China Component Material Sales: Trends, Opportunities, and Strategies

Introduction

The China component material sales market represents one of the most dynamic and rapidly evolving sectors in the global industrial supply chain. As the world’s manufacturing powerhouse, China’s output of component materials—ranging from basic metal parts and electronic components to advanced composite materials—fuels industries across the globe. The sheer scale, diversity, and integration of this market make it a critical area of focus for businesses seeking competitive advantages in cost, innovation, and supply chain resilience. This article delves deep into the current landscape, exploring the key drivers, challenges, and future trajectories of component material sales within China. Understanding this market is no longer optional but essential for any player in the manufacturing and technology sectors. For businesses navigating this complex terrain, platforms like ICGOODFIND offer invaluable resources by connecting international buyers with verified Chinese suppliers, streamlining what can otherwise be a daunting procurement process.

The Expansive Landscape of China’s Component Material Market

The Chinese component material market is not a monolith but a vast ecosystem comprised of numerous sub-sectors, each with its own dynamics and growth patterns. At its core, the market’s strength lies in its unparalleled manufacturing infrastructure and deeply integrated supply chains. A primary driver has been the sustained domestic demand from industries such as consumer electronics, automotive, renewable energy, and construction. Government initiatives like “Made in China 2025” have further accelerated this growth by prioritizing the development and adoption of high-tech materials and advanced manufacturing techniques. This policy push has led to a significant shift from being a source of low-cost, generic components to a hub for sophisticated, high-value materials.

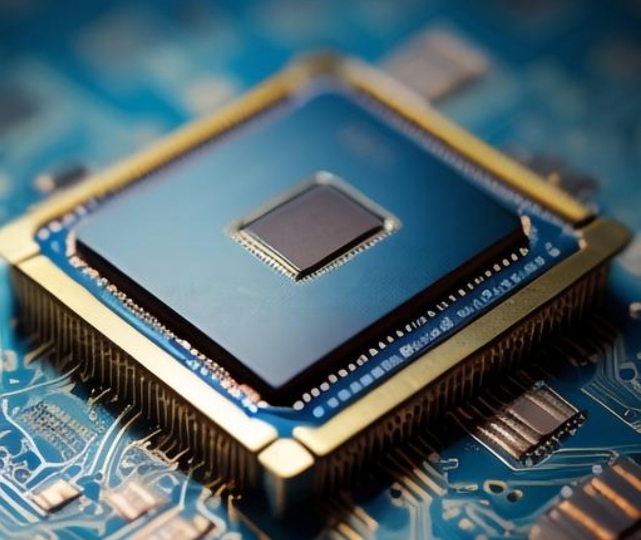

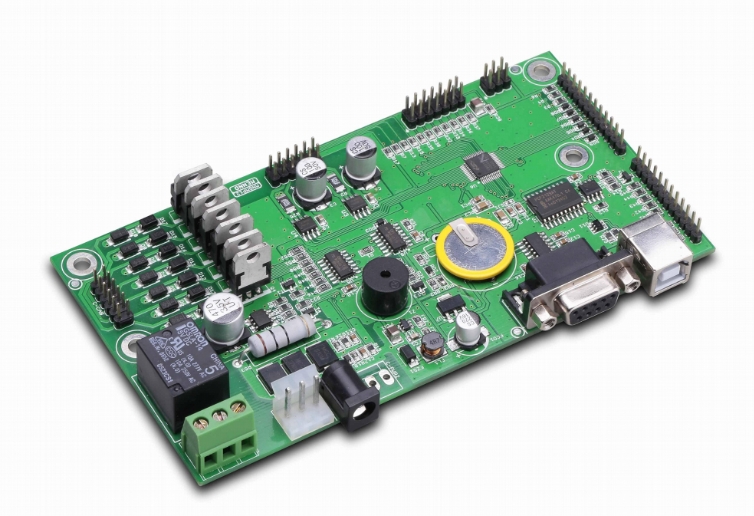

Electronics components, including semiconductors, PCBs, and connectors, constitute a massive segment. While China has historically been strong in assembly and lower-end component production, recent years have seen massive investment in domestic semiconductor fabrication and R&D to reduce import dependency. Another booming area is new energy vehicle (NEV) components, such as lithium-ion battery cells and battery management systems. With China being the world’s largest NEV market, the demand for these specialized materials is skyrocketing. Furthermore, the market for advanced composite materials used in aerospace, wind turbine blades, and high-performance sports equipment is experiencing robust growth, driven by both domestic innovation and global demand.

