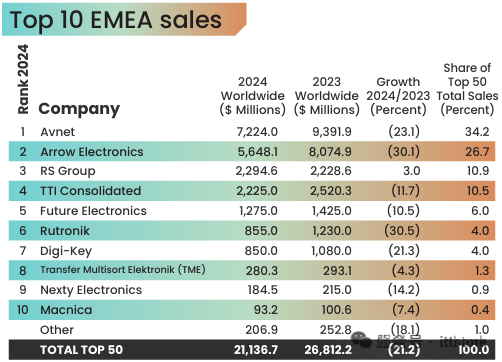

EMEA Top 10 (2024)

- Avnet: $72.24B Electronic Components Industry Association

- Arrow Electronics: $56.48B

- RS Components: $22.95B

- TTI: $22.25B

- Future Electronics: $12.75B

- Rutronik: $8.55B

- DigiKey: $8.5B

- Tech Data: $2.8B

- NEXTY Electronics: $1.84B

- Macnica: $0.93B

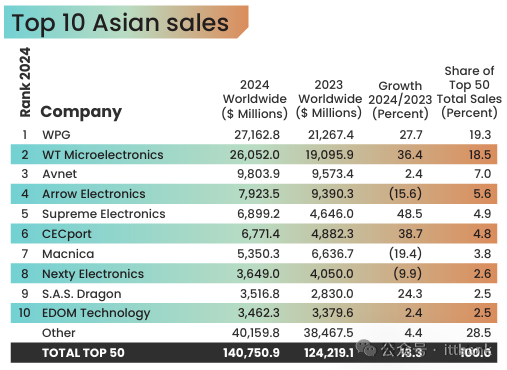

Asia-Pacific Top 10 (2024)

- WPG Holdings: $271.63B

- WT Micro: $260.52B

- Avnet: $98.04B

- Arrow Electronics: $79.24B

- Sager: $68.99B

- CECEP: $67.71B

- Macnica: $53.5B

- NEXTY Electronics: $36.49B

- Seco Group: $35.17B

- YIH Corporation: $34.62B

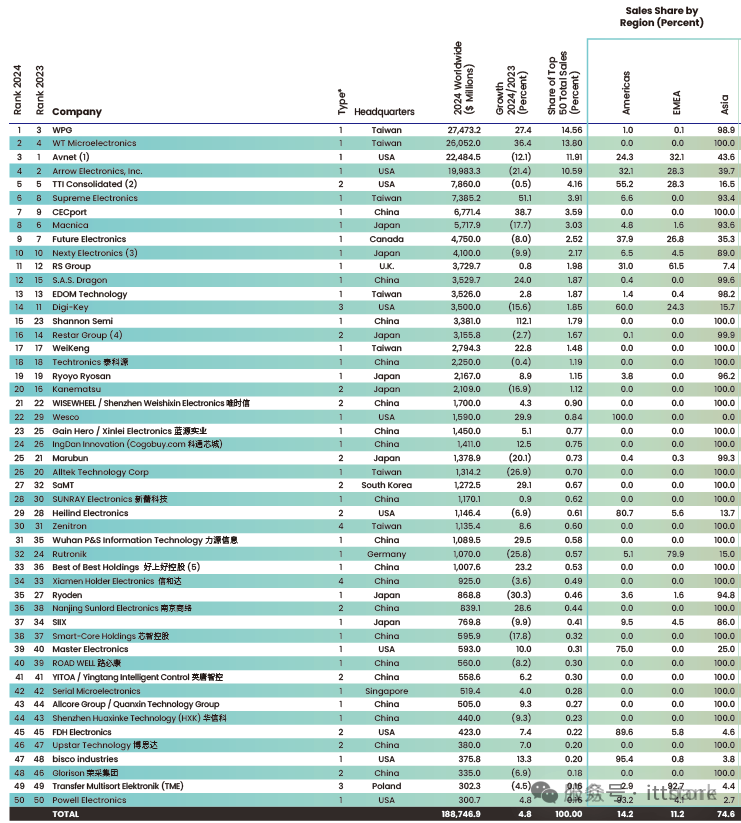

Global Top 50 (2024) - Selected Highlights

- WPG Holdings: $274.73B

- WT Micro: $260.52B

- Avnet: $224.85B

- Arrow Electronics: $199.83B

- TTI: $78.6B

- Sager: $73.85B

- CECEP: $67.71B

- Macnica: $57.18B

- Future Electronics: $47.5B

- NEXTY Electronics: $41B

Product Category Revenue Mix

| Category | 2024 Revenue Share | 2023 Revenue Share |

|---|---|---|

| Semiconductors | 79.3% | 77.9% |

| Connectors | 6.1% | 6.3% |

| Passive Components | 5.0% | 5.9% |

| Electromechanical | 4.6% | 4.7% |

| Computer/Systems | 1.3% | 1.4% |

| Power & Batteries | 1.2% | 1.2% |

| Others | 2.6% | 2.6% |

Top 10 Distributors by Product Category (2024)

Semiconductor Distributors

- WPG Holdings: $264.84B Electronic Components Industry Association

- WT Micro: $260.52B

- Avnet: $180.33B

- Arrow Electronics: $151.87B

- Sager: $68.52B

- CECEP: $66.83B

- Macnica: $55.18B

- YIH Corporation: $34.59B

- Future Electronics: $34.2B

- NEXTY Electronics: $34.11B

Growth Rate Leaders

- Shannon IC Innovation: 112.1% Electronic Components Industry Association

- Sager: 51.1%

- CECEP: 38.7%

- WT Micro: 36.4%

- Wesco: 29.9%

- Liyuan: 29.5%

- SAMT: 29.1%

- Shangluo: 28.6%

- WPG Holdings: 27.4%

- Seco Group: 24%

ICgoodFind Industry Insights

1. Asia-Pacific Dominance & China's Rising Power

Asia-Pacific now accounts for 74.6% of global distribution revenue (up from 68.9% in 2023), with China/Hong Kong contributing 62% of this region's total. The increasing representation of Chinese companies (19 in TOP50 vs 13.2% revenue share in 2023) signals China's growing influence in the global supply chain.

2. Semiconductor as Growth Engine

Semiconductors represent 79.3% of total revenue (up from 77.9% in 2023), confirming their position as the industry's primary growth driver. This aligns with the global AI and digital transformation trends, creating significant opportunities for distributors with strong semiconductor expertise.

3. Consolidation & Regional Focus

The industry shows increasing concentration, with top players (WPG, WT Micro, Avnet, Arrow) capturing substantial market share. Meanwhile, regional specialization is emerging, with Chinese distributors excelling in domestic market penetration while global players dominate cross-border trade.

4. Digital Transformation & Supply Chain Resilience

High-growth companies (like Shannon IC Innovation at 112.1%) achieve success through digital innovation and supply chain optimization. Electronic Components Industry Association This highlights the importance of technological capabilities in meeting evolving customer demands and navigating supply chain complexities.

Conclusion

The 2025 ECIA report reveals a dynamic industry where Asia-Pacific, particularly China, is reshaping the global distribution landscape. Distributors must balance global scale with regional expertise, invest in semiconductor capabilities, and accelerate digital transformation to thrive in this new environment.

Report data sourced from ECIA's official publication, all figures in USD unless specified.