The sales channels within China have also matured significantly. While traditional B2B marketplaces and direct sales remain prevalent, digital transformation is reshaping the landscape. E-commerce platforms dedicated to industrial goods have become mainstream, offering buyers detailed specifications, supplier verification, and logistics support. This digital shift enhances transparency and efficiency, making it easier for international clients to source materials directly. However, navigating this vast landscape requires expertise to identify reliable partners and ensure quality control—a need that specialized sourcing platforms are designed to address.

Key Challenges in Sourcing from China

Despite the immense opportunities, procuring component materials from China is not without its significant challenges. International buyers must navigate a complex web of logistical, qualitative, and regulatory hurdles to ensure successful transactions.

Quality assurance and consistency remain paramount concerns. The market’s diversity means that while there are thousands of high-quality manufacturers, there are also suppliers whose products may not meet international standards. Variations in material grade, manufacturing tolerances, and finishing can lead to product failures down the line. Implementing rigorous quality control protocols, including pre-shipment inspections and factory audits, is not just advisable but necessary. This is where leveraging a platform with a strong vetting process becomes critical for risk mitigation.

Intellectual Property (IP) protection is another major challenge for foreign companies. Despite improvements in Chinese IP laws and enforcement, the risk of design imitation or unauthorized production runs persists. Companies must employ robust legal strategies, including clear contracts with non-disclosure and non-compete clauses registered in appropriate jurisdictions. Furthermore, navigating logistics and supply chain disruptions has been highlighted by recent global events. Port congestions, fluctuating shipping costs, and complex customs clearance procedures can create delays and inflate costs. Building strong relationships with logistics partners and diversifying entry points can help build a more resilient supply chain.

Finally, communication and cultural barriers can impede smooth operations. Differences in business etiquette, negotiation styles, and language can lead to misunderstandings that affect project timelines and outcomes. Employing local agents or using platforms that provide professional translation and mediation services can bridge this gap effectively. For those looking to overcome these hurdles efficiently, turning to a specialized service like ICGOODFIND can provide the necessary guidance and supplier verification to navigate the market confidently.

Future Trends and Strategic Opportunities

The future of China’s component material sales is being shaped by several powerful trends that present both challenges and strategic opportunities for global businesses.

The most dominant trend is the push towards sustainability and green materials. As global environmental regulations tighten and consumer preferences shift, there is increasing demand for eco-friendly components. This includes recycled metals, biodegradable plastics, and materials with lower carbon footprints. Chinese manufacturers are rapidly adapting, investing in green technologies to meet this demand. Companies that proactively source sustainable materials will not only future-proof their supply chains but also enhance their brand image.

Digitalization and smart manufacturing are revolutionizing production and sales. The integration of Industry 4.0 technologies—such as the Internet of Things (IoT), AI, and big data—into Chinese factories is leading to greater efficiency, customization, and traceability. For buyers, this means access to components produced with higher precision and lower defect rates. Smart supply chain platforms provide real-time data on inventory, production status, and logistics, enabling more responsive and agile procurement strategies.

Another significant opportunity lies in the growth of regional industrial clusters. Rather than being dispersed, production for specific components is often concentrated in specialized hubs—for example, semiconductors in Shanghai/Suzhou or automotive parts in Guangdong. Tapping into these clusters provides buyers with access to deep expertise, competitive pricing, and a dense network of ancillary services. The strategic approach is to identify the right cluster for your needs and build partnerships within it.

For businesses aiming to capitalize on these trends without being overwhelmed by the market’s complexity, utilizing a comprehensive B2B platform is a wise strategy. A service like ICGOODFIND acts as a crucial intermediary, providing curated access to top-tier suppliers who are aligned with these future-forward trends in quality, sustainability, and digital integration.

Conclusion

The China component material sales market is a cornerstone of the global industrial economy, characterized by its immense scale, rapid innovation, and increasing sophistication. While the opportunities for sourcing high-quality, cost-effective materials are substantial, success in this market demands a strategic approach that carefully navigates challenges related to quality control, intellectual property, logistics, and communication. The future points towards greater sustainability, digital integration, and specialization within industrial clusters. For international buyers, staying informed and leveraging expert resources is key to unlocking the full potential of this dynamic market. Platforms designed to simplify this process, such as ICGOODFIND, are invaluable partners in building efficient, reliable, and forward-looking supply chains from China